Inspire Medical Systems (INSP): Reassessing Valuation After Recent Volatile Share Price Swings

Inspire Medical Systems (INSP) has experienced a volatile ride lately, with the stock dropping over the past week but still sitting well above where it traded a month ago.

See our latest analysis for Inspire Medical Systems.

Stepping back, that sharp 1 day and 7 day share price pullback comes after a powerful 30 day and 90 day rebound, but longer term total shareholder returns remain deeply negative. This suggests momentum is rebuilding from a still beaten up base.

If Inspire’s recent swings have you rethinking where you look for healthcare opportunities, this could be a good moment to scout other compelling names across healthcare stocks.

With shares still far below prior highs yet trading at a modest discount to analyst targets despite double digit growth, investors face a key question: Is Inspire now a contrarian buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 7% Undervalued

With Inspire Medical Systems last closing at $119.26 against a narrative fair value near $128, the story hinges on whether future growth can sustain a richer multiple.

The analysts have a consensus price target of $144.533 for Inspire Medical Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $97.0.

Want to see what justifies paying a premium multiple on future earnings and margins, even as growth moderates from past highs? The narrative breaks down how long term revenue expansion, rising profitability, and a specific discount rate combine to support that higher fair value, and why analysts think the market is still underestimating the earnings power baked into those projections.

Result: Fair Value of $128.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering execution challenges around the Inspire V rollout and potential long term pressure from GLP 1 weight loss therapies could still derail that optimistic setup.

Find out about the key risks to this Inspire Medical Systems narrative.

Another Angle on Value: Rich Multiples, Different Story

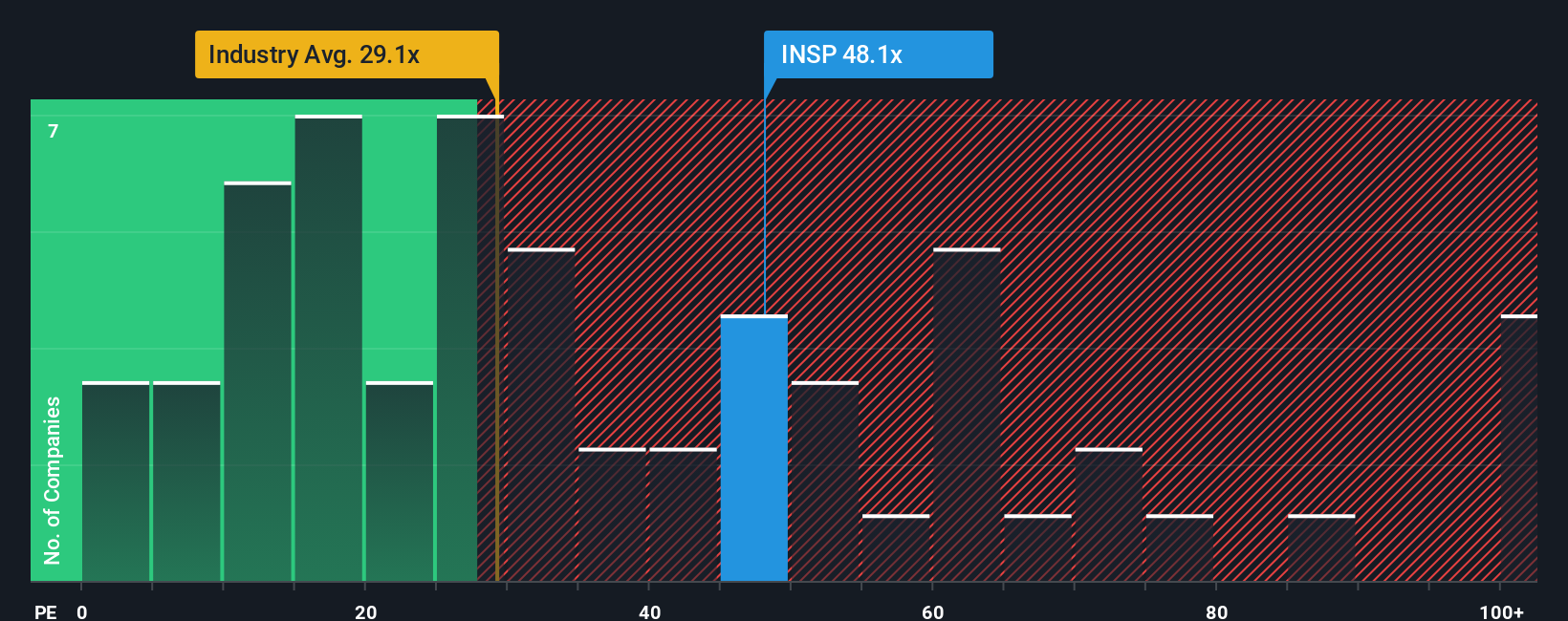

While the narrative fair value suggests Inspire Medical Systems is modestly undervalued, the market ratio view looks harsher. At a price to earnings ratio of 77.8 times versus a fair ratio of 32.3 times and an industry closer to 30 times, the shares screen as clearly expensive, raising the question of how much execution risk is really priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you see the setup differently or want to stress test the assumptions yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover fresh stock ideas tailored to your strategy before the market catches on.

- Capture potential mispricings early by targeting these 908 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride powerful secular trends by zeroing in on these 26 AI penny stocks that could reshape entire industries with intelligent automation.

- Strengthen your portfolio’s income engine by focusing on these 13 dividend stocks with yields > 3% that may offer cash returns alongside long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal