Reassessing China Gas Holdings (SEHK:384) Valuation After Its Strategic New Energy Partnership With EVE Energy

China Gas Holdings (SEHK:384) has just signed a wide ranging strategic cooperation deal with battery specialist EVE Energy, linking its traditional gas footprint to energy storage, biomass, and broader low carbon platforms.

See our latest analysis for China Gas Holdings.

Investors already seemed to be warming to the story before this deal, with a year to date share price return of 22.12% at HK$8.06 and a 1 year total shareholder return of 31.09%. This hints that the market is slowly reassessing China Gas Holdings’ long term growth and transition potential.

If this kind of transition story has caught your eye, it could be worth scanning fast growing stocks with high insider ownership to see which other companies insiders are backing for faster growth.

With earnings back in positive territory, a hefty intrinsic value discount, and a price target sitting almost on the current share price, the key question now is simple: is China Gas Holdings still mispriced or is the market already baking in its low carbon pivot?

Price-to-Earnings of 15.5x: Is it justified?

China Gas Holdings trades on a Price to Earnings Ratio of 15.5 times, which screens as expensive versus both its closest peers and the wider Asian gas utilities group at the latest close of HK$8.06.

The price to earnings multiple compares today’s share price to the company’s per share earnings, making it a quick way to gauge how much investors are paying for each unit of profit. For a mature, utility-like business with relatively steady cash flows, this is a closely watched yardstick of how optimistic the market is about future earnings power.

In this case, the 15.5 times earnings tag stands above the Asian Gas Utilities industry average of 13.3 times and even further above the peer average of 11.8 times. This implies investors are already pricing China Gas Holdings at a premium to comparable names. Our fair price to earnings estimate of 10.8 times underlines that gap and suggests the market valuation may need to compress towards that level if earnings do not grow fast enough to justify the current premium.

Explore the SWS fair ratio for China Gas Holdings

Result: Price-to-Earnings of 15.5x (OVERVALUED)

However, slower than expected earnings growth or a reversal in China’s clean energy policy support could quickly undermine the premium valuation that investors are paying.

Find out about the key risks to this China Gas Holdings narrative.

Another View: DCF Says the Market May Be Too Pessimistic

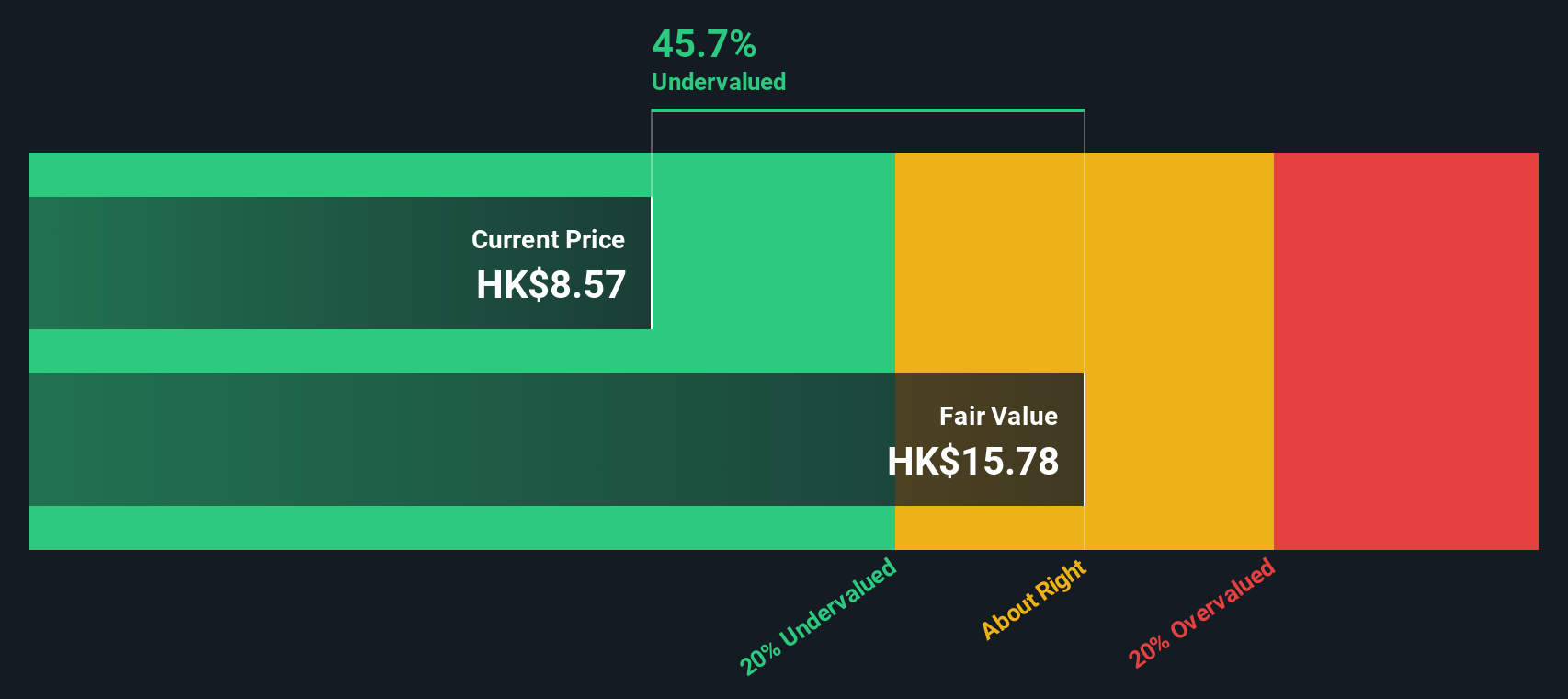

While the price to earnings multiple presents China Gas Holdings as expensive, our DCF model indicates a different view. It suggests fair value around HK$15.60, roughly 48% above today’s HK$8.06 level. This raises the possibility that the market is underestimating longer term cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Gas Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Gas Holdings Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can quickly build and customise your own narrative: Do it your way.

A great starting point for your China Gas Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when you can line up your next moves. Use the Simply Wall Street Screener to uncover fresh, data driven stock ideas today.

- Explore under the radar names by scanning these 3612 penny stocks with strong financials that pair attractive prices with solid underlying businesses.

- Review these 26 AI penny stocks shaping critical applications across data, automation, and intelligent software.

- Identify potential quality at a reasonable price by targeting these 908 undervalued stocks based on cash flows where cash flows suggest the market has yet to catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal