EMB Mission Bound AB (publ) (STO:EMB) Might Not Be As Mispriced As It Looks After Plunging 26%

EMB Mission Bound AB (publ) (STO:EMB) shares have had a horrible month, losing 26% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 68%, which is great even in a bull market.

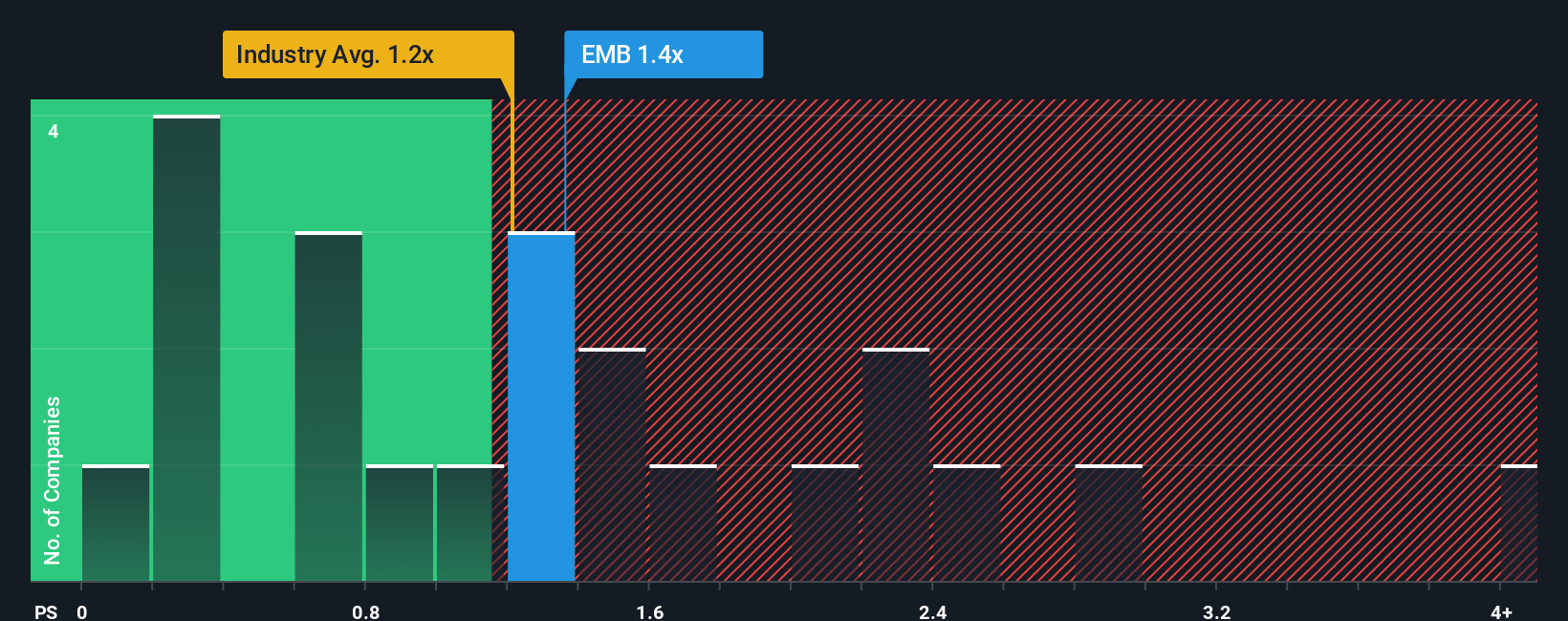

In spite of the heavy fall in price, there still wouldn't be many who think EMB Mission Bound's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Sweden's Hospitality industry is similar at about 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for EMB Mission Bound

How EMB Mission Bound Has Been Performing

Recent times have been quite advantageous for EMB Mission Bound as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on EMB Mission Bound will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on EMB Mission Bound's earnings, revenue and cash flow.How Is EMB Mission Bound's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like EMB Mission Bound's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 140%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 1.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that EMB Mission Bound is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for EMB Mission Bound looks to be in line with the rest of the Hospitality industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that EMB Mission Bound currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for EMB Mission Bound (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of EMB Mission Bound's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal