Waste Connections (WCN): Revisiting Valuation After Fresh Analyst Optimism and Notable Insider Sale

Recent analyst moves and an insider sale have put Waste Connections (WCN) back on investors’ radar. The conversation is centering less on the headline trades and more on the company’s evolving cash flow story.

See our latest analysis for Waste Connections.

The stock’s recent rebound, with a roughly mid single digit year to date share price return and a solid multi year total shareholder return, suggests momentum is slowly rebuilding as investors refocus on its cash generation and acquisition runway.

If this cash flow story has you rethinking your watchlist, it could be a smart moment to explore fast growing stocks with high insider ownership for other compelling, quietly compounding names.

With shares hovering below analyst targets yet already boasting a strong multi year run, the key question is whether Waste Connections is quietly trading at a discount, or if the market has fully priced in its next leg of growth?

Most Popular Narrative: 13.9% Undervalued

Compared to the last close at $176.47, the most followed narrative pegs Waste Connections’ fair value near $205, framing the stock as modestly discounted.

The analysts have a consensus price target of $210.947 for Waste Connections based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $227.0, and the most bearish reporting a price target of just $150.0.

Want to see how steady, mid single digit growth, a sharp margin reset, and a rich future earnings multiple all combine into that valuation? The narrative lays it bare.

Result: Fair Value of $205 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat narrative could be challenged if weather related disruption persists or acquisition integration stumbles, crimping volumes, margins, and the expected cash flow uplift.

Find out about the key risks to this Waste Connections narrative.

Another Angle on Valuation

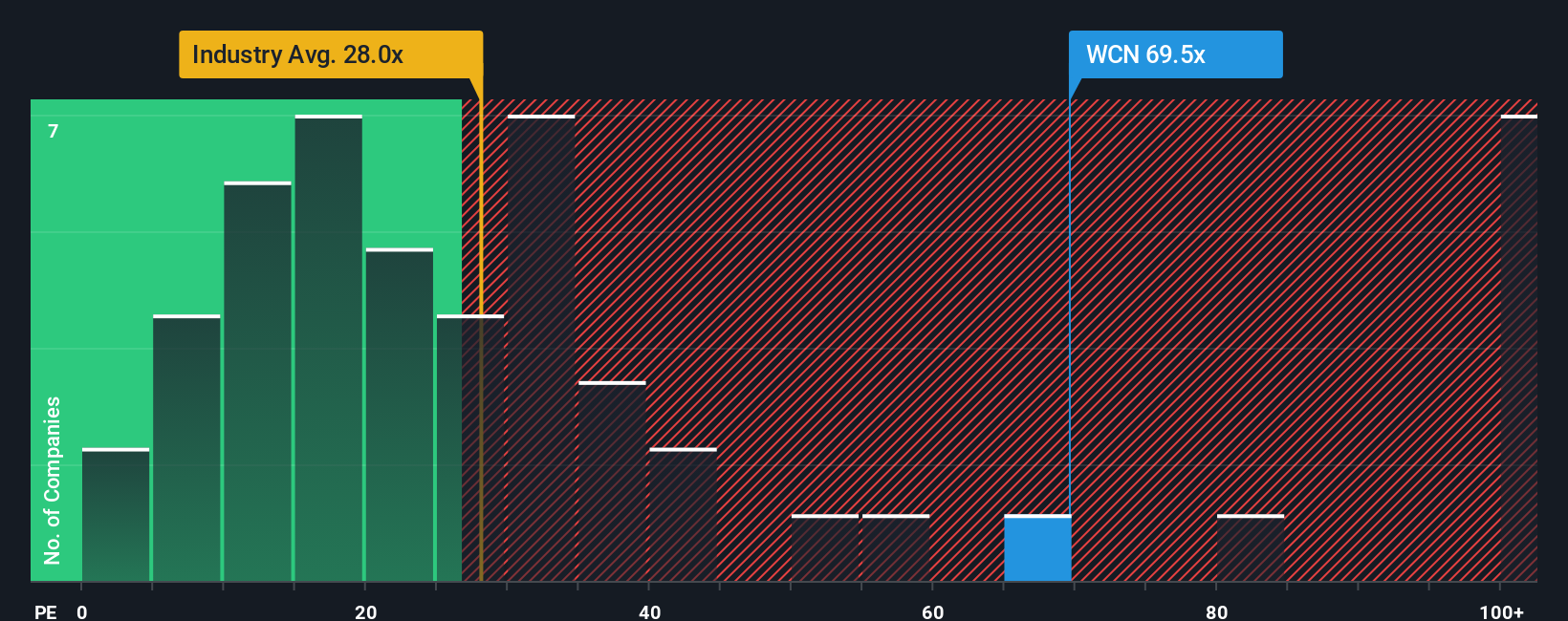

Step away from the narrative of fair value and the earnings multiple tells a very different story. At 72.6 times earnings versus a fair ratio of 35.4 and an industry average of 24.6, Waste Connections screens as richly priced, leaving less room if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Waste Connections research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity now by using the Simply Wall St Screener to uncover fresh, high conviction ideas that others might overlook.

- Target reliable income streams with these 13 dividend stocks with yields > 3% that can help strengthen your portfolio’s cash flow while markets stay unpredictable.

- Capitalize on powerful growth themes by zeroing in on these 26 AI penny stocks shaping the future of intelligent automation and data driven products.

- Position yourself for potential mispriced opportunities by using these 908 undervalued stocks based on cash flows that the market may be underappreciating today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal