Invesco (IVZ) valuation check as it launches Solana ETP and deepens private markets push

Invesco (IVZ) just gave investors two fresh reasons to revisit the stock, pairing a new Solana ETP launch with Galaxy Asset Management and a private markets partnership with LGT Capital Partners that pushes deeper into alternatives.

See our latest analysis for Invesco.

The stock has quietly rebuilt momentum in 2025, with an 11.65% 1 month share price return and an 18.82% 3 month share price return helping drive a 51.59% 1 year total shareholder return as investors reprice Invesco’s digital assets and alternatives push.

If Invesco’s latest moves have you thinking more broadly about what is working in markets, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with the shares now trading close to analyst targets after a 50 percent plus 12 month run, the key question is whether Invesco is still mispriced, or if the market has already baked in its next leg of growth?

Most Popular Narrative Narrative: 3% Undervalued

With Invesco closing at $26.26 against a narrative fair value of about $27.08, the story leans modestly in favor of further upside.

The company's aggressive expansion in private markets and alternative asset offerings, including strategic partnerships (e.g., with Barings and MassMutual) and increased distribution through wealth management channels, aligns with the growing demand for alternatives and could drive higher-fee revenue streams and improved earnings resilience.

Curious how shrinking headline revenues can still support richer margins, rising earnings, and a higher future multiple than today? The narrative’s math might surprise you.

Result: Fair Value of $27.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee pressure from the shift to low cost products and any stumble on QQQ restructuring could quickly challenge the margin improvement story.

Find out about the key risks to this Invesco narrative.

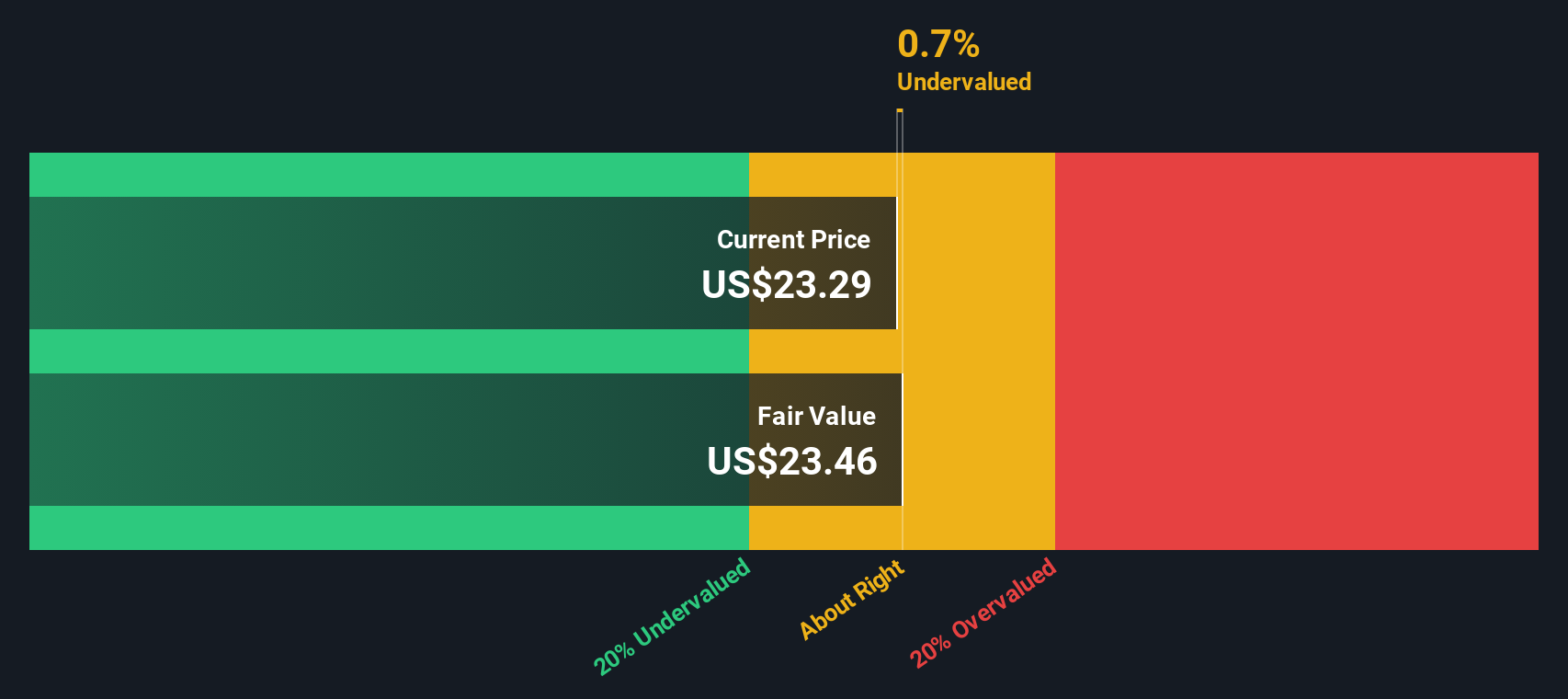

Another Angle on Valuation

Our SWS DCF model paints a sharper contrast, estimating Invesco’s fair value at about $12.25, well below the current $26.26 share price. This implies the stock screens as overvalued on long term cash flows. Is the market overpaying for margin leverage, or are the model inputs too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Invesco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Invesco Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing angles?

If you stop at Invesco, you could miss other potential opportunities. Use the Simply Wall St Screener to uncover fresh, data driven ideas tailored to your strategy.

- Capture potential mispricings by targeting quality companies trading below intrinsic value through these 909 undervalued stocks based on cash flows built on cash flow fundamentals.

- Explore the next wave of innovation by focusing on companies involved in machine learning and automation with these 26 AI penny stocks.

- Strengthen your income stream by zeroing in on yield opportunities via these 13 dividend stocks with yields > 3% that currently offer more than 3 percent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal