A Piece Of The Puzzle Missing From Tobii AB (publ)'s (STO:TOBII) 30% Share Price Climb

Tobii AB (publ) (STO:TOBII) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

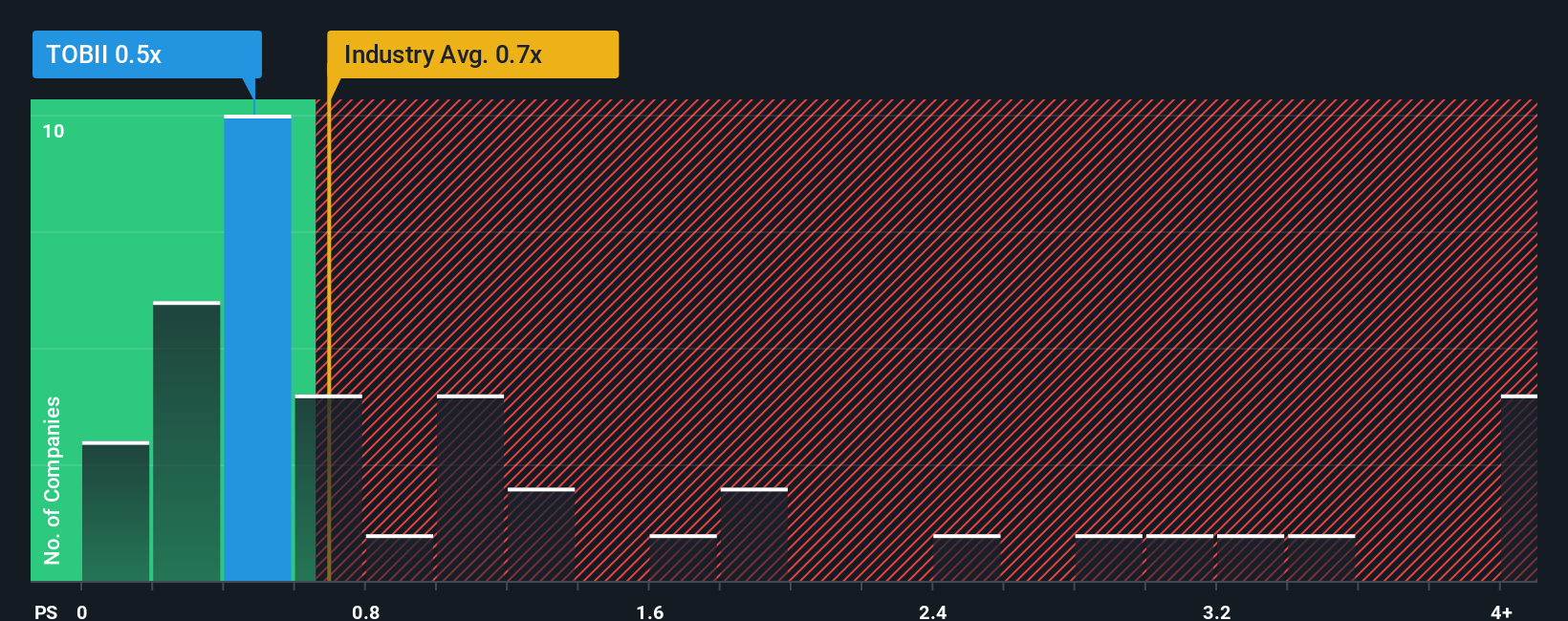

In spite of the firm bounce in price, given about half the companies operating in Sweden's Tech industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Tobii as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tobii

What Does Tobii's P/S Mean For Shareholders?

Revenue has risen firmly for Tobii recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Tobii, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Tobii's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 30% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 9.4% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Tobii is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

Tobii's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Tobii currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

Plus, you should also learn about these 2 warning signs we've spotted with Tobii (including 1 which shouldn't be ignored).

If you're unsure about the strength of Tobii's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal