Coastal Financial (CCB): Revisiting Valuation After TD Cowen Signals a Post-Investment Growth Phase

Coastal Financial (CCB) is back in focus after a TD Cowen analyst, fresh off investor meetings, argued that the bank has finished a heavy investment phase and is now set up for faster, partner driven growth.

See our latest analysis for Coastal Financial.

The stock has cooled slightly in the last week even as its 1 month share price return of 8.8 percent and year to date share price return of 34.6 percent signal building momentum, backed by a hefty 5 year total shareholder return of 453.8 percent.

If Coastal’s run has you thinking about what else could surprise on the upside, this is a good moment to explore fast growing stocks with high insider ownership.

With revenue and earnings accelerating, a bullish analyst target still 18 percent above the current price, and a rich multiyear run already in the bag, is Coastal still a buy or is future growth already priced in?

Price to Earnings of 36.2x: Is it justified?

On traditional valuation, Coastal looks richly priced, with its 36.2x price to earnings ratio sitting well above many US bank peers at the latest close of $114.09.

The price to earnings multiple compares the company’s share price to its earnings per share and is a common way to gauge how much investors are paying for current profits. For a fast growing bank that leans heavily on Banking as a Service partnerships and tech enabled revenue, a higher multiple can signal that the market is already baking in years of elevated earnings expansion.

Here, investors are paying a price to earnings multiple of 36.2x, which is significantly higher than both the estimated fair price to earnings ratio of 22.1x and the US Banks industry average of 11.9x, as well as a 13.2x peer average. That gap suggests the market is assigning a premium that could compress over time if Coastal’s growth does not keep outrunning the pack, while the fair ratio implies a level the valuation might gravitate toward if expectations cool.

Explore the SWS fair ratio for Coastal Financial

Result: Price to Earnings of 36.2x (OVERVALUED)

However, rising competition in Banking as a Service, along with any slowdown in partner growth, could pressure Coastal’s premium valuation and stall its earnings momentum.

Find out about the key risks to this Coastal Financial narrative.

Another View: Our DCF Says The Stock Is Cheap

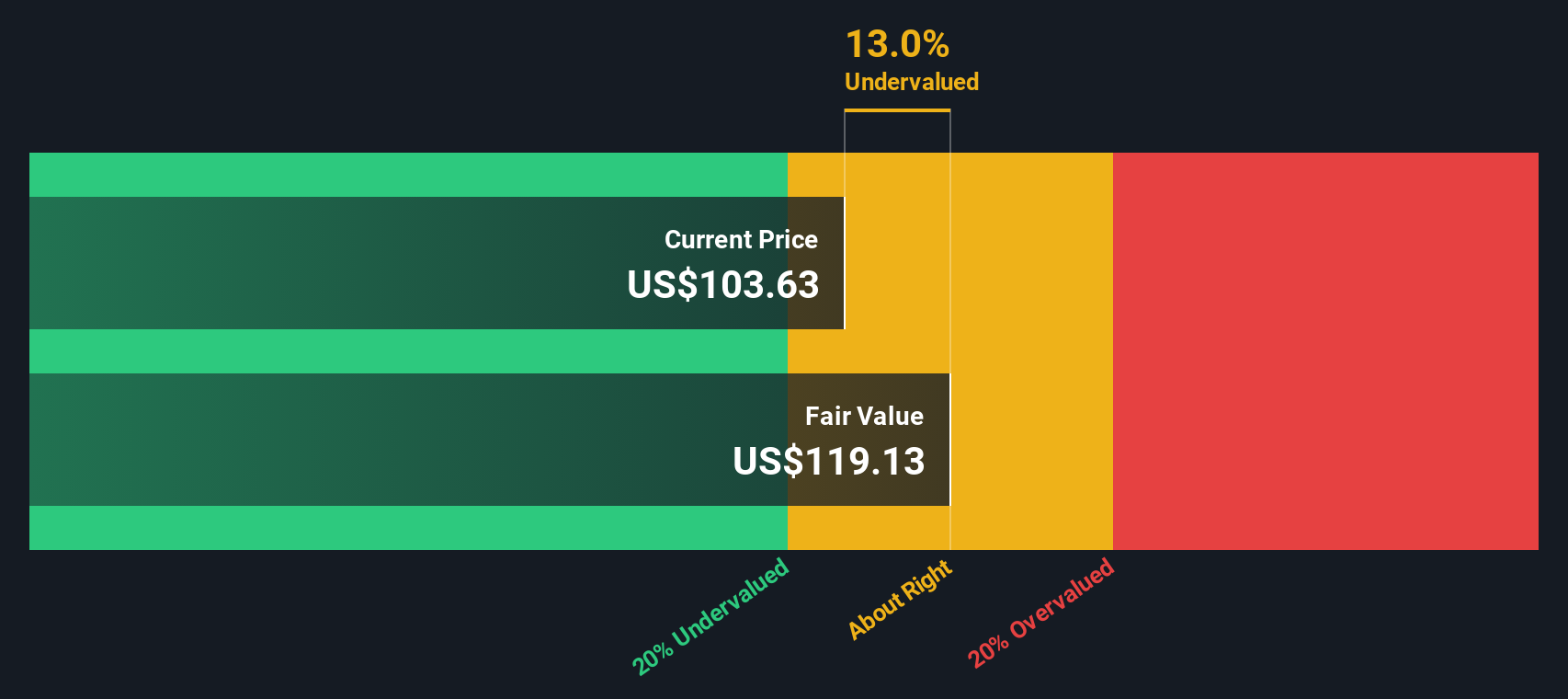

While the 36.2x earnings multiple appears expensive, our DCF model suggests the opposite, with fair value around $135.35 versus today’s $114.09. That implies Coastal could be about 15.7 percent undervalued and raises a real question: is momentum actually underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coastal Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coastal Financial Narrative

If you see Coastal’s story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Coastal Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more opportunity rich ideas?

Do not stop at Coastal. Put Simply Wall St’s powerful Screener to work now so you can spot the next wave of potential winners before others do.

- Capitalize on mispriced quality by reviewing these 901 undervalued stocks based on cash flows that align strong fundamentals with attractive entry points.

- Ride structural growth trends by targeting these 30 healthcare AI stocks tackling real problems at the intersection of medicine and machine intelligence.

- Tap into emerging innovation by scanning these 80 cryptocurrency and blockchain stocks positioned to benefit from the next phase of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal