ASX Penny Stocks With Market Caps Under A$300M To Consider

The Australian market is experiencing a period of uncertainty, with shares opening flat and lacking the anticipated end-of-year rally. Despite this cautious atmosphere, there are still opportunities for investors to explore, particularly in the realm of penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer intriguing prospects for those willing to look beyond larger firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.465 | A$69.11M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.785 | A$48.88M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.05 | A$225.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.25B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.95 | A$136.74M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 430 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

EDU Holdings (ASX:EDU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EDU Holdings Limited, with a market cap of A$136.74 million, operates through its subsidiaries to provide tertiary education services in Australia.

Operations: The company generates revenue through its subsidiaries, with A$45.01 million from Ikon Institute of Australia and A$16.50 million from Australian Learning Group Pty Limited.

Market Cap: A$136.74M

EDU Holdings Limited is experiencing significant financial improvements, having become profitable in the last year with an outstanding return on equity of 47%. The company's debt levels are well-managed, with cash exceeding total debt and interest payments well covered by EBIT. Despite its high volatility over the past three months, EDU's shares are trading at a substantial discount to estimated fair value. Recent announcements include a share buyback program of up to 18 million shares for A$9.9 million, indicating confidence from the board in the company's valuation and future prospects. However, significant insider selling has occurred recently.

- Click to explore a detailed breakdown of our findings in EDU Holdings' financial health report.

- Examine EDU Holdings' earnings growth report to understand how analysts expect it to perform.

Lumos Diagnostics Holdings (ASX:LDX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lumos Diagnostics Holdings Limited develops, manufactures, and commercializes point-of-care diagnostic products for infectious disease management in the United States, with a market cap of A$208.60 million.

Operations: The company's revenue segment is focused on generating $12.4 million from the provision of point-of-care diagnostics goods and services.

Market Cap: A$208.6M

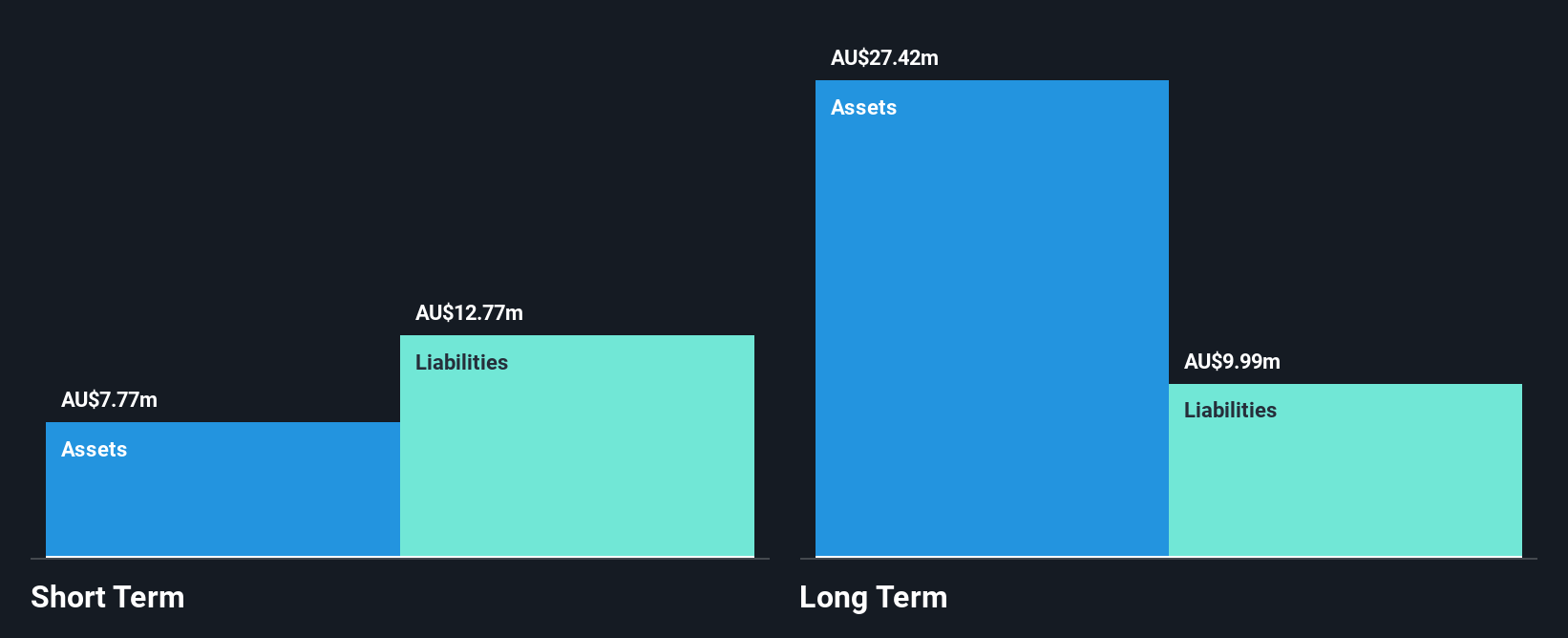

Lumos Diagnostics Holdings is navigating the penny stock landscape with a focus on point-of-care diagnostics, generating A$12.4 million in revenue. Despite being unprofitable and not expected to achieve profitability in the next three years, Lumos has reduced losses by 13.2% annually over five years and forecasts a 33.51% annual revenue growth. The company is debt-free but faces challenges with short-term liabilities exceeding assets by A$2.2 million and only a three-month cash runway as of June 2025, though it raised additional capital recently. Its management team and board are experienced, offering some stability amidst high share price volatility.

- Get an in-depth perspective on Lumos Diagnostics Holdings' performance by reading our balance sheet health report here.

- Gain insights into Lumos Diagnostics Holdings' future direction by reviewing our growth report.

Whitefield Income (ASX:WHI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Whitefield Income Limited is an investment company with a market cap of A$222.82 million.

Operations: The company's revenue segment includes Unclassified Services generating A$10.27 million.

Market Cap: A$222.82M

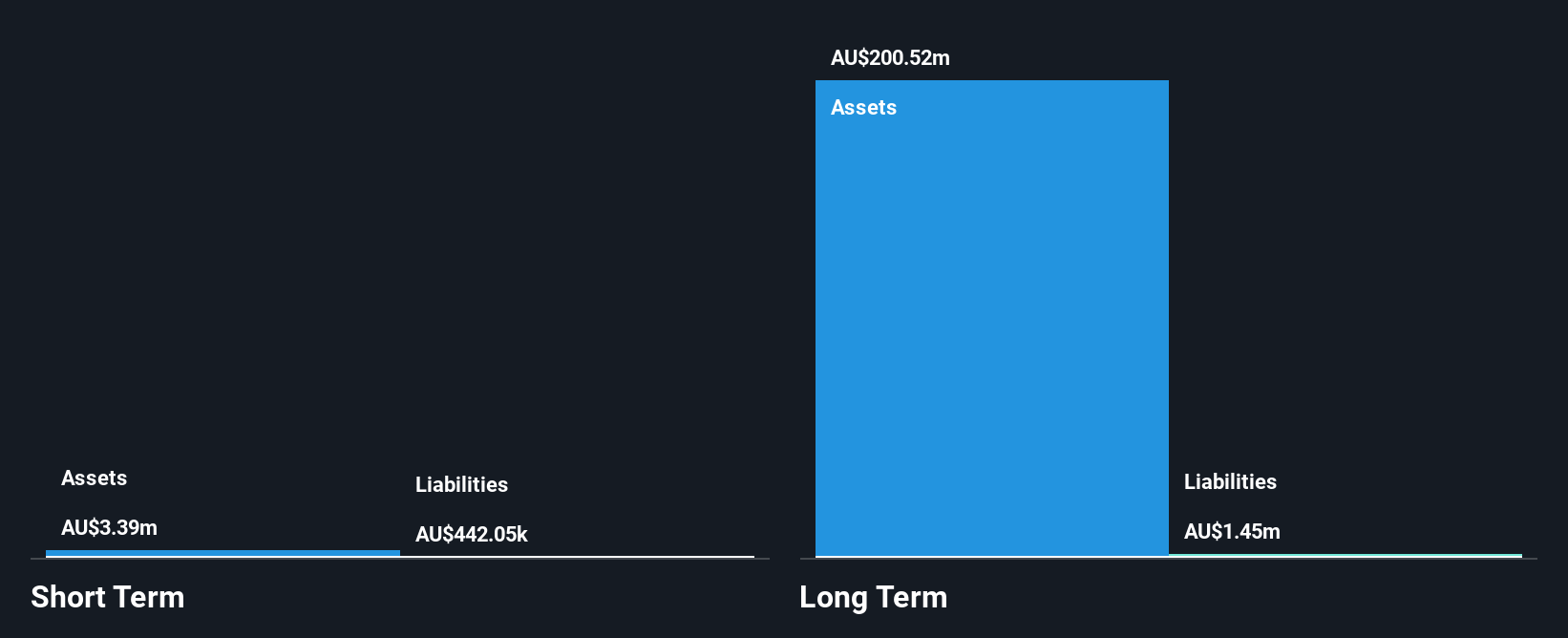

Whitefield Income Limited, with a market cap of A$222.82 million, has shown substantial earnings growth over the past year but maintains a low return on equity at 3.9%. The company is debt-free and its short-term assets exceed both short and long-term liabilities, indicating financial stability. Despite high-quality earnings, its dividend yield of 5.03% is not well covered by free cash flows. Recent follow-on equity offerings raised significant capital, totaling approximately A$122 million in November 2025 alone, which may support future operations or investments but also suggests potential shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of Whitefield Income stock in this financial health report.

- Gain insights into Whitefield Income's historical outcomes by reviewing our past performance report.

Next Steps

- Investigate our full lineup of 430 ASX Penny Stocks right here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal