Emerging market currencies are making a strong comeback! The trillion-dollar capital in 2026 is expected to continue the momentum for gains

The Zhitong Finance App learned that amid market fluctuations in 2025, emerging market currencies showed strong performance, and the surge in interest in foreign exchange trading in emerging markets was also a highlight. The weakening trend of the US dollar is expected to continue in 2026, which will benefit emerging markets. Hedge funds and banks' forex trading departments have benefited the most.

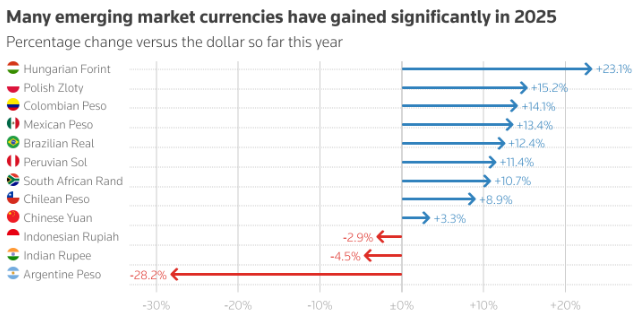

For example, as a currency that has long been marginalized in emerging markets, the trading volume of the Hungarian forint has more than doubled since US President Donald Trump took office in January of this year. Since he announced a large-scale “Liberation Day” import tariff policy, traders' interest has been growing day by day. Traders, strategists and hedge funds say this increase in trading volume is no accident; they are participating in the global foreign exchange market with a scale of up to $1 trillion a day.

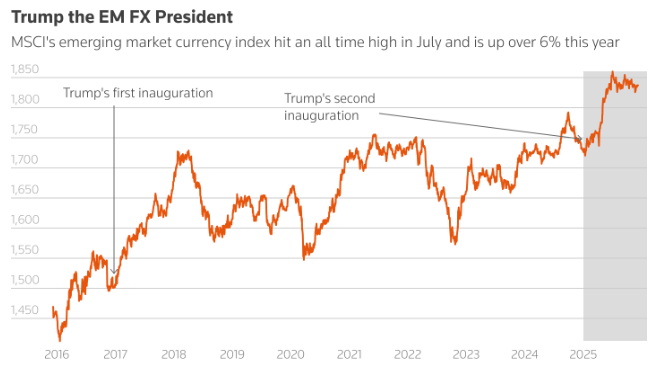

This year, the exchange rate of the forint against the US dollar has risen by about 20%, making it the best performance in nearly 25 years, making it one of the best performing emerging currencies in 2025. On a broader level, emerging market currencies have also performed quite well this year: the MSCI Emerging Markets Currency Index hit a record high in July and is expected to achieve its best annual performance since 2017, with an increase of more than 6%. Most traders, fund managers, and analysts surveyed by institutions expect this trend to continue next year.

The strong performance of emerging market currencies was due to the increased volatility and continued weakening of the US dollar, which prompted investors to re-examine their investment exposure to the US dollar and question the long-term strength of the US dollar and its position as a global currency. At the same time, they are betting on increasing economic value in some developing countries (from South Africa to Hungary) to get rid of dependence on US assets.

Jonny Goulden, head of fixed income strategy research for emerging markets at J.P. Morgan Chase, said: “We think what we call the bear cycle for emerging market currencies (which has now been going on for 14 years) is probably over. This is part of a shift in the dollar cycle — the dollar cycle means that the world owns a large number of US assets and avoids investing in emerging market assets. ”

For Elina Theodorakopoulou, Manulife's emerging markets bond portfolio manager, the surprise this year was that price fluctuations were triggered by events in advanced economies.

Theodorakopoulou notes, “This year's emerging market is like an 'underdog student' in the class because it's not a driver of volatility.” The US-driven split in world trade, geopolitical turmoil, and policy differences between central banks are expected to continue to drive price fluctuations.

For governments, currency appreciation and capital inflows have significant economic impacts, including reducing the attractiveness of export products and increasing their ability to borrow and repay their debts. These risks have not been overlooked. The International Monetary Fund warned of potential risks in the currency market in its latest financial stability report.

According to the organization, nearly half of global foreign exchange transactions are handled by a small number of trading institutions mainly dominated by large banks. If these institutions reduce their trading activity during times of stress, the market will be at risk. According to the latest data from the Bank for International Settlements, the volume of foreign exchange transactions has increased by almost 30% in the past three years.

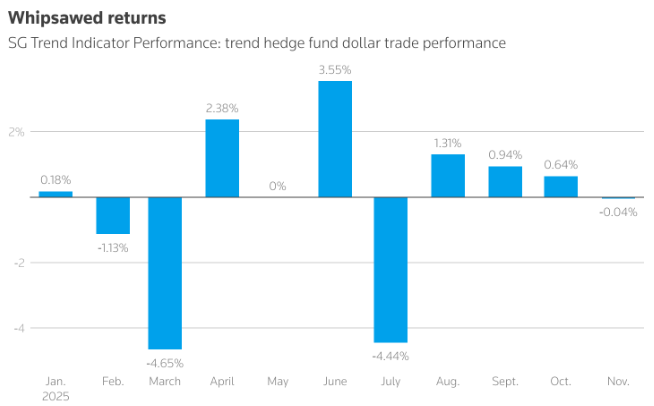

2025 can be described as a year of ups and downs. The volatility of developed market currencies soared to a two-year high in April; then there was an easing, and a more stable market made arbitrage trading (that is, borrowing low-yield currencies to invest in high-yield currencies) more attractive. The high volatility of the foreign exchange market has brought profit opportunities to hedge funds. For example, a person familiar with the matter said that the hedge fund EDL Capital, which manages $1 billion in assets, increased 28% this year, boosting earnings at the beginning of the year and during the so-called “Liberation Day” period, as well as bets on the US dollar.

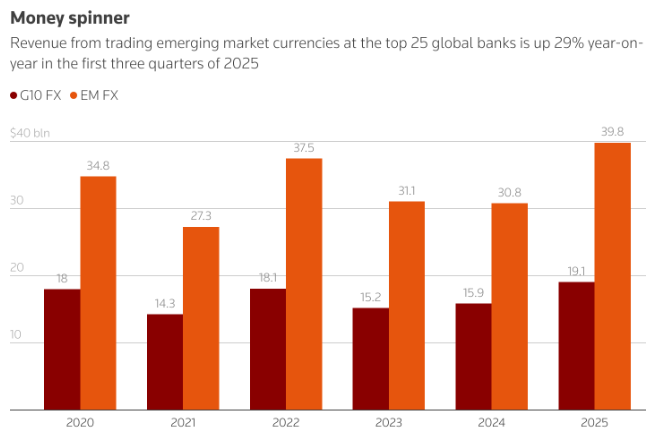

For banks, trading emerging market currencies is also a lucrative business. According to Vali Analytics, in the first nine months, the foreign exchange business in emerging markets brought in nearly $40 billion in revenue to the top 25 global banks, the best year for these banks to date. This figure is more than double the revenue these banks received ($19 billion) from transactions in 10 major currencies, including the dollar, pound, and euro.

Samer Oweida, global head of the foreign exchange and emerging markets trading business at Morgan Stanley, said it has always been challenging to find profitable opportunities in the field of foreign exchange trading, especially between G10 countries. “If investors only operate in the foreign exchange sector, they tend to turn to higher-yielding structured investment opportunities in emerging markets,” Oweida said.

More than half of the 14 top forex traders, hedge fund managers, and analysts surveyed by institutions said interest in emerging market currencies is growing in 2026 as a key trend. They said that in an age where the US dollar no longer has absolute strength, increased hedging and volatility are expected to continue.

However, the weakening wave of the US dollar did not benefit all participants. Weak trading and investment flows caused the Indian rupee to hit a record low, while concerns about central bank independence and political instability hurt the Indonesian rupiah.

However, although the dollar has recovered from its heavy impact — it experienced its biggest quarterly decline since the early 1970s in the first half of the year, with a drop of nearly 11% — analysts expect the US interest rate cuts to further weaken.

According to LSEG data, traders expect the Federal Reserve to cut interest rates by 25 basis points two more times next year. For many emerging market currencies, this context is critical and drives capital inflows. For some currencies, increasing arbitrage transactions have further strengthened their gains.

For example, the Mexican peso and the Brazilian real were also among the top performing emerging market currencies this year. They are characterized by a robust central bank and high interest rates. In Brazil, for example, interest rates have reached a high of 15%, which is the highest level in nearly 20 years, and the currency and bond markets are also very easy to trade.

“Large amounts of capital are pouring into a wide range of emerging markets, including domestic and foreign bond markets, and I don't think this trend will be reversed anytime soon,” said Amia Capital fund manager Nikolas Skouloudis. The fund manages around $1.4 billion in assets, and the hedge fund has reported a return of 16% so far this year.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal