US stocks started “headwind” this week: technology stock sell-offs spread, key data: the pre-wave market fluctuated again

The Zhitong Finance App noticed that the US stock market closed down on Monday because the sell-off in technology stocks continued and traders were preparing for a large amount of economic data to be released.

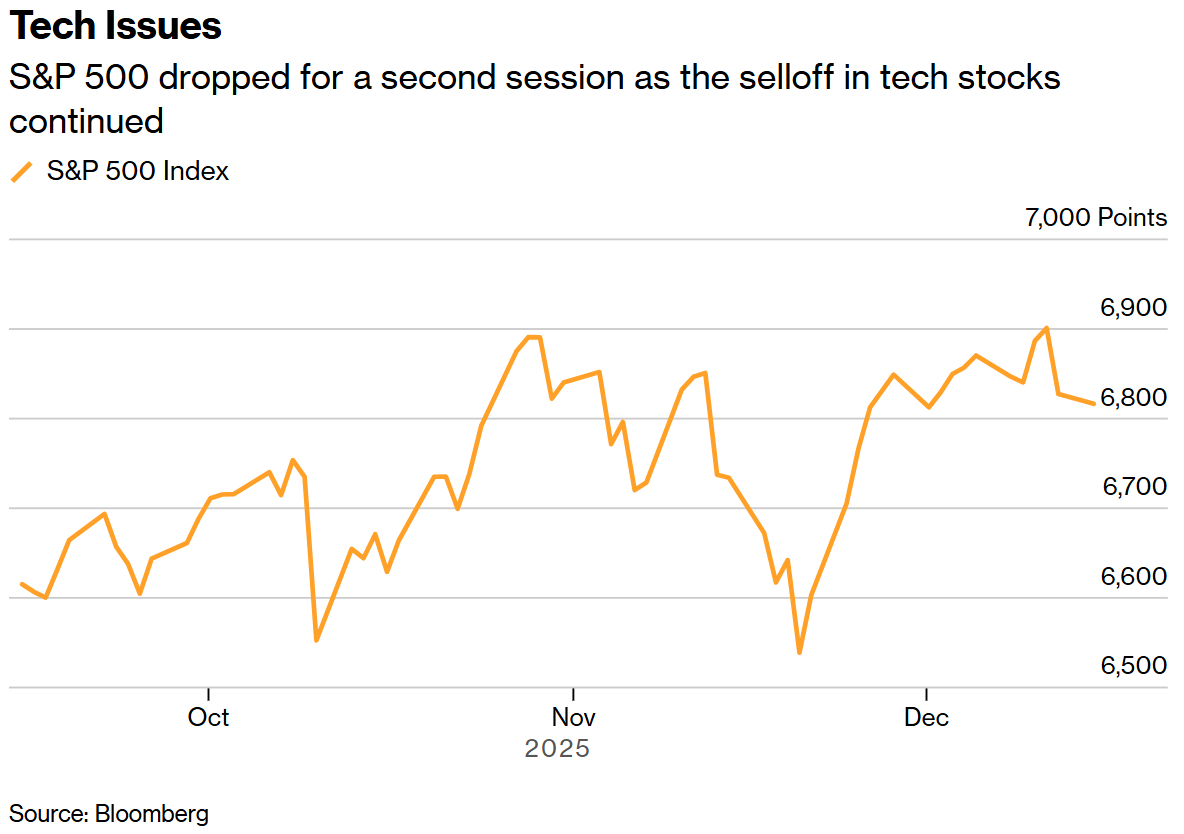

The S&P 500 closed down 0.2% in New York, erasing early gains and recording a decline for the second consecutive trading day. The tech-heavy Nasdaq 100 index fell 0.5%, causing the benchmark index to fall for the third consecutive trading day.

Chris Beauchamp, IG's chief market analyst, said: “The positive mood in early trading has dissipated, and last Friday's sell-off continued into the US trading session this Monday.” He said, “After such a strong recovery since April, the temptation for many investors to make a profit must be very strong, especially when there are plenty of macro events on the calendar this week.”

Tech stocks did not perform well last week as concerns about artificial intelligence resurfaced. Disappointing earnings reports from Oracle (ORCL.US) and Broadcom (AVGO.US) have heightened these concerns and undone the optimism brought about by the Federal Reserve's interest rate cuts.

Rick Gardner, chief investment officer at RGA Investments, believes that whether investors will continue to accept overvaluations of big tech stocks and artificial intelligence stocks is “a big question” in 2026. He pointed out that while the technology showed “huge promise,” the valuation of many stocks “traded as if all artificial intelligence productivity had now been achieved.”

Seven tech giants closed with mixed results, including Nvidia (NVDA.US), Meta (META.US), and Tesla (TSLA.US) ) Increased. The seven tech giants' indices rose 0.1%.

The S&P 500 index fell for the second consecutive trading day

Nationwide's Mark Hackett thinks concerns about the AI bubble are “probably exaggerated.”

“It's not a market-wide phenomenon — it's very company-specific and relatively manageable,” Hackett said. He said that although some individual stocks have a greater impact on the S&P 500 index than others, “this risk is weakening as market leadership continues to shift and investors diversify their investments from a narrow group of companies.”

He added, “What we're seeing is more like the market is recalibrating.”

Traders will turn their attention to the large amount of economic data that will be released this week. Non-farm payrolls data for October and November and the unemployment rate report for November are scheduled to be released on Tuesday. Subsequently, the partial Consumer Price Index (CPI) report for October and the full CPI report for November will be released on Thursday.

For traders, this week's economic data will help fill the data gap caused by the government shutdown. Economists expect the number of employed people to increase by 50,000 in November, with an unemployment rate of 4.5%.

Wall Street strategists remain optimistic about US stocks. Morgan Stanley's Michael Wilson said that this week's moderately weak employment data may increase the possibility that the Federal Reserve will cut interest rates further, thereby boosting the bullish sentiment in the stock market.

“We are now back in the 'good news is bad news/bad news is good news' mechanism,” Wilson wrote in a report released on Monday. “This means that the moderate weakness in the labor market is likely to be interpreted by the stock market from a bullish perspective,” he said.

Meanwhile, Citi's strategists, led by Scott Chronert, are among the latest to predict a double-digit increase in the US stock market next year. Chronert predicts that the S&P 500 will jump to 7,700 points by the end of 2026, and strong earnings and expectations of loose monetary policy are at the core of this forecast.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal