Assessing Establishment Labs Holdings’ valuation as upbeat analyst views follow US breast augmentation growth prospects

Recent commentary around Establishment Labs Holdings (ESTA) has focused on its growing foothold in the US breast augmentation and reconstruction markets. In these markets, stronger demand expectations and supportive sector trends have helped propel the share price.

See our latest analysis for Establishment Labs Holdings.

Those growth expectations are already showing up in the numbers, with the share price at $72.51 after a powerful 90 day share price return of 85.21 percent and a five year total shareholder return of 112.95 percent, suggesting momentum is clearly building rather than fading.

If this kind of healthcare growth story is on your radar, it is worth exploring other potential opportunities using our screener for healthcare stocks to see what else fits your strategy.

But with the shares now trading close to analyst targets after such a steep run, the big question is whether Establishment Labs is still mispriced by the market or if investors are already paying for tomorrow’s growth.

Most Popular Narrative Narrative: 2.3% Undervalued

With Establishment Labs closing at $72.51 versus a narrative fair value near $74.22, the stock is framed as modestly discounted despite its rally.

Improving operational leverage, via stable operating expenses, moderation in cash use, and anticipated EBITDA and cash flow breakeven milestones, points toward expanding net margins and earnings scalability as revenues continue to rise. Secular growth tailwinds, such as a rising global middle class and broadening social acceptance of aesthetic and reconstructive procedures, are expected to drive higher procedure volumes globally, underpinning multi year revenue, margin, and earnings growth for Establishment Labs Holdings.

Want to see what powers this premium growth story? The narrative leans on rapid top line compounding, sharply improving margins, and a valuation multiple usually reserved for market darlings.

Result: Fair Value of $74.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high operating costs and a slower than expected commercial ramp in key markets could challenge both the pace and the durability of the current growth narrative.

Find out about the key risks to this Establishment Labs Holdings narrative.

Another View on Valuation

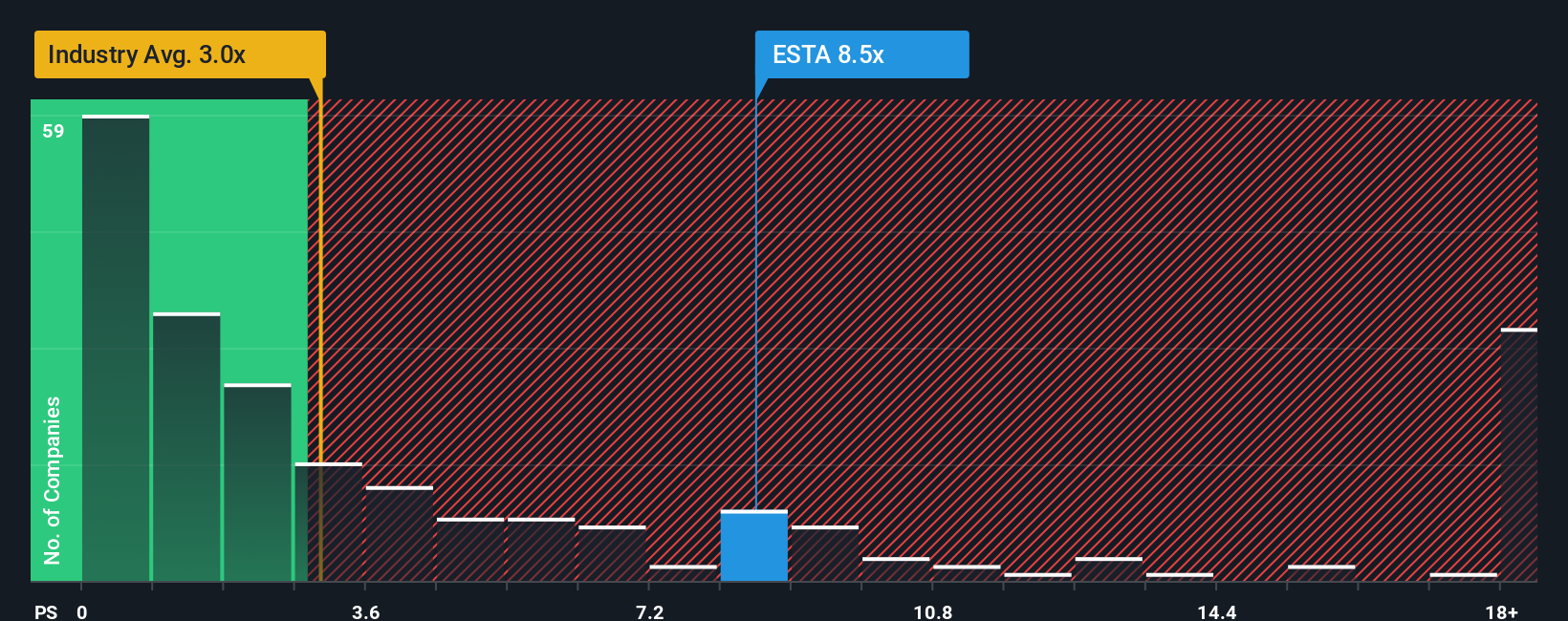

Looked at through sales multiples, Establishment Labs does not look cheap. The shares trade at roughly 11 times sales versus about 3.5 times for the wider US medical equipment sector and 1.7 times for peers, above a fair ratio of 5.6 times that the market could eventually gravitate toward. That premium can reward believers if growth stays flawless, but how much margin of safety is really left if the story stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Establishment Labs Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener today to uncover focused stock ideas across themes and sectors, so you are not left chasing the market later.

- Capitalize on potential market mispricing by targeting these 909 undervalued stocks based on cash flows, which may be candidates for a rerating as fundamentals change.

- Consider structural tech shifts by looking at these 26 AI penny stocks that are positioned in automation, data intelligence and productivity-focused technologies.

- Explore ways to strengthen your income stream with these 13 dividend stocks with yields > 3%, which can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal