Knife River (KNF) Valuation Check After Texas Acquisitions and $112 Million Highway Contract Win

Knife River (KNF) has been busy in Texas, locking in a $112 million highway paving contract and acquiring Texcrete Operations and TexAgg to deepen its vertically integrated footprint across the fast growing Texas Triangle.

See our latest analysis for Knife River.

Despite these Texas wins, Knife River's share price return has been weak year to date at minus 24.1 percent, and its 1 year total shareholder return of minus 28.4 percent suggests that while recent 1 month share price momentum of 9.6 percent is picking up, investors are still pricing in execution and cyclical risks rather than fully rewarding its growth runway.

If this kind of infrastructure led story interests you, it might also be worth exploring aerospace and defense stocks as another way to find companies tied to long term government and industrial spending.

So with profits growing, a major Texas contract in hand and the stock still trading well below analyst targets, is Knife River quietly undervalued here, or is the market already baking in its next leg of growth?

Most Popular Narrative: 21.2% Undervalued

With the most followed narrative pointing to a fair value of $96.80 against a last close of $76.27, the gap between price and projected potential is hard to ignore.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $264.4 million, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 8.1%.

Curious what kind of revenue trajectory, margin uplift and future earnings multiple have to come together to justify that fair value gap? The full narrative unpacks a surprisingly aggressive growth path and valuation profile that looks more like a premium compounder than a traditional materials play. Ready to see which specific financial levers have to fire for this upside case to work?

Result: Fair Value of $96.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent infrastructure funding delays and extreme weather disruptions could easily derail that upside path and test both backlog visibility and margin resilience.

Find out about the key risks to this Knife River narrative.

Another View, Richer Multiples

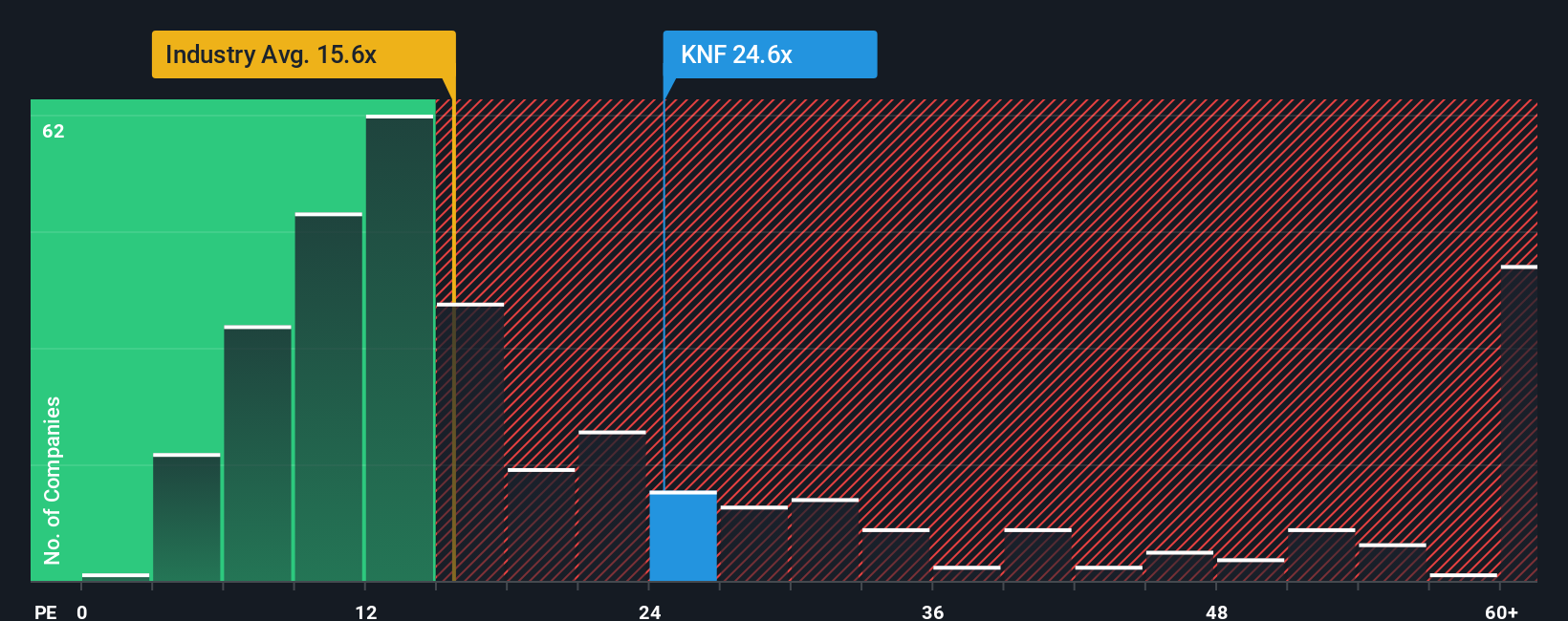

While the narrative suggests Knife River is 21.2 percent undervalued, its 29.1 times price to earnings stands well above both peers at 19.1 times and the sector fair ratio of 20.7 times. That premium implies limited margin for error if growth or margins fall short, so which signal would you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Knife River Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a custom Knife River narrative in minutes: Do it your way.

A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh ideas with the Simply Wall Street Screener so you are not catching up after the market moves.

- Capture potential bargains early by reviewing these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully recognized yet.

- Ride powerful innovation trends by targeting these 26 AI penny stocks that focus on reshaping productivity, automation and long term earnings across entire industries.

- Strengthen your income foundation by focusing on these 13 dividend stocks with yields > 3% that combine attractive yields with financials that support paying through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal