Cardinal Health (CAH): Assessing Valuation After a Recent Pullback in the Share Price

Cardinal Health (CAH) has quietly pulled back about 4% over the past month even after a strong run this year, creating an interesting setup for investors weighing whether the longer term uptrend still holds.

See our latest analysis for Cardinal Health.

That pullback comes after a powerful run, with the share price still around $198.18 and a strong year to date share price return feeding into an impressive multi year total shareholder return. This suggests momentum is cooling, but the broader uptrend is intact.

If Cardinal Health’s move has you thinking more broadly about healthcare, this could be a good moment to explore other opportunities across healthcare stocks and see what else fits your strategy.

With shares hovering just below analyst targets and a hefty implied intrinsic discount, is Cardinal Health a rare value play hiding in plain sight, or has the market already baked in its next leg of growth?

Most Popular Narrative: 8.5% Undervalued

With Cardinal Health closing at $198.18 against a narrative fair value near $216.60, the story leans toward undervaluation driven by future earnings strength.

The company's investments in automation, advanced supply chain technology, and new distribution centers are expected to deliver long-term operational efficiencies and cost savings, supporting improved net margins and free cash flow as healthcare shifts to value-based and outpatient models.

Curious how steady, not flashy growth assumptions can still justify a richer future earnings multiple than the broader healthcare space? The narrative leans on compounding revenue, firming margins, and disciplined capital returns to back that higher implied valuation. Want to see precisely how those moving parts add up to the projected fair value?

Result: Fair Value of $216.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny on drug pricing and any slowdown in pharma volumes or contract renewals could quickly undermine those optimistic earnings assumptions.

Find out about the key risks to this Cardinal Health narrative.

Another Lens on Valuation

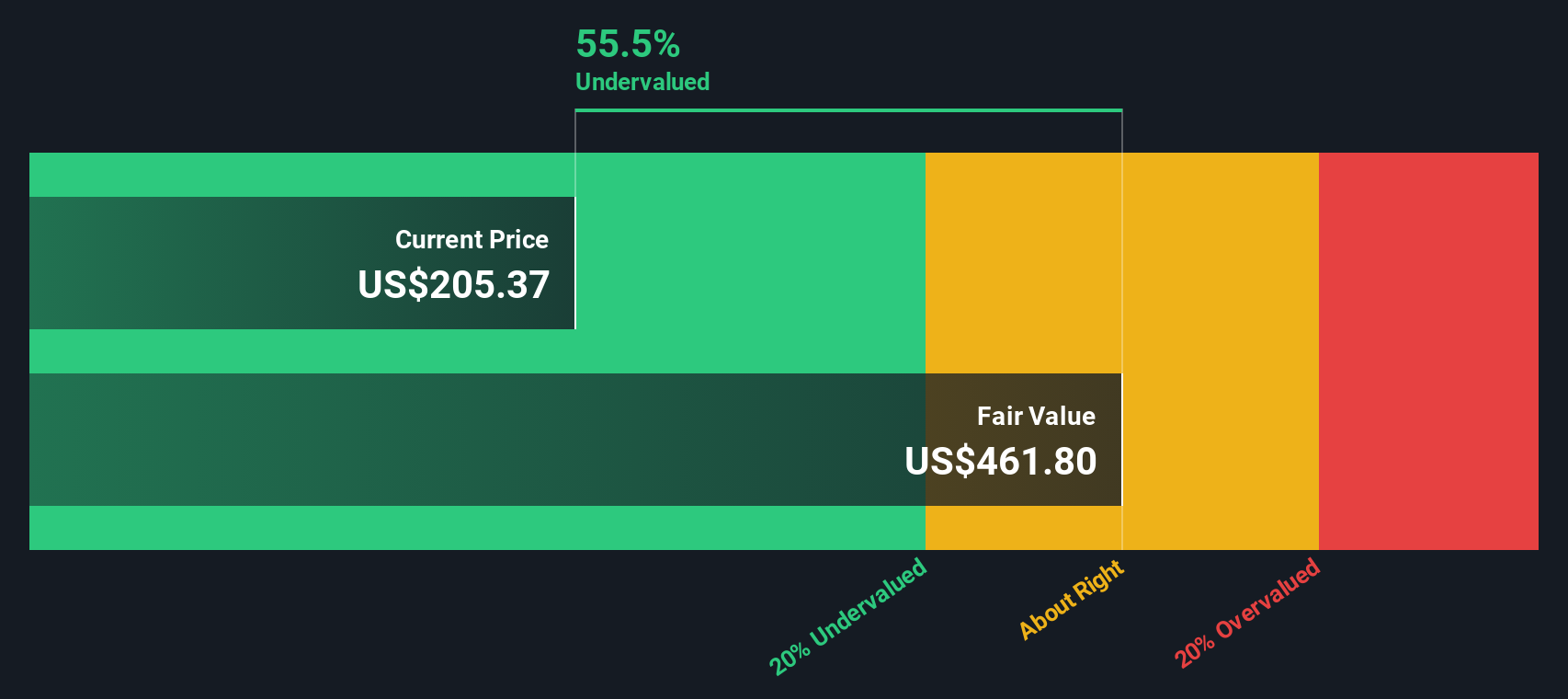

Look past the narrative fair value and the SWS DCF model paints an even starker picture, suggesting Cardinal Health trades about 57% below its estimated intrinsic value of roughly $461.54 per share. If that gap is even half right, are investors underestimating the long term cash generation here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cardinal Health Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by using the Simply Wall Street Screener to uncover targeted opportunities most investors are still overlooking.

- Capture potential mispricings by reviewing these 901 undervalued stocks based on cash flows that combine solid fundamentals with attractive discounted cash flow profiles.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned at the heart of artificial intelligence transformation.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% offering reliable payouts that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal