Wix.com (WIX): Reassessing Valuation After a Sharp Short-Term Share Price Slide

Wix.com (WIX) shares have slid sharply over the past month and the past 3 months, even as the business continues to grow double digits in revenue and earnings, raising a fresh valuation question for investors.

See our latest analysis for Wix.com.

At a share price of $97.78, Wix.com has seen its 30 day share price return tumble nearly 22 percent and its year to date share price return fall sharply. However, the three year total shareholder return remains positive, signaling that recent momentum is clearly fading against an otherwise improving earnings story.

If Wix.com’s setback has you reassessing growth names, this could be a good moment to explore high growth tech and AI stocks for other software and AI driven businesses showing stronger share price momentum.

With revenue and earnings still growing at double-digit rates and the stock now trading at a steep discount to analyst targets, investors face a key question: Is this a mispriced growth story, or is the market already discounting future gains?

Most Popular Narrative Narrative: 41.5% Undervalued

Against Wix.com’s last close of $97.78, the most widely followed narrative points to a fair value near $167, implying a striking upside gap.

The analysts have a consensus price target of $206.091 for Wix.com based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $255.0, and the most bearish reporting a price target of just $160.0.

If you want to see how double digit growth, rising margins and a punchy future earnings multiple all combine into that lofty fair value, dive into the full narrative to uncover the precise assumptions behind this bold upside case.

Result: Fair Value of $167.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on Wix navigating intensifying AI driven competition and margin pressure from heavy Base44 and infrastructure investment.

Find out about the key risks to this Wix.com narrative.

Another Angle on Value

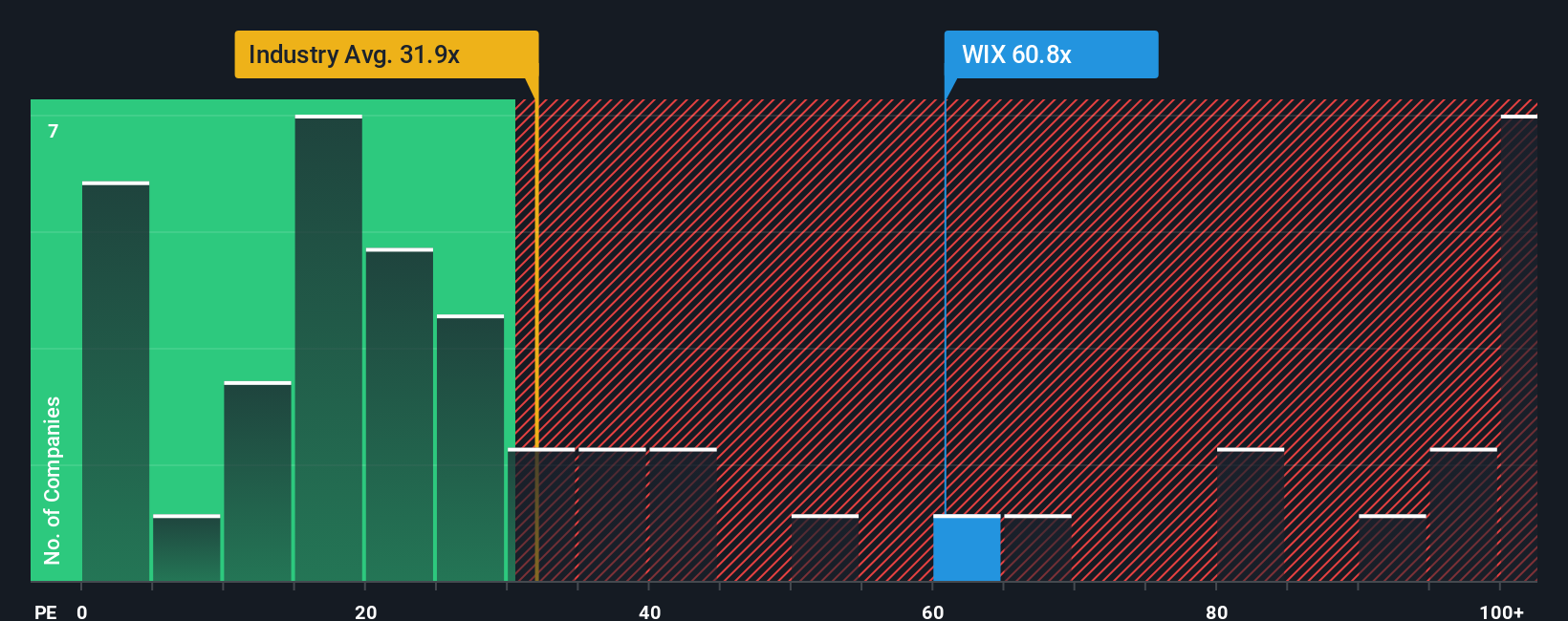

Our valuation checks suggest Wix looks cheap versus its fair value estimate, yet its 38.5x price to earnings ratio still sits above a 37.1x fair ratio and the US IT sector at 29.9x. Is the current discount a chance to buy growth, or a warning on multiple risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wix.com Narrative

If you see the story differently or want to test your own assumptions, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Wix.com research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market’s next move, take a few minutes to uncover fresh opportunities with the Simply Wall Street Screener so your watchlist stays ahead of the crowd.

- Capitalize on overlooked value by scanning these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has mispriced.

- Explore the next wave of intelligent automation with these 26 AI penny stocks positioned at the heart of AI driven transformation.

- Strengthen your income strategy through these 13 dividend stocks with yields > 3% offering yields that could support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal