Taking Stock of Brunello Cucinelli (BIT:BC)’s Valuation After Upgraded Outlook and Strong Order Momentum

Brunello Cucinelli (BIT:BC) is back in focus after the company lifted its 2025 revenue growth outlook to 11–12% and flagged strong advance orders for its spring and summer 2026 collections.

See our latest analysis for Brunello Cucinelli.

The upbeat guidance and broker upgrade have nudged sentiment higher, with a 7 day share price return of 3.1% and 1 month share price return of 6.4%, even though the year to date share price return remains negative. The 5 year total shareholder return of 176.6% still underlines the brand’s longer term momentum.

If Brunello Cucinelli’s renewed growth story has caught your eye, this could be a good moment to scan the market for other luxury adjacent names using fast growing stocks with high insider ownership.

With revenue still growing double digits and the share price trading about 14% below consensus targets, is Brunello Cucinelli quietly undervalued, or is the market already fully pricing in its next chapter of luxury growth?

Most Popular Narrative: 12.1% Undervalued

With Brunello Cucinelli’s last close at €96.14 versus a narrative fair value near €109, the current share price sits below the projected luxury runway.

The analysts have a consensus price target of €112.867 for Brunello Cucinelli based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €125.0, and the most bearish reporting a price target of just €68.0.

Want to see why a traditional Italian maison is being priced with growth expectations usually reserved for market darlings? The narrative leans on ambitious revenue expansion, rising margins and a future profit multiple that pushes beyond today’s already rich levels. Curious which exact earnings path and discount rate have to line up for that to hold? Click through to unpack the full valuation story.

Result: Fair Value of €109.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt levels and faster growing operating costs could squeeze margins if luxury demand cools, undermining the upbeat growth and valuation case.

Find out about the key risks to this Brunello Cucinelli narrative.

Another View: Rich Multiples Signal Caution

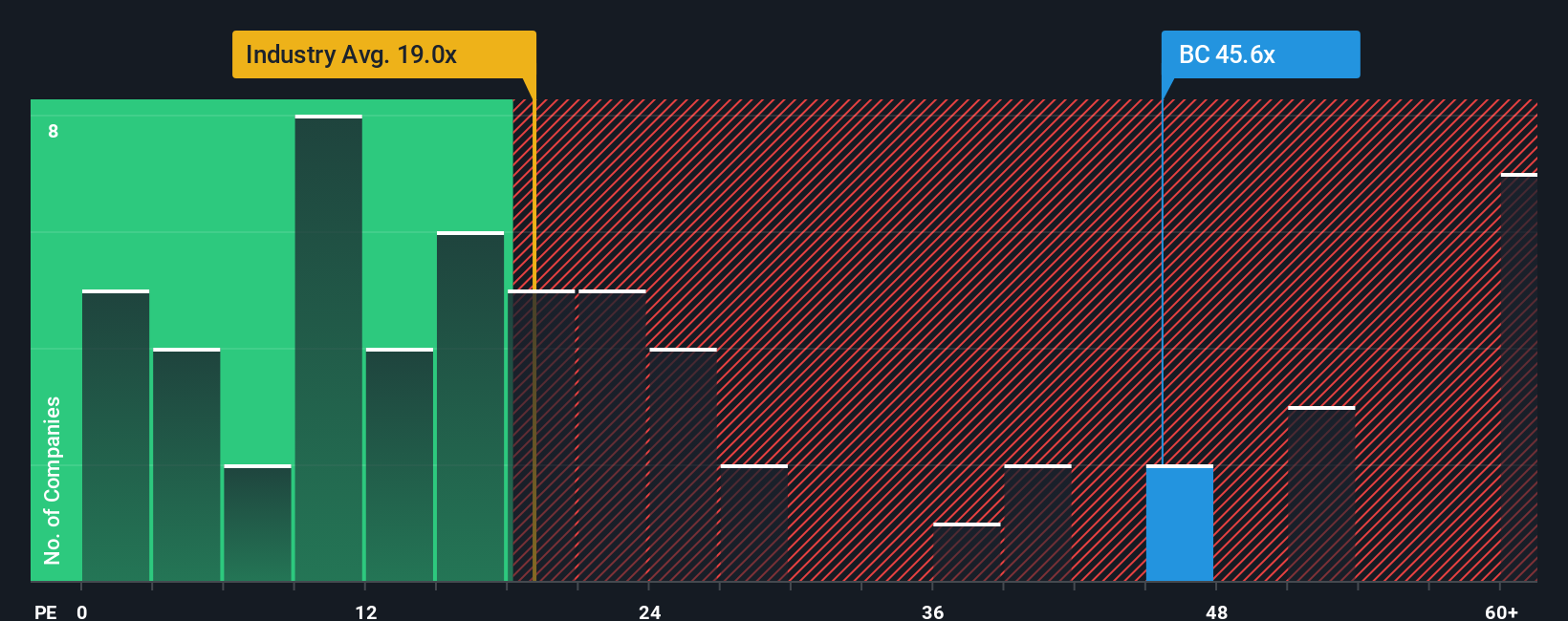

While the narrative fair value points to upside, a simple earnings based lens tells a tougher story. Brunello Cucinelli trades on about 49.6 times earnings versus a fair ratio of 23.2 times, and roughly 21 times for the wider European luxury group and 20.4 times for peers.

That kind of premium suggests investors are already paying up heavily for flawless execution, leaving little room for disappointment if growth or margins slip. Is this really a mispriced gem, or just a great business at a demanding price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brunello Cucinelli Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a personalised narrative in just a few minutes: Do it your way.

A great starting point for your Brunello Cucinelli research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one compelling story. Use Simply Wall Street’s screener to uncover more focused opportunities and reduce the chance of missing the next standout performer.

- Seek more reliable income prospects by targeting these 13 dividend stocks with yields > 3% that may support long-term compounding and stability in your portfolio.

- Consider positioning yourself early in transformative tech by researching these 26 AI penny stocks involved in enterprise automation, intelligent software, and the data economy.

- Aim to strengthen your margin of safety by focusing on these 901 undervalued stocks based on cash flows where market expectations may differ from underlying cash flow characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal