The Bull Case For FactSet Research Systems (FDS) Could Change Following Arcesium Platform Integration - Learn Why

- Earlier this month, FactSet and Arcesium announced a new unified investment management platform that connects front, middle, and back office workflows across public, private, and alternative assets, combining FactSet’s analytics with Arcesium’s cloud-native IBOR, ABOR, and data management capabilities.

- This collaboration aims to give asset managers a single source of truth across increasingly complex portfolios, potentially making FactSet more central to clients’ operational and data infrastructure decisions.

- We’ll now explore how this FactSet–Arcesium integration, especially its single source of truth promise, affects FactSet’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

FactSet Research Systems Investment Narrative Recap

To own FactSet, you need to believe it can stay embedded in clients’ workflows as they standardize data and automate research. The FactSet Arcesium integration and the new Amazon Quick Research access both support that “single source of truth” vision, but do not fundamentally change the near term story, where softer pricing uplift, higher cloud costs, and budget pressure at asset managers and banks still look like the key swing factors.

Among recent developments, the Amazon Quick Research launch is especially relevant here, because it links FactSet’s data directly into a client’s AWS environment, aligning with the same theme of deeper enterprise integration that underpins catalysts such as GenAI tools, data feeds, and cross selling recent acquisitions. Together, these moves reinforce the idea that FactSet is trying to meet clients where their workflows already live, rather than pulling them into closed systems.

Yet behind this push into clients’ infrastructure, investors should be aware of how rising cloud and software costs might weigh on margins if...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' narrative projects $2.7 billion revenue and $730.7 million earnings by 2028. This requires 5.7% yearly revenue growth and about a $197.8 million earnings increase from $532.9 million today.

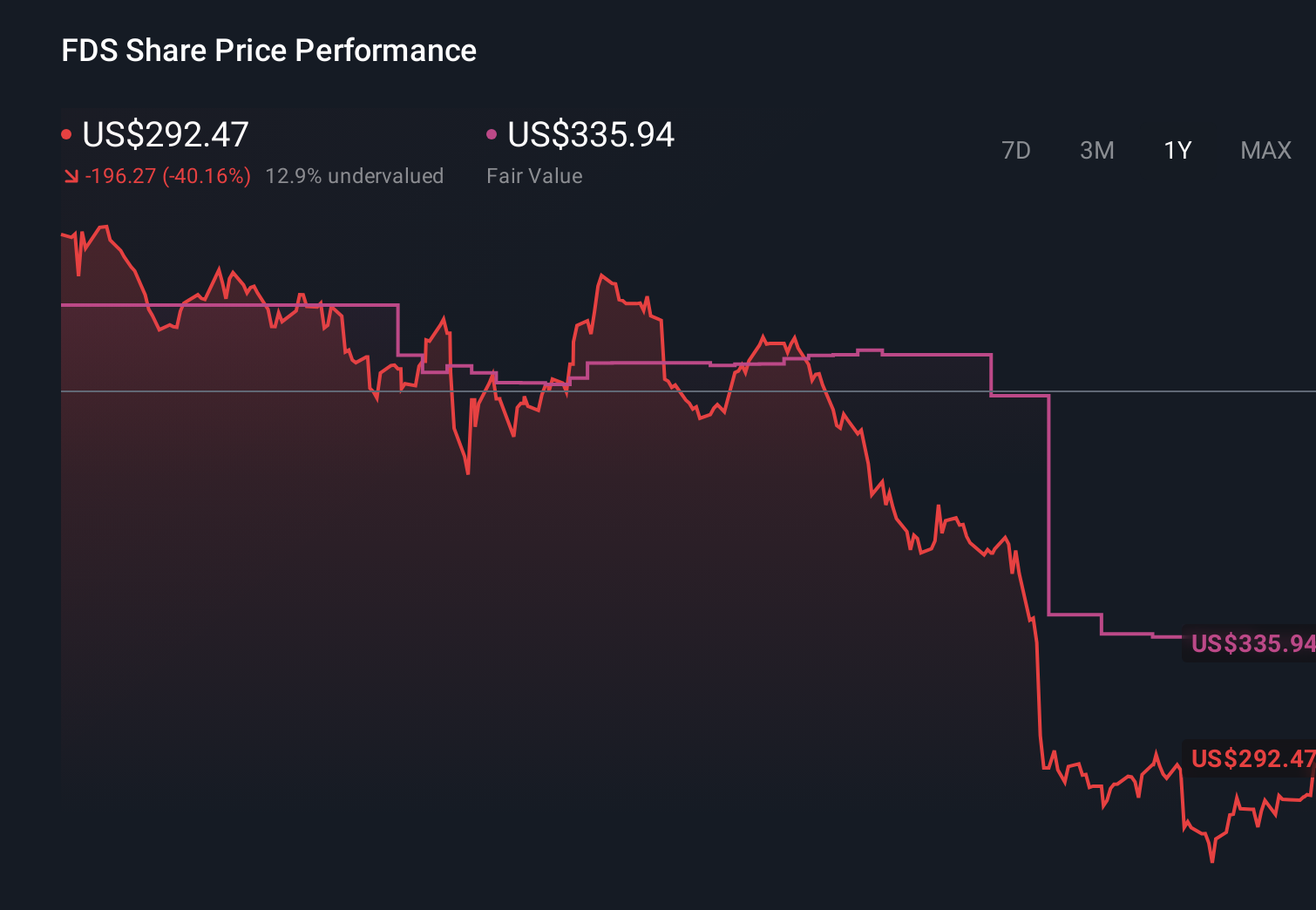

Uncover how FactSet Research Systems' forecasts yield a $335.94 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community valuations cluster between US$276.99 and US$335.94 per share, underscoring how differently individual investors see FactSet’s prospects. As you weigh those views, keep in mind that higher technology and cloud spending could pressure margins and influence how the company’s recent product and partnership efforts ultimately show up in financial performance, so it pays to compare several perspectives before deciding what FactSet is worth.

Explore 4 other fair value estimates on FactSet Research Systems - why the stock might be worth as much as 15% more than the current price!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal