3 Asian Growth Companies With Up To 22 Percent Insider Ownership

As global markets navigate a complex landscape marked by interest rate adjustments and economic uncertainties, Asia's stock markets have been experiencing varied performance. While Japan shows signs of resilience with potential central bank policy shifts, China's economy grapples with deflationary pressures, impacting investor sentiment. In such an environment, growth companies with high insider ownership can offer unique insights into market confidence and potential stability.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.1% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

PATEO CONNECT Technology (Shanghai) (SEHK:2889)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PATEO CONNECT Technology (Shanghai) Corporation specializes in developing smart cockpit solutions and vehicle connectivity services for OEMs and Tier-1 suppliers in China and Hong Kong, with a market cap of HK$29.13 billion.

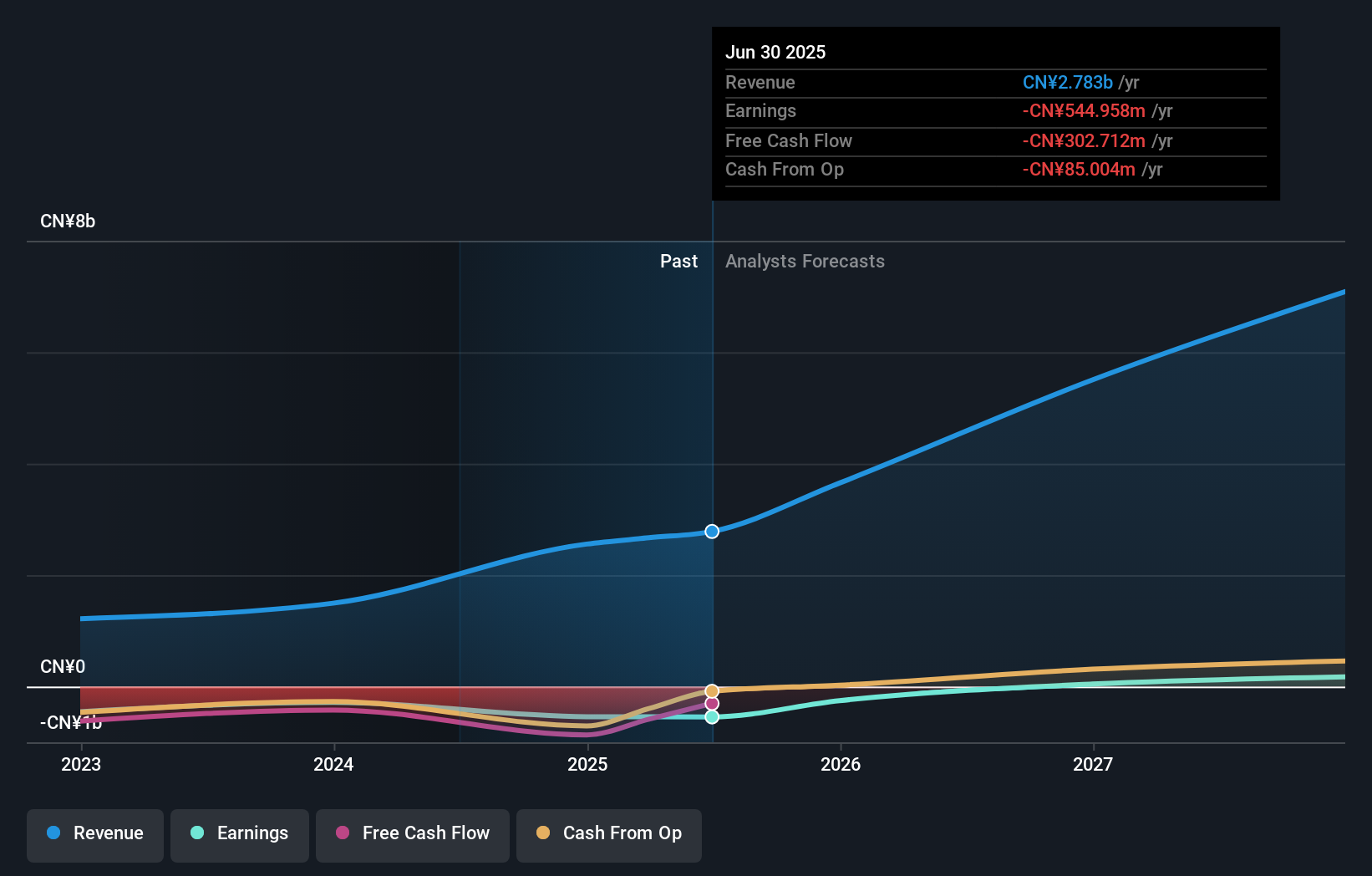

Operations: The company generates revenue from smart cockpit solutions amounting to CN¥2.66 billion and vehicle connectivity support services totaling CN¥122.39 million.

Insider Ownership: 22.3%

PATEO CONNECT Technology (Shanghai) is experiencing significant revenue growth, with a 37.5% increase over the past year and forecasts suggesting continued expansion at 36.4% annually, outpacing the Hong Kong market. Recent project wins from leading automotive manufacturers bolster its position in the new energy vehicle sector. Despite a volatile share price and current losses (CNY 227.18 million), profitability is anticipated within three years, supported by a recent HKD 1.07 billion IPO to fund future growth initiatives.

- Navigate through the intricacies of PATEO CONNECT Technology (Shanghai) with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that PATEO CONNECT Technology (Shanghai)'s current price could be inflated.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥8.52 billion.

Operations: Hangzhou Zhongtai Cryogenic Technology focuses on the development, design, manufacturing, and sale of cryogenic equipment within China.

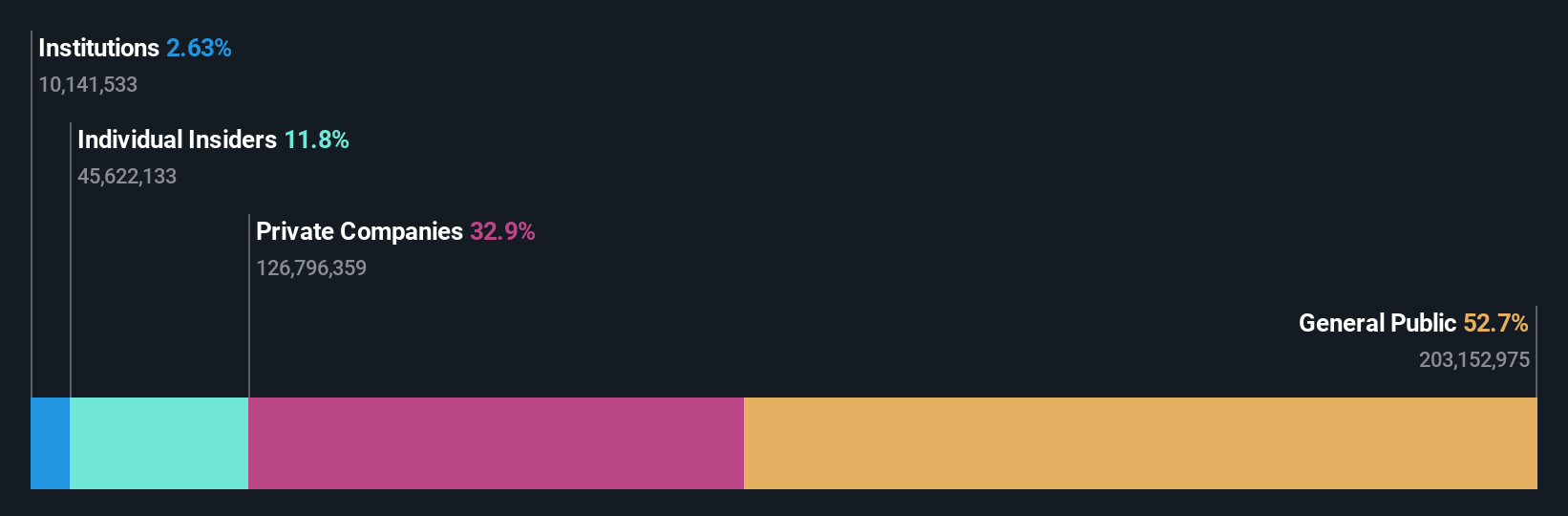

Insider Ownership: 11.8%

Hangzhou Zhongtai Cryogenic Technology is experiencing robust earnings growth, with net income reaching CNY 335.52 million for the first nine months of 2025, up from CNY 189.48 million a year ago. Revenue growth is projected at 17.1% annually, outpacing the broader Chinese market's forecasted growth rate. Despite lower profit margins this year (2.4%), insider ownership remains strong with no significant insider trading activity reported recently, supporting confidence in its strategic direction and governance changes approved in November 2025.

- Delve into the full analysis future growth report here for a deeper understanding of Hangzhou Zhongtai Cryogenic Technology.

- Our expertly prepared valuation report Hangzhou Zhongtai Cryogenic Technology implies its share price may be too high.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persol Holdings Co., Ltd. offers human resource services globally under the PERSOL brand and has a market capitalization of ¥643.38 billion.

Operations: The company's revenue is primarily derived from its Staffing segment at ¥605.90 billion, followed by the Asia Pacific region contributing ¥475.36 billion, the Career segment with ¥149.57 billion, Technology at ¥120.30 billion, and BPO generating ¥132.40 billion.

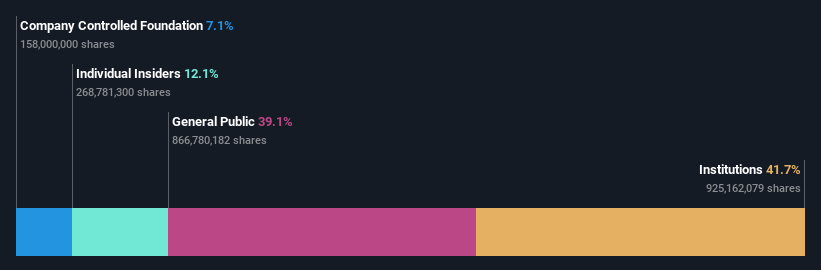

Insider Ownership: 12.1%

Persol Holdings Ltd. shows a stable growth trajectory, with earnings projected to grow 11.6% annually, surpassing the Japanese market's average of 8.4%. The company recently announced a dividend increase to ¥5.50 for the second quarter of fiscal year ending March 2026, reflecting strong cash flow management despite an unstable dividend history. Additionally, Persol plans to acquire Gojob SAS, enhancing its AI-driven staffing capabilities and expanding its subsidiary network across Asia and Europe.

- Unlock comprehensive insights into our analysis of Persol HoldingsLtd stock in this growth report.

- Our expertly prepared valuation report Persol HoldingsLtd implies its share price may be lower than expected.

Turning Ideas Into Actions

- Navigate through the entire inventory of 635 Fast Growing Asian Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal