Forget the AI Bubble and Buy Nvidia Stock for 2026: Here’s Why

While Nvidia (NVDA) stock is still outperforming the S&P 500 Index ($SPX) this year, it has lost over 17% from its recent highs. NVDA has been the flagbearer of the artificial intelligence (AI) trade and delivered stellar returns in 2023 and 2024, which helped it become the first-ever company to command a $5 trillion market cap.

However, we have seen a realignment of sorts among AI stocks over the last three months. For instance, Apple (AAPL) and Alphabet (GOOG) (GOOGL), which were perceived to be AI laggards, have rebounded from their lows, and the Google parent is now the best-performing “Magnificent Seven” stock this year. On the other hand, Meta Platforms (META) and Nvidia, which outperformed spectacularly over the last two years, have been quite grounded of late.

Nvidia’s Financial Performance Has Been Stellar

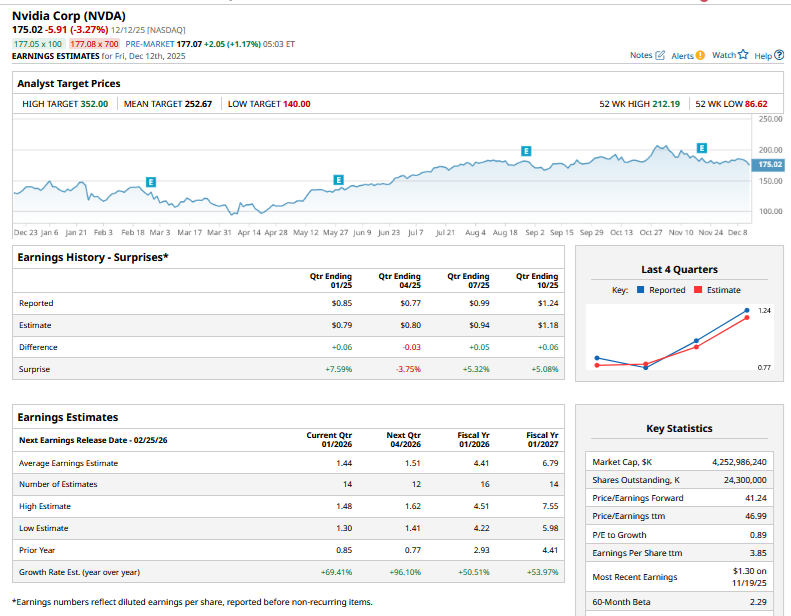

Nvidia's financial performance has been quite impressive, though, and in its fiscal Q3 2026, the Jensen Huang-led company reported revenues of $57 billion, which were up 62% year-over-year (YoY). The quarter-over-quarter (QoQ) increase in Nvidia’s revenue was $10 billion, which, for context, is higher than the total quarterly revenues it used to post before AI really took off. The strong topline growth is flowing to Nvidia’s bottom line, and EPS rose 67% to $1.30 in fiscal Q3. What makes the growth all the more astonishing is that the company achieved this despite being virtually locked out of China, the world’s second-largest market for AI chips.

Nvidia's growth story is far from over, and management expects fiscal Q4 revenues to be $65 billion at the midpoint, which represents a YoY rise of around 65%.

Why Has NVDA Stock Been Dropping?

The decline in Nvidia shares might seem odd considering the stellar financial performance that the company has been reporting. Here’s what’s been driving down NVDA.

- AI Bubble Concerns: The AI bubble chatter has grown louder, pulling down AI names, including Nvidia.

- Concerns Over Hyperscaler Spending: There are intermittent concerns over hyperscalers slowing down their AI capex, which would mean that they would need fewer Nvidia chips.

- Rising Competition: The competition in the AI chip market has risen as chipmakers as well as tech companies want a piece of the lucrative market. Chip companies like Advanced Micro Devices (AMD) and Broadcom (AVGO) have upped their game and signed up OpenAI as a customer. At the same time, Anthropic announced plans to buy as many as 1 million of Alphabet’s Tensor Processing Units (TPUs), and reports suggest that Meta Platforms is also in talks to buy chips worth billions of dollars from the company. Companies like Amazon (AMZN) are also building custom chips, which would help them lower their reliance on Nvidia.

- Nvidia Might Have Lost Out on China Business: While the Trump administration has granted a go-ahead to Nvidia to sell its H200 chips to “approved customers” in China, albeit with the controversial 25% cut in revenues, Chinese companies don’t seem to be lining up for NVDA's silicon. China has doubled down on domestic chips, and Nvidia might have lost out on the Chinese market, which CEO Jensen Huang believes is a $50 billion opportunity for the company this year.

Nvidia Stock Is a Buy on Reasonable Valuations

Meanwhile, despite the concerns over the AI bubble and rising competition, I believe NVDA stock is a buy. I believe the AI infrastructure buildout is still in its early days, and we are nowhere near the bubble territory that some are worried about. Sovereign AI is another growth driver for AI chips as major countries globally are pouring billions into the initiative amid what’s a literal AI arms race.

Also, while the competition is for real, Nvidia has so far been a step ahead in terms of innovation, and its chips are more powerful than what is being offered by other companies. Moreover, shifting to other chips is easier said than done, though, given Nvidia’s Compute Unified Device Architecture (CUDA) computing platform, which has become the de facto standard for AI developers and researchers, creating a lock-in of sorts.

Finally, from a valuation perspective, Nvidia trades at a forward price-to-earnings (P/E) multiple of 41.2x, while the P/E-to-growth (PEG) multiple is 0.89x. Those multiples look quite reasonable considering the kind of growth Nvidia brings to the table.

Notably, at the October GTC, Nvidia touted orders worth $500 billion for its AI chips between 2025 and 2026. During the Q3 earnings call, CFO Colette Kress said there is “definitely an opportunity for us to have more on top of the $500 billion that we announced,” pointing to the partnerships with Saudi Arabia and Anthropic in recent days.

Overall, I find Nvidia’s risk-return quite attractive here and used the recent dip to add to my existing positions. While NVDA stock might not keep on doubling every year, it can still deliver decent returns over the next year.

On the date of publication, Mohit Oberoi had a position in: NVDA , META , GOOG , AAPL , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal