Should Marqeta’s US$100 Million Buyback Authorization Require Action From Marqeta (MQ) Investors?

- Earlier in December 2025, Marqeta, Inc. announced that its Board had authorized a share repurchase program of up to US$100 million of its Class A common stock, with no set expiration date and execution aligned to its capital allocation priorities.

- This buyback initiative highlights management’s confidence in Marqeta’s underlying business and signals an intention to return excess capital while potentially reducing share count over time.

- We’ll now examine how Marqeta’s newly announced US$100 million share repurchase authorization could influence its investment narrative and capital priorities.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Marqeta Investment Narrative Recap

To own Marqeta, I think you need to believe its card issuing platform can stay central to embedded finance while it moves toward sustainable profitability. The new US$100 million buyback authorization supports the capital return story but does not materially change the near term catalyst of execution on revenue growth guidance, nor does it reduce the key risk that a major customer like Block could scale back volumes or move away.

The most closely linked development is Marqeta’s earlier February 2025 authorization of up to US$300 million in share repurchases, under which it has already bought back more than 45 million shares. Taken together, these programs reinforce the role of capital allocation in the thesis, but the real test for the shares still hinges on how effectively Marqeta converts growing payment volumes and product innovation into durable margins and eventual profitability.

Yet behind the buybacks, one risk investors should be aware of is the continued dependence on a small number of key customers...

Read the full narrative on Marqeta (it's free!)

Marqeta's narrative projects $900.6 million revenue and $47.9 million earnings by 2028. This requires 17.6% yearly revenue growth and a $112.6 million earnings increase from -$64.7 million today.

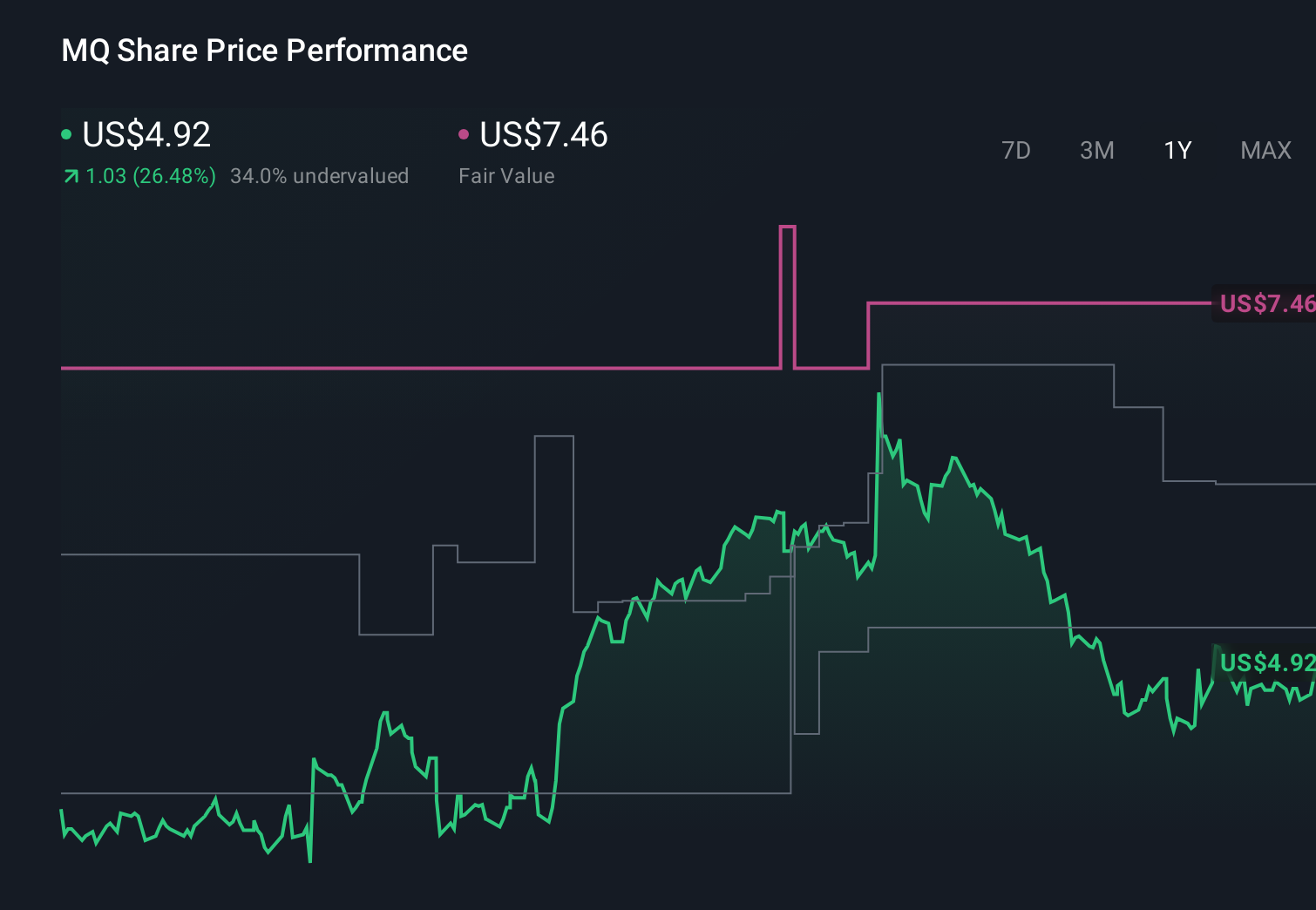

Uncover how Marqeta's forecasts yield a $6.18 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Marqeta between US$3.70 and US$8.00 per share, underscoring how far opinions can spread. Against that backdrop, the company’s heavy reliance on a few dominant customers may shape how you weigh those different views and think about Marqeta’s ability to sustain its current business mix.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth as much as 66% more than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal