Willis Towers Watson (WTW): Assessing Valuation After a Steady Year-to-Date Share Price Climb

Willis Towers Watson (WTW) has been quietly grinding higher, with the stock up around 7% this year and roughly flat over the past 3 months, despite mixed profit and revenue growth trends.

See our latest analysis for Willis Towers Watson.

At around $330.77 per share, Willis Towers Watson’s steady year to date share price return of about 7% and robust five year total shareholder return near 70% suggest momentum is gradually building as investors grow more comfortable with its mixed growth profile.

If WTW’s measured climb has you thinking about what else could rerate as confidence improves, it is worth exploring fast growing stocks with high insider ownership for other compelling ideas.

With revenue still growing, profits under pressure and the shares trading at a modest discount to analyst targets, does WTW quietly offer value today, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 11% Undervalued

With Willis Towers Watson last closing at $330.77 against a narrative fair value near $371.61, the story hinges on sustained free cash flow and margin gains.

Active portfolio optimization, including cost discipline, segment divestitures, and strategic investments in high-growth markets like the Middle East, are streamlining operations and supporting margin expansion. This is setting the stage for higher net margins and free cash flow. WTW's strategic focus on specialized, higher-margin segments (e.g., data centers, clean energy, health) and growth in emerging markets diversifies revenue streams and buffers against macroeconomic headwinds, supporting mid-single to high-single-digit organic revenue growth over the long term.

Want to see what powers that double lift in margins and earnings, even as growth stays steady, not explosive? The full narrative reveals the math.

Result: Fair Value of $371.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating AI driven commoditization and intensifying competition from global peers could pressure fees and challenge the margin expansion that underpins this undervaluation story.

Find out about the key risks to this Willis Towers Watson narrative.

Another Angle on Valuation

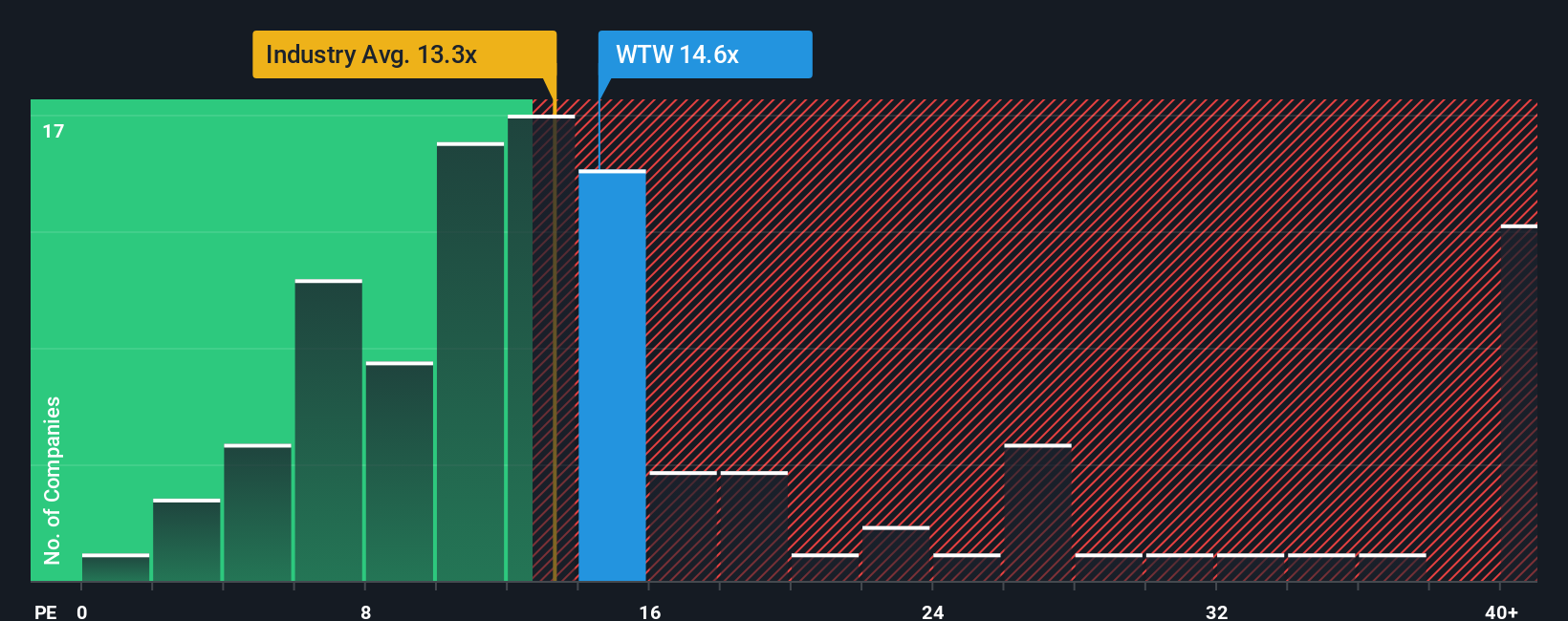

On earnings, Willis Towers Watson looks less of a bargain. The shares trade on about 15 times earnings versus 13.4 times for the US insurance sector, and a fair ratio of 11.4 times. If sentiment cools, could that premium multiple be the first thing to unwind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willis Towers Watson Narrative

If you see the story differently, or just want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore a few fresh angles from the Simply Wall St Screener so you are not leaving potential returns on the table.

- Boost your search for overlooked bargains by scanning these 908 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Seek exposure to intelligent automation by targeting these 26 AI penny stocks that are positioned to benefit from expanding AI adoption across industries.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can potentially enhance long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal