Are Bullish Analyst Calls on Quanta (PWR) Revealing a Deeper Infrastructure Advantage?

- Earlier this week, analysts at Jefferies reiterated their Buy rating on Quanta Services, while J.P. Morgan upgraded the stock and reaffirmed their positive stance on the company's role in modernizing power, utility, and communications infrastructure.

- These endorsements highlight how Quanta's broad engineering capabilities across electric grids, renewables, natural gas, and telecoms are increasingly viewed as central to long-term infrastructure upgrades and reliability improvements.

- Next, we'll examine how this wave of bullish analyst commentary could influence Quanta Services' long-term investment narrative and risk-reward profile.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Quanta Services Investment Narrative Recap

To own Quanta Services, you need to believe that large, multi‑year investments in power grids, renewables and communications networks will continue to require the kind of end‑to‑end engineering and construction expertise Quanta offers. The fresh analyst upgrades and reiterated positive views support that thesis, but they do not materially change the key near term swing factors: execution on a very full project backlog as capex stays robust, and the risk that large, complex projects face delays, cancellations or slower customer spending.

Among recent developments, the November decision to increase the quarterly dividend to US$0.11 per share stands out in this context, as it reflects management’s confidence in cash generation while Quanta leans into grid modernization and energy transition work. That capital return sits alongside raised 2025 guidance for revenue of US$26.7 billion to US$27.2 billion and higher expected earnings, which together frame how investors might weigh the analyst optimism against the execution, regulatory and spending risks embedded in Quanta’s project pipeline.

Yet even as demand for grid and data center related projects looks supportive, investors should be aware of how sensitive Quanta remains to potential slowdowns in large scale utility and data center capital spending...

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028.

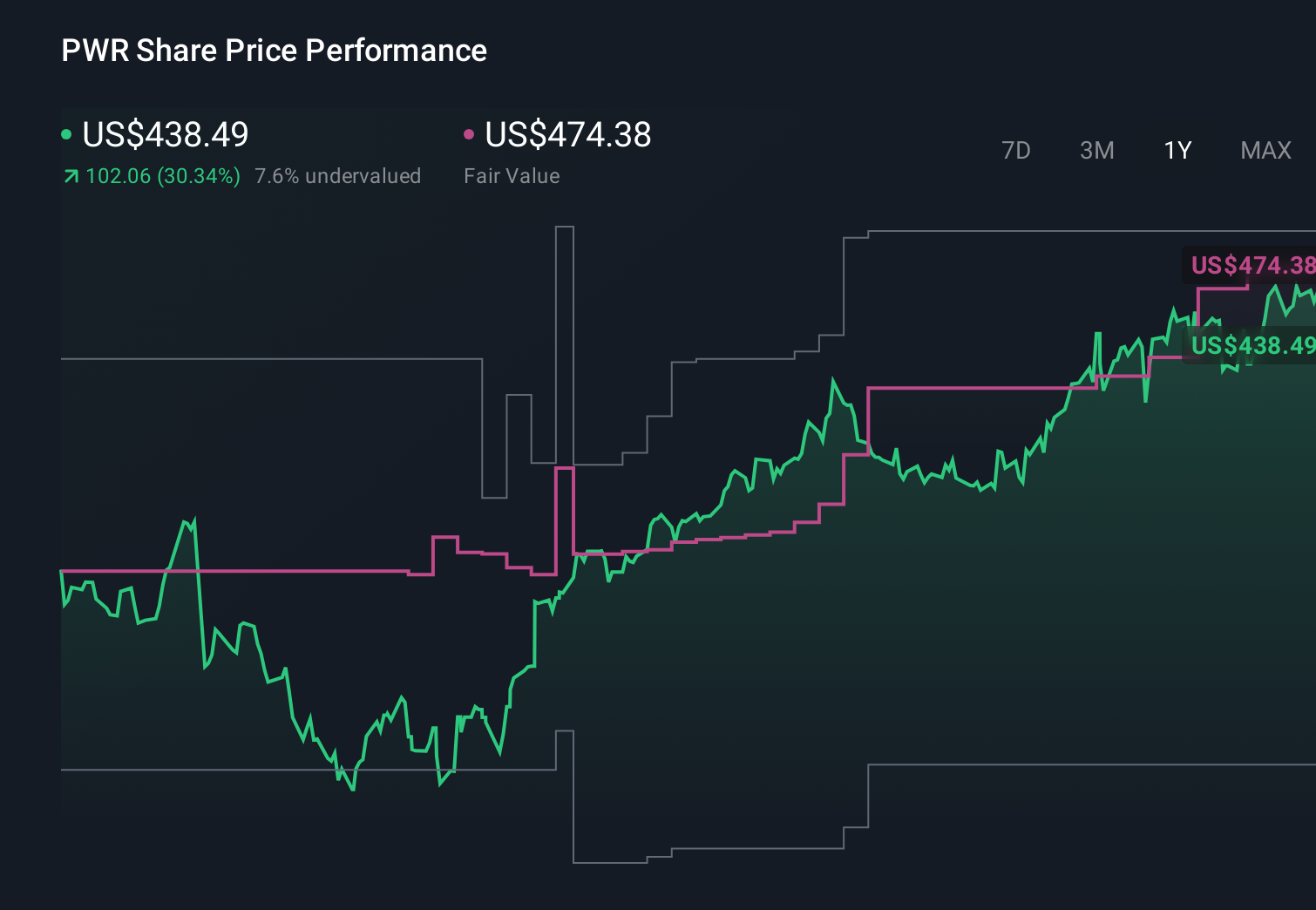

Uncover how Quanta Services' forecasts yield a $474.38 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Quanta Services between US$263 and US$474 per share, highlighting how far opinions can stretch. When you set those views against Quanta’s reliance on ongoing transmission and data center build out to support its backlog, it underlines why many investors want to compare multiple perspectives before deciding how the stock fits their own expectations.

Explore 5 other fair value estimates on Quanta Services - why the stock might be worth as much as 8% more than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal