Hongming Electronics GEM IPO submitted for registration to raise 1,907.1 billion yuan

The Zhitong Finance App learned that on December 15, the review status of Chengdu Hongming Electronics Co., Ltd. (Hongming Electronics)'s application for the Shenzhen Stock Exchange GEM IPO was changed to “submit registration”. As its sponsor, Shenwan Hongyuan Securities plans to raise 1,507.1 billion yuan.

According to the prospectus, Hongming Electronics is mainly engaged in R&D, production and sales of new electronic components, mainly resistive components, and is committed to providing customers with high-performance, high-reliability electronic component products. At the same time, the company is also involved in the precision components business. Its products are mainly used in consumer electronics fields such as tablets and laptop computers, and fields such as new energy batteries and automotive electronic structural parts.

During the reporting period, the company's main products were new electronic components and precision component products represented by resistive and capacitive components. Among them, revenue and profit mainly come from the electronic components business, and the company's electronic components are mainly used in the defense field.

In terms of electronic components, the company's main products include multilayer porcelain capacitors (MLCCs), chip ceramic capacitors, organic and mica capacitors, tantalum electrolytic capacitors, thermistors, displacement sensors, etc., as well as other electronic component products such as filters/connectors and microwave devices.

In the field of defense, the company's high-reliability products such as MLCCs, organic and mica capacitors, displacement sensors, and thermistors have strong competitive advantages.

In terms of precision components, the company provides support for consumer electronics products such as tablets, laptops, and mobile phones from well-known brands such as Apple, Lenovo, and Motorola, and has become one of the important suppliers in Apple's industry chain. Furthermore, in recent years, the company has actively expanded business opportunities in the field of new energy vehicles and developed new energy batteries and automotive electronic structural components products.

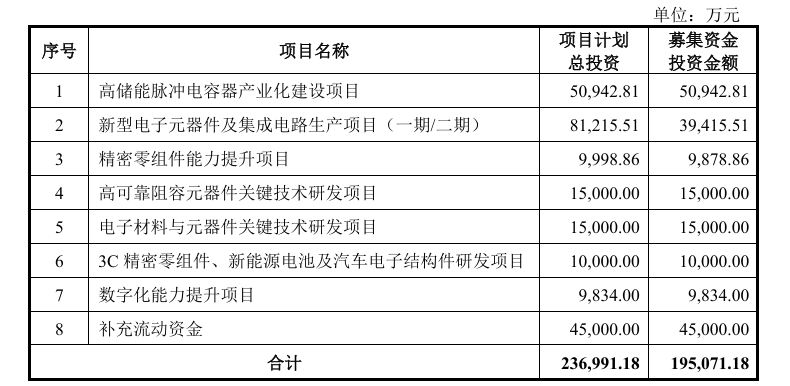

After deducting issuance fees, the funds raised this time will be prioritized and invested in the following projects according to the construction progress of the project:

On the financial side, in 2022, 2023, 2024, and January-June 2025, the company achieved operating revenue of approximately RMB 3.146 billion, RMB 2,727 billion, RMB 2,494 billion, and RMB 1,528 billion, respectively.

For the same period, the company's net profit was approximately RMB 690 million, RMB 598 million, RMB 386 million, and RMB 370 million, respectively.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal