Neuren Pharmaceuticals (ASX:NEU): Valuation Check After FDA Approval of DAYBUE STIX Rett Syndrome Powder Formulation

The catalyst here is clear. Neuren Pharmaceuticals (ASX:NEU) just secured FDA approval for DAYBUE STIX, a new powder version of its Rett syndrome therapy that could broaden usage and deepen royalty streams.

See our latest analysis for Neuren Pharmaceuticals.

The market seems to be recognising that story, with the share price at A$19.28 after a strong year to date share price return of about 57 percent and a standout five year total shareholder return above 1,400 percent. This suggests momentum is still firmly on Neuren’s side, even if shorter term moves around recent news have been choppy.

If DAYBUE STIX has you thinking about what else is happening in rare disease and biotech, it is worth exploring healthcare stocks for more potential candidates.

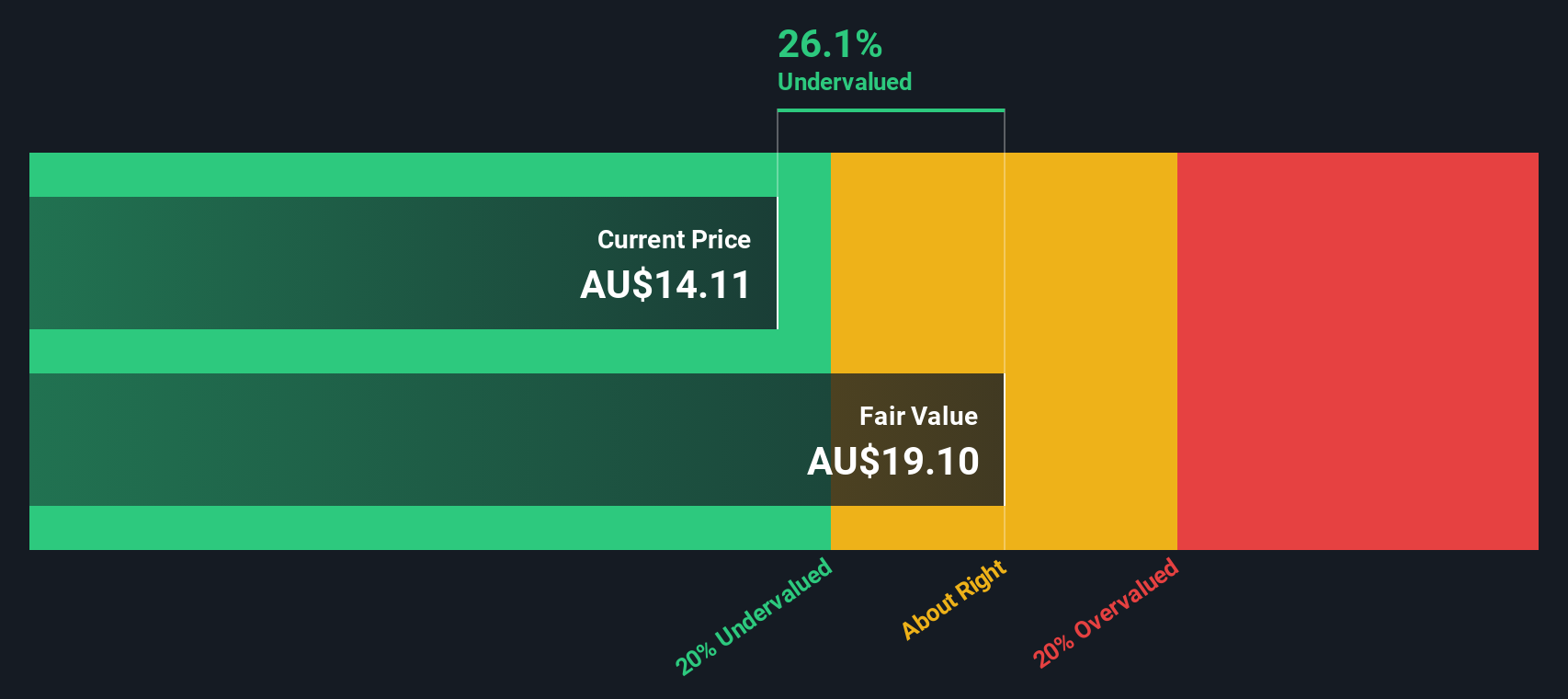

With the shares already up strongly and trading almost 30 percent below the average analyst target, the key question now is whether Neuren remains underappreciated, or if the market is already pricing in its next leg of growth?

Most Popular Narrative: 21.3% Undervalued

Against Neuren’s last close of A$19.28, the most popular narrative points to a materially higher fair value, built on ambitious profitability and margin assumptions.

The analysts have a consensus price target of A$24.512 for Neuren Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$30.5, and the most bearish reporting a price target of just A$21.2.

Want to see what justifies a richer valuation from here? The narrative focuses on strong earnings, improving margins and a future multiple that assumes Neuren continues to exceed expectations. Curious how those factors combine into that fair value view? Read on to uncover the numbers behind the story.

Result: Fair Value of $24.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could quickly change if regulatory setbacks for NNZ-2591 emerge, or if Acadia underdelivers on DAYBUE uptake and commercial execution.

Find out about the key risks to this Neuren Pharmaceuticals narrative.

Another Lens on Value

Our SWS DCF model presents a very different picture, with fair value closer to A$5.25 versus the current A$19.28 share price. On this basis, Neuren appears materially overvalued relative to long term cash flows. Is the market correctly pricing durable cash generation, or is it being driven more by near term momentum?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Neuren Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Neuren Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Smart investors never stop hunting for the next opportunity, so put your capital to work now with focused ideas tailored by the Simply Wall St Screener.

- Explore potential income streams by scanning for reliable payers through these 13 dividend stocks with yields > 3%, focusing on companies that distribute cash to shareholders.

- Position for structural shifts in technology by targeting innovators using these 26 AI penny stocks, where smaller, high-conviction names may offer differentiated exposure.

- Search for possible mispriced opportunities by sifting through these 908 undervalued stocks based on cash flows, concentrating on businesses where fundamentals may indicate a margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal