OPmobility (ENXTPA:OPM): Reviewing Valuation After Kepler Cheuvreux’s Upgrade on Improving Margins and Outlook

Kepler Cheuvreux recently shifted OPmobility (ENXTPA:OPM) to a buy rating, citing a recovering Lighting division, steadier hybrid car demand, and shrinking losses in new energy activities as key margin drivers.

See our latest analysis for OPmobility.

The upbeat call comes after a strong run in the shares, with a roughly 54% year to date share price return and a 64% one year total shareholder return. This suggests momentum is clearly building despite a still-muted five year picture.

If OPmobility’s move has you rethinking the auto space, this could be a good moment to explore other auto manufacturers that might be pricing in similar shifts in demand and technology.

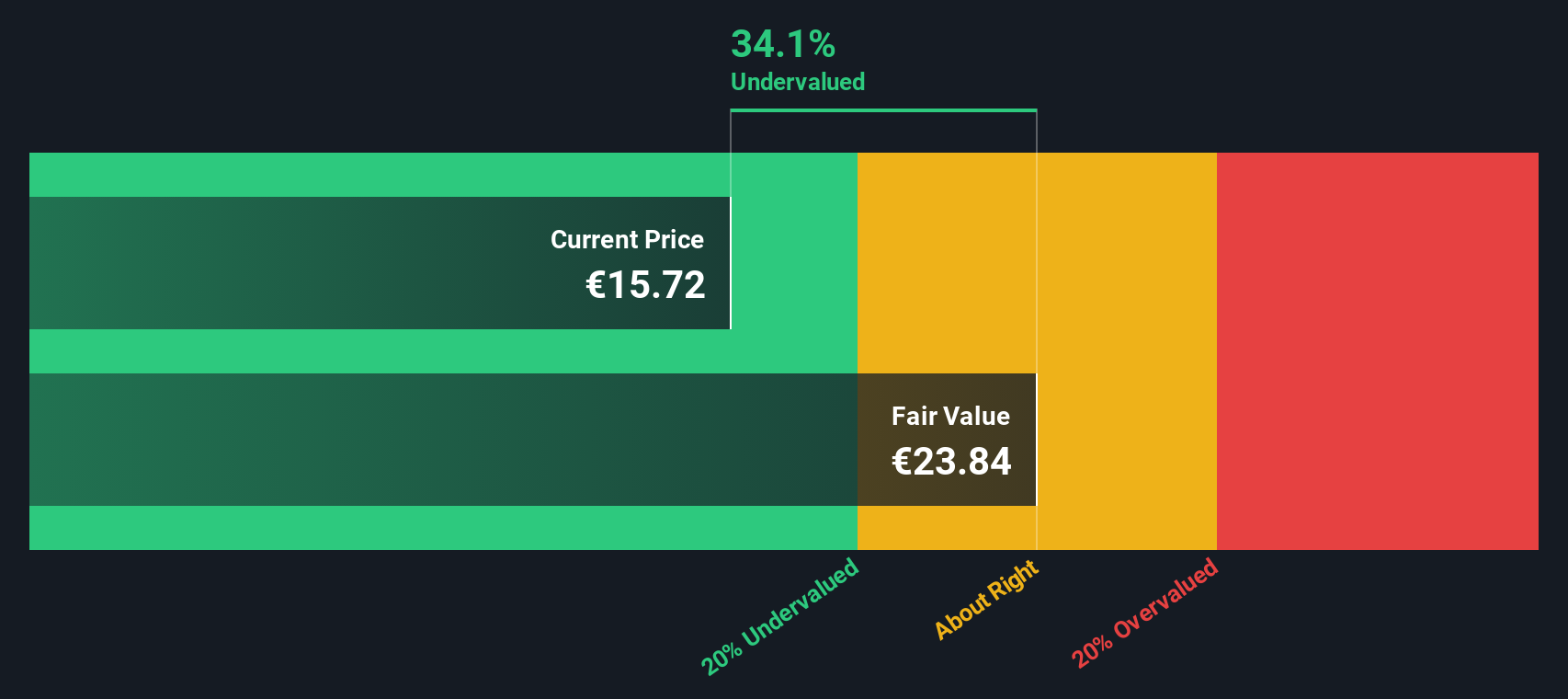

With earnings recovering and brokers turning bullish, OPmobility still trades at a steep intrinsic discount even after its rally. Is this the start of a catch up story, or are investors already paying for tomorrow’s growth?

Most Popular Narrative: 14.2% Overvalued

With OPmobility’s narrative fair value sitting below the €15.55 last close, the story hinges on how far earnings and margins can really stretch.

The analysts have a consensus price target of €12.08 for OPmobility based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.0, and the most bearish reporting a price target of just €7.4.

Curious what justifies a richer future earnings multiple, even as growth and margins are only expected to edge higher, and discount rates barely move? The full narrative explains the delicate balance between modest top line expansion, firmer profitability, and a slightly higher valuation bar, and shows how these moving parts combine into its fair value call.

Result: Fair Value of $13.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro and auto cycle sensitivity, along with heavy investment demands for electrification and regulation, could quickly challenge today’s optimistic earnings and valuation assumptions.

Find out about the key risks to this OPmobility narrative.

Another View: Cash Flows Tell a Different Story

While the popular narrative flags OPmobility as 14.2% overvalued, our DCF model presents a more generous picture. On our numbers, the shares trade at a 33.9% discount to fair value. This suggests investors may be underpricing future cash flows rather than overpaying for growth. Which lens should matter more for you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OPmobility for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OPmobility Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative yourself in minutes: Do it your way.

A great starting point for your OPmobility research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to sharpen your next move?

OPmobility might fit your thesis today, but the real edge comes from lining up a full bench of ideas that match your strategy and risk appetite.

- Capture potential mispricings by targeting these 909 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride powerful innovation trends by focusing on these 26 AI penny stocks shaping the next wave of intelligent products and platforms.

- Lock in income potential by screening for these 13 dividend stocks with yields > 3% that can keep paying you while markets swing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal