Cadre Holdings (CDRE): Valuation Check After $50m Med‑Eng Contract and Strong Q3 2025 Results

Cadre Holdings (CDRE) recently secured a five-year contract worth up to $50 million through its Med Eng subsidiary with the United States Department of War, providing meaningful validation of its specialized protective equipment business.

See our latest analysis for Cadre Holdings.

The contract win follows strong Q3 2025 results and a fresh investor spotlight from upcoming conference appearances, and the stock’s roughly 90 day share price return of 32.6 percent suggests momentum is firmly building on top of a robust three year total shareholder return of 111.3 percent.

If this kind of steady, contract driven story appeals to you, it could be a good moment to explore aerospace and defense stocks as you hunt for your next idea.

With shares up sharply and analysts still seeing upside, investors now face a key question: Is Cadre trading at a discount to its long term contract pipeline, or has the market already priced in that growth?

Most Popular Narrative Narrative: 9.9% Undervalued

With Cadre’s fair value estimate sitting above the recent 43.72 dollar close, the most followed narrative argues the current price still underappreciates its long term earnings power.

The company's robust pipeline of high margin M&A targets, paired with disciplined capital allocation, is expected to drive scale, operational leverage, and long term adjusted EBITDA growth, with free cash flow generation supporting both organic growth and shareholder returns.

Curious how steady contract wins, expanding margins, and a richer earnings profile can all point to a higher value than today’s price suggests? The narrative’s projections quietly re-rate Cadre toward a multiple more often reserved for faster growing defense names. Want to see which growth and profitability assumptions unlock that upside and how the discount rate shapes the final number? Read on to unpack the full valuation blueprint behind this call.

Result: Fair Value of $48.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on timely contract conversions and smooth nuclear integration. Delays or execution missteps could quickly challenge the bullish valuation case.

Find out about the key risks to this Cadre Holdings narrative.

Another View: Expensive on Earnings Today

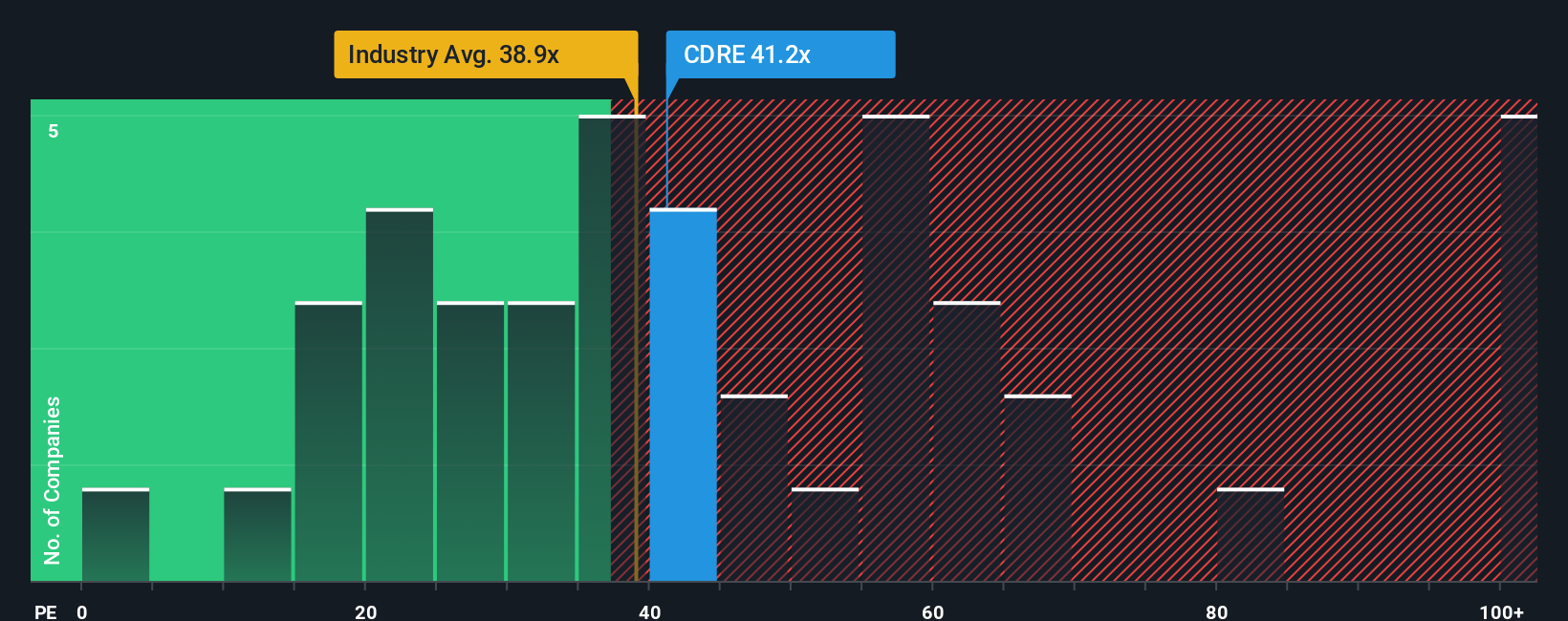

On an earnings multiple basis, Cadre looks far less forgiving. It trades at about 39.2 times earnings, above the 23.3 times fair ratio our work suggests the market could move toward and slightly richer than the 38.7 times industry average, even while sitting below peer levels around 55.7 times. For investors, that gap means less room for execution hiccups, not more. Which version of Cadre do you believe in the most, the high conviction growth story or the demanding current price tag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadre Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Cadre thesis in minutes: Do it your way.

A great starting point for your Cadre Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next potential opportunity by running a quick check through targeted stock screens built to surface high conviction ideas efficiently.

- Explore potential multi baggers early by scanning through these 3611 penny stocks with strong financials that may still be flying under most investors' radar.

- Position yourself at the frontier of innovation by reviewing these 26 AI penny stocks that are focused on commercializing real world AI solutions rather than simply following short-term trends.

- Strengthen your portfolio’s value core by focusing on these 906 undervalued stocks based on cash flows where cash flows support prices that may not yet have attracted the market’s full attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal