Top Asian Dividend Stocks Offering Up To 5.5% Yield

As global markets navigate fluctuating interest rates and economic uncertainties, Asian markets have shown a mixed performance, with mainland Chinese stocks retreating slightly amid profit-taking and Japan's indices seeing moderate gains. In this dynamic environment, dividend stocks in Asia stand out as potential options for investors seeking steady income streams; these stocks offer attractive yields while providing a buffer against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.78% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.11% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.72% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1016 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

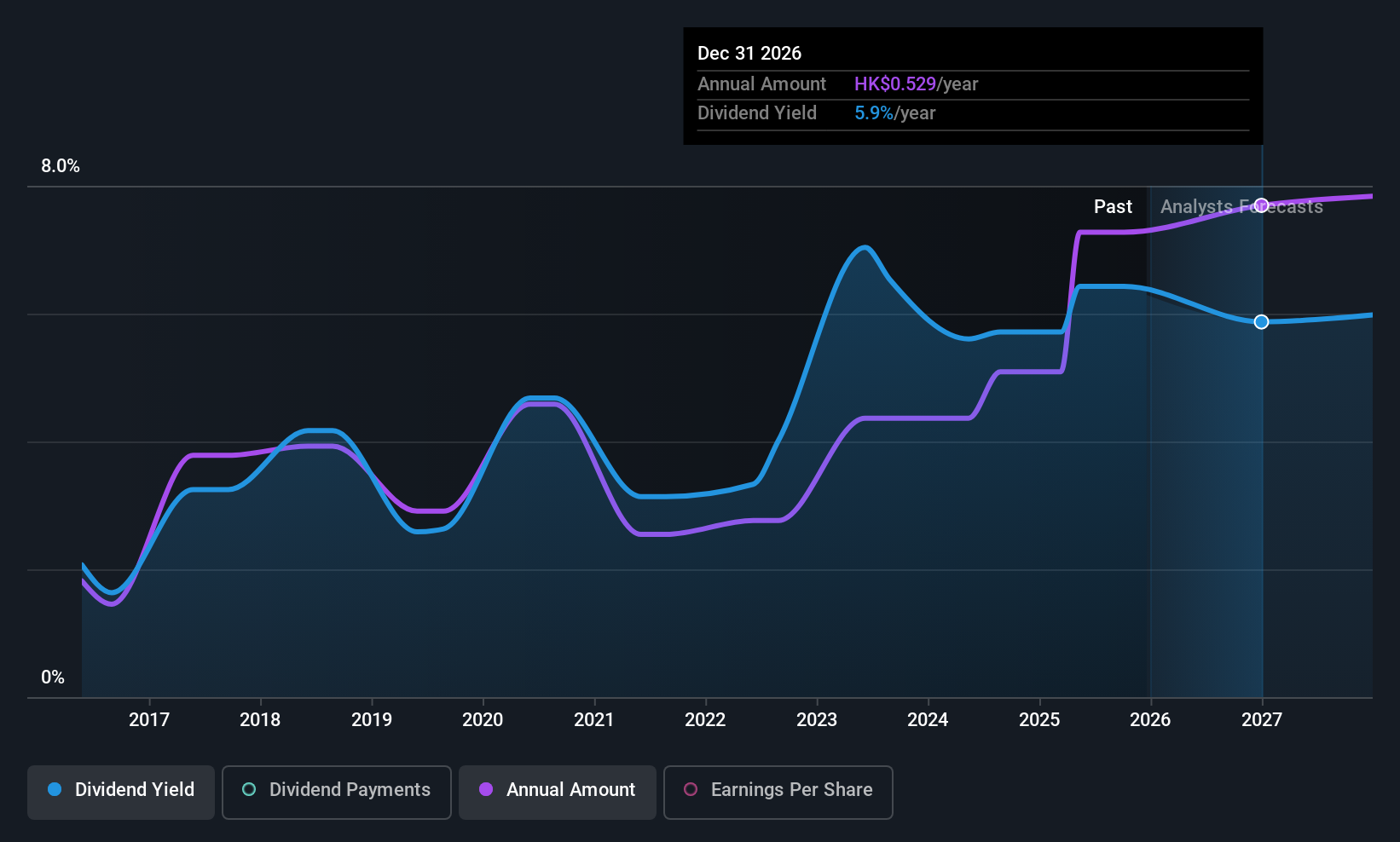

WH Group (SEHK:288)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WH Group Limited is an investment holding company that produces and sells packaged meats and pork across China, North America, and Europe with a market cap of HK$114.06 billion.

Operations: WH Group Limited generates revenue from its main segments, with $15.42 billion from pork and $13.85 billion from packaged meats.

Dividend Yield: 5.6%

WH Group's dividend profile shows a mixed picture. While the company declared a special cash dividend of HK$0.3 per share in September 2025, its regular dividend yield of 5.58% lags behind the top quartile in Hong Kong. Despite this, dividends are well-covered by earnings and cash flows with payout ratios at 61.2% and 41.9%, respectively, indicating sustainability. However, past volatility raises concerns about reliability for consistent income-focused investors.

- Get an in-depth perspective on WH Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that WH Group is trading behind its estimated value.

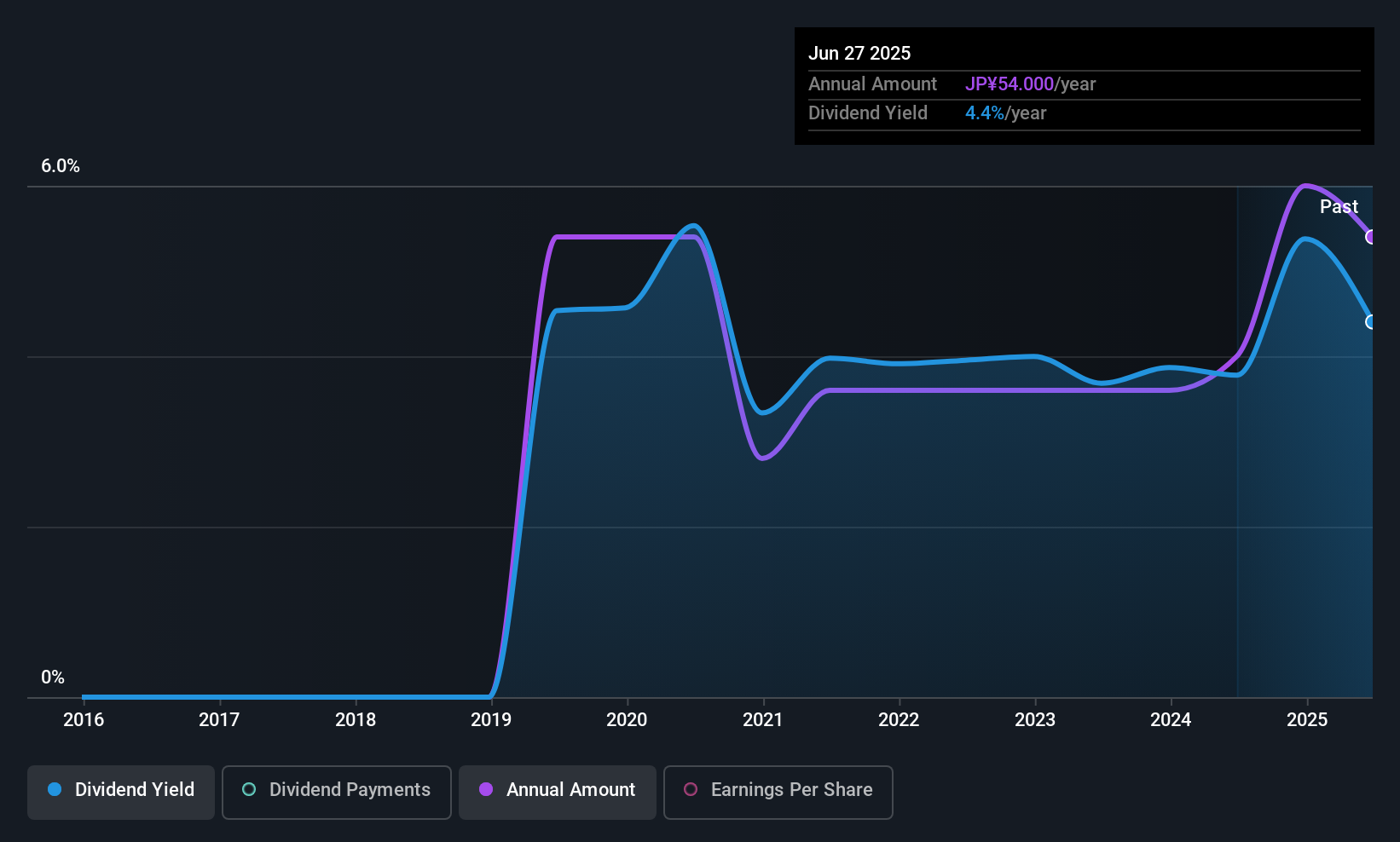

SpaceLtd (TSE:9622)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Space Co., Ltd. (TSE:9622) operates in Japan, focusing on the planning, design, supervision, and construction of commercial facilities, with a market cap of ¥39.08 billion.

Operations: Space Co., Ltd. generates revenue primarily from its Display Business segment, which accounted for ¥69.50 billion.

Dividend Yield: 3.8%

SpaceLtd's dividend profile is characterized by a strong coverage with a payout ratio of 43.2% and cash payout ratio of 37.5%, ensuring sustainability. The dividend yield stands at 3.77%, placing it in the top quartile in Japan, though its seven-year history reveals volatility and unreliability, raising concerns for stability-seeking investors. Recent management changes aim to enhance growth and corporate value, potentially impacting future dividend strategies positively or negatively depending on execution success.

- Unlock comprehensive insights into our analysis of SpaceLtd stock in this dividend report.

- According our valuation report, there's an indication that SpaceLtd's share price might be on the cheaper side.

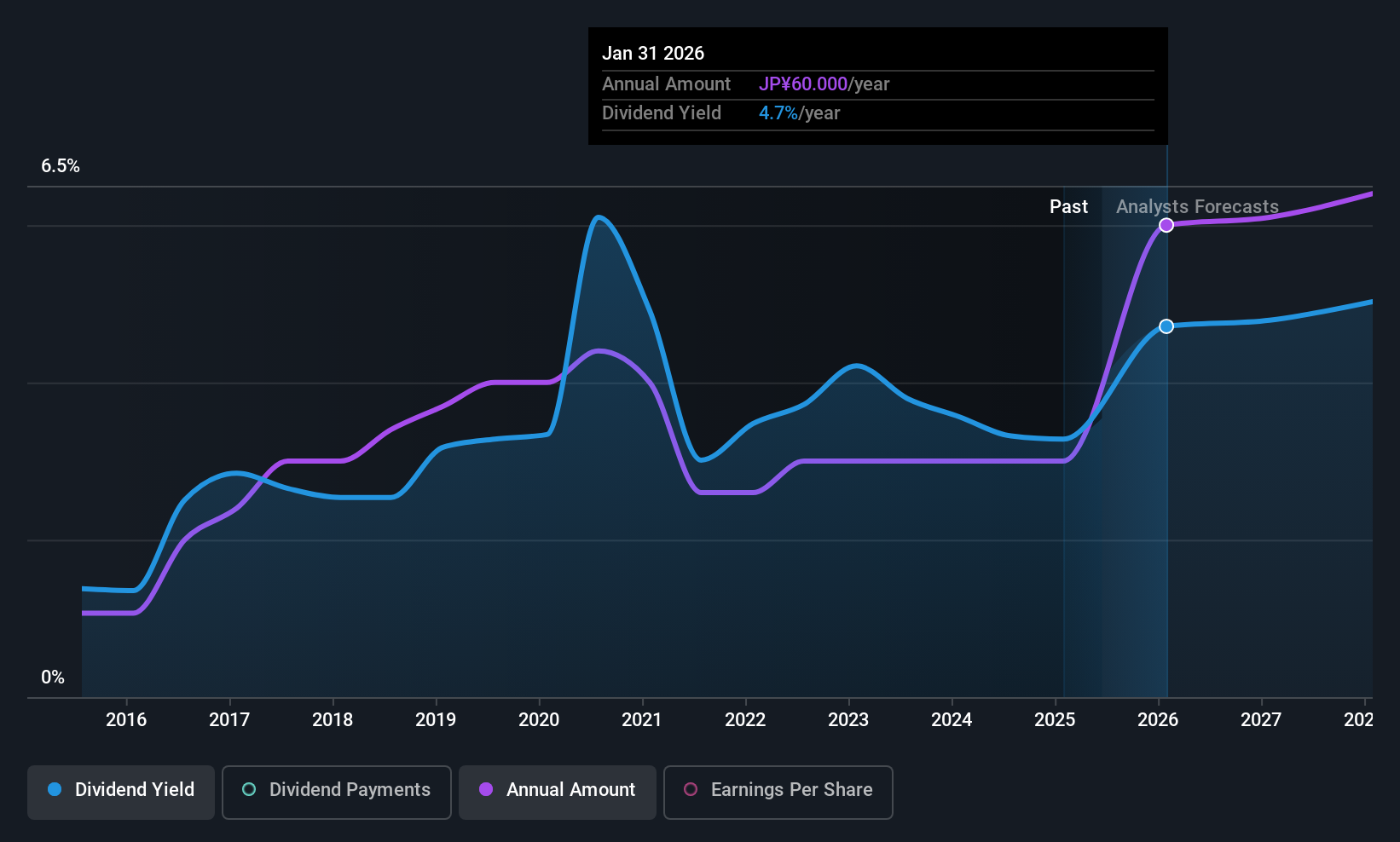

Tanseisha (TSE:9743)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tanseisha Co., Ltd. specializes in the research, planning, design, layout, production, construction, and operation of various commercial and cultural spaces both in Japan and internationally with a market cap of ¥72.58 billion.

Operations: Tanseisha Co., Ltd.'s revenue is primarily derived from its Commercial and Other Facility Business, generating ¥74.46 billion, followed by the Chain Store Business at ¥25.96 billion and the Cultural Facility Business at ¥9.24 billion.

Dividend Yield: 4.8%

Tanseisha's dividend is supported by a payout ratio of 46.4% and a cash payout ratio of 72.8%, suggesting coverage by earnings and cash flows, despite its historically volatile payments over the past decade. The dividend yield at 4.82% ranks in Japan's top quartile, yet its unstable track record may deter conservative investors. Trading at 42.4% below estimated fair value, Tanseisha presents potential value but faces forecasted earnings decline challenges ahead.

- Take a closer look at Tanseisha's potential here in our dividend report.

- Our valuation report unveils the possibility Tanseisha's shares may be trading at a discount.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1016 companies within our Top Asian Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal