Three Stocks That May Be Undervalued In December 2025

As the United States market experiences fluctuations with tech shares under pressure and major indices retreating from record highs, investors are keenly observing opportunities amid concerns of an AI bubble. In such a volatile environment, identifying potentially undervalued stocks becomes crucial for those seeking to capitalize on market inefficiencies and price discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.16 | $17.89 | 48.8% |

| UMB Financial (UMBF) | $118.17 | $232.81 | 49.2% |

| Sportradar Group (SRAD) | $23.11 | $45.87 | 49.6% |

| Schrödinger (SDGR) | $18.05 | $35.42 | 49% |

| Perfect (PERF) | $1.75 | $3.43 | 49% |

| Motorcar Parts of America (MPAA) | $13.77 | $26.53 | 48.1% |

| Mobileye Global (MBLY) | $11.07 | $21.30 | 48% |

| Krystal Biotech (KRYS) | $244.65 | $469.32 | 47.9% |

| FirstSun Capital Bancorp (FSUN) | $37.79 | $73.32 | 48.5% |

| Columbia Banking System (COLB) | $29.24 | $57.69 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

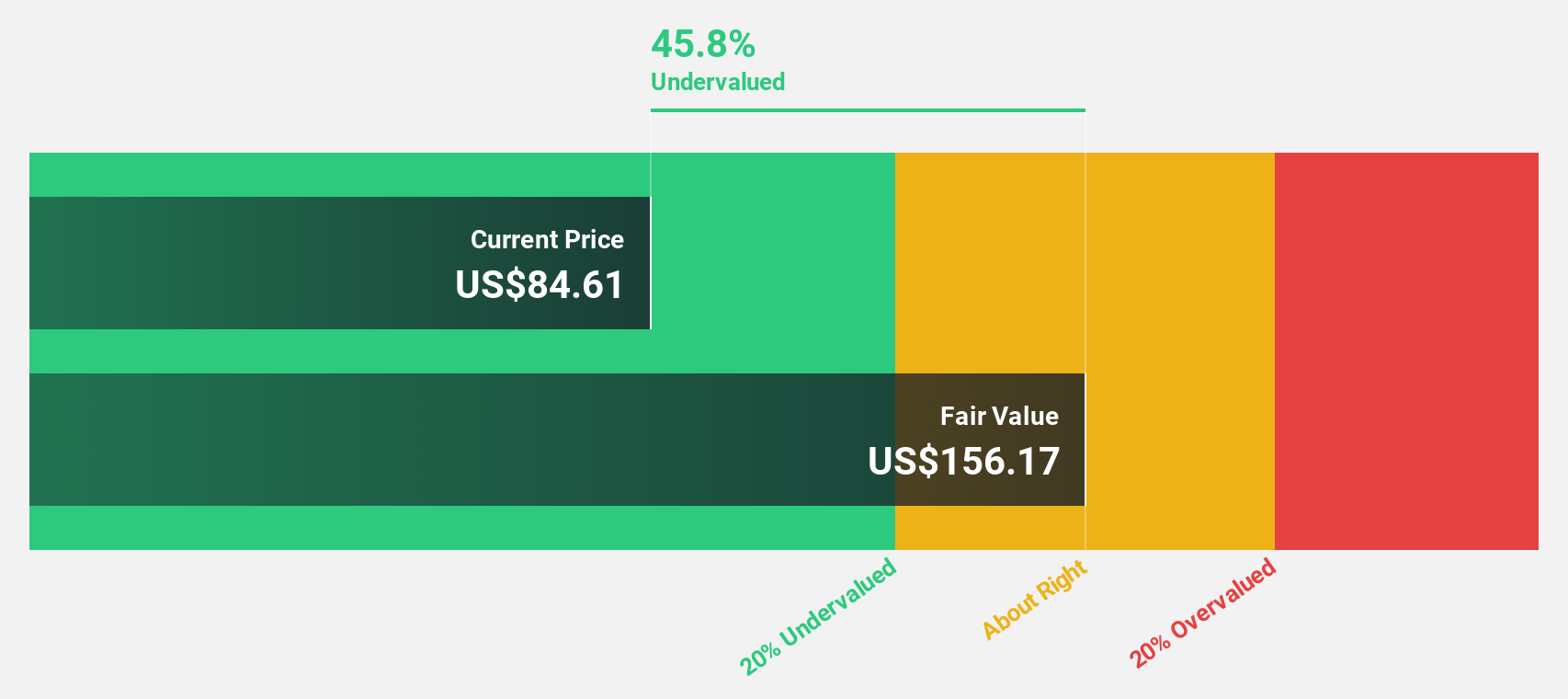

Protagonist Therapeutics (PTGX)

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company focused on developing peptide therapeutics for hematology and blood disorders, as well as inflammatory and immunomodulatory diseases, with a market cap of $5.96 billion.

Operations: The company generates revenue from its biotechnology segment, specifically focusing on startups, amounting to $209.22 million.

Estimated Discount To Fair Value: 18.3%

Protagonist Therapeutics is trading at US$95.35, below its estimated fair value of US$116.77, suggesting potential undervaluation based on cash flows. The company forecasts a significant 44% annual earnings growth over the next three years, outpacing the broader market's growth expectations. Despite recent net losses and declining profit margins, Protagonist's promising pipeline includes rusfertide for polycythemia vera, which has received multiple FDA designations and demonstrated positive Phase 3 results.

- Insights from our recent growth report point to a promising forecast for Protagonist Therapeutics' business outlook.

- Click here to discover the nuances of Protagonist Therapeutics with our detailed financial health report.

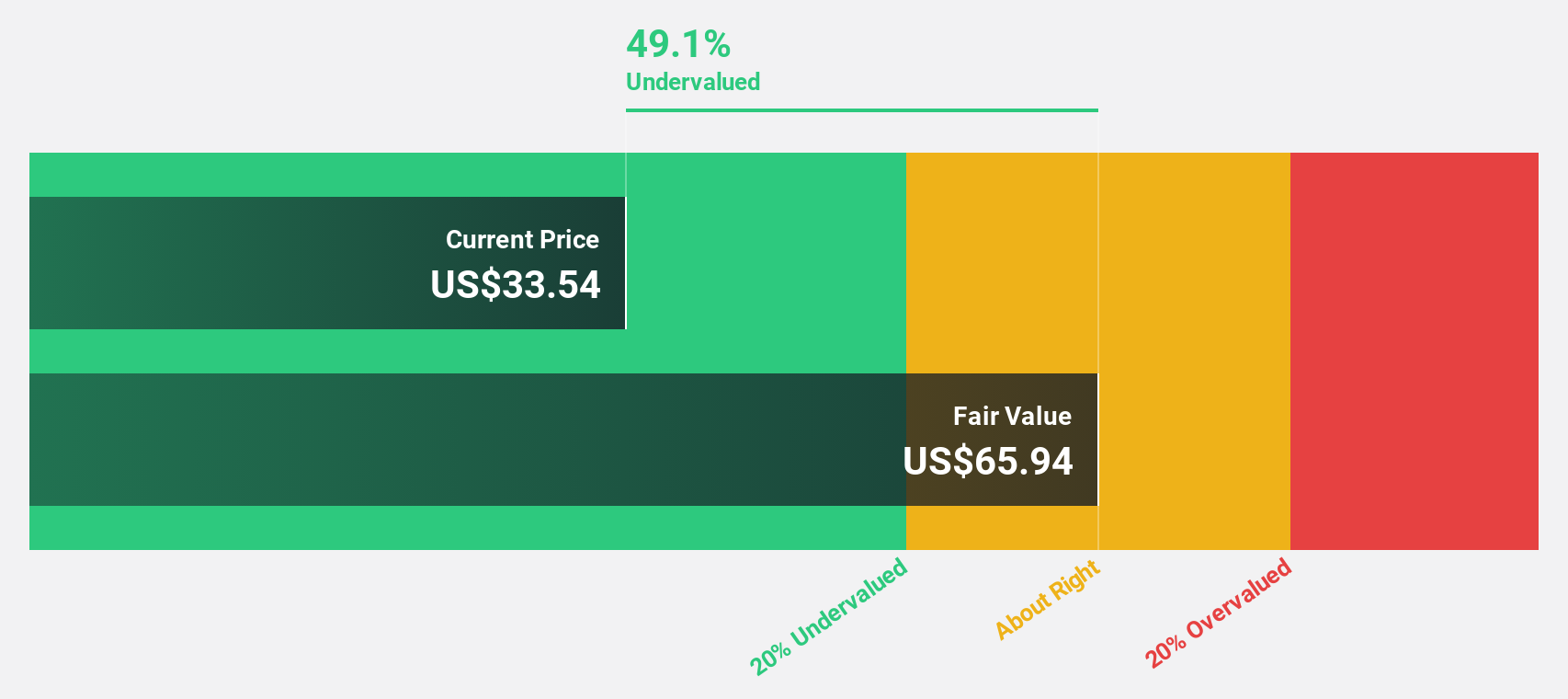

Atlantic Union Bankshares (AUB)

Overview: Atlantic Union Bankshares Corporation is a bank holding company for Atlantic Union Bank, offering a range of banking and financial services to consumers and businesses in the United States, with a market cap of approximately $5.22 billion.

Operations: Atlantic Union Bankshares generates revenue through its Consumer Banking segment, which accounts for $416.66 million, and its Wholesale Banking segment, contributing $474.99 million.

Estimated Discount To Fair Value: 19.2%

Atlantic Union Bankshares, trading at $36.65, is undervalued compared to its fair value estimate of $45.36 based on discounted cash flow analysis. The company anticipates significant earnings growth of 41.5% annually over the next three years, surpassing market expectations. However, recent shareholder dilution and low forecasted return on equity pose challenges. Despite these issues, Atlantic Union's dividend yield remains attractive following a recent increase to 4.5%, supported by strong net interest income growth in recent quarters.

- Our expertly prepared growth report on Atlantic Union Bankshares implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Atlantic Union Bankshares.

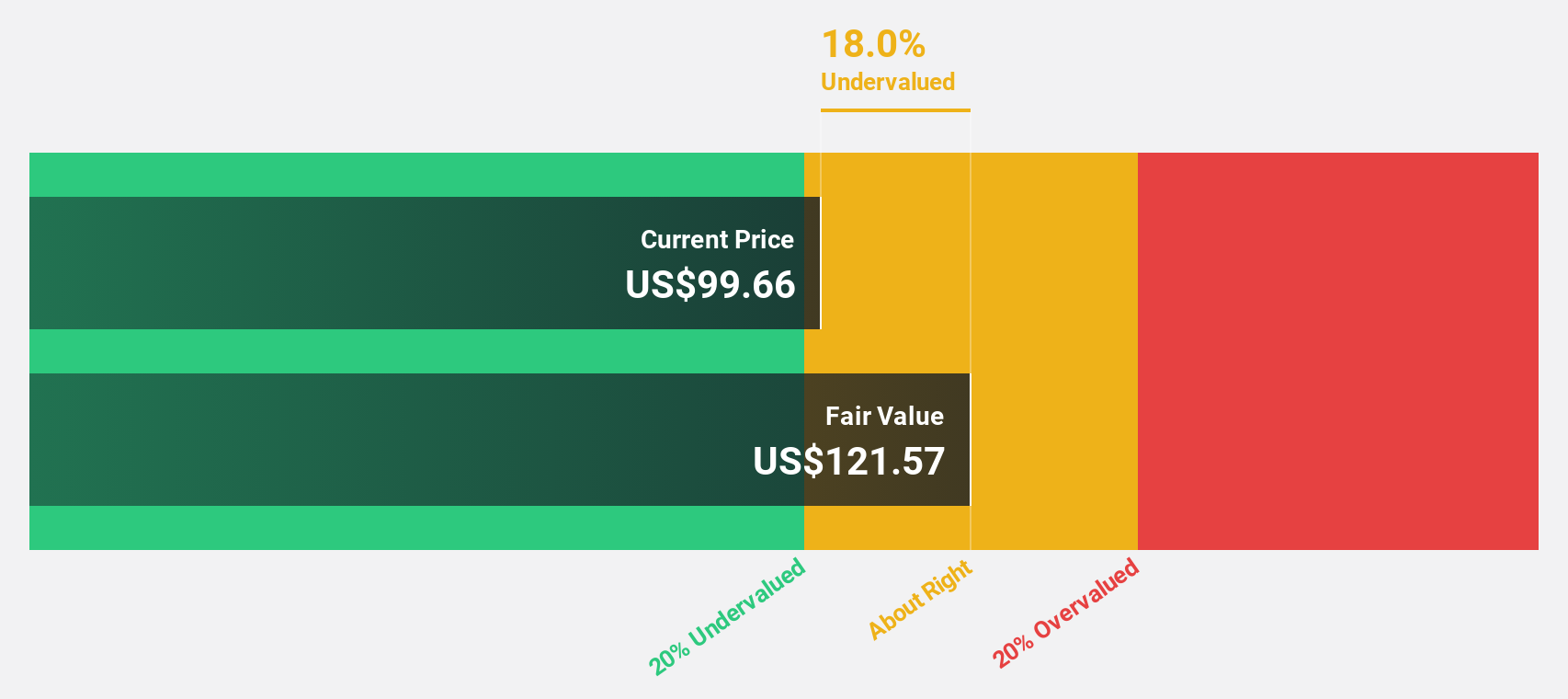

Tapestry (TPR)

Overview: Tapestry, Inc. is a company that offers accessories and lifestyle brand products across North America, Greater China, the rest of Asia, and internationally, with a market cap of approximately $25.21 billion.

Operations: The company's revenue is derived from its segments: Coach at $5.86 billion, Kate Spade at $1.17 billion, and Stuart Weitzman at $176 million.

Estimated Discount To Fair Value: 10.5%

Tapestry's recent financial performance highlights its potential as an undervalued stock based on cash flows. The company reported a substantial increase in net income to US$274.8 million for the first quarter, with earnings per share rising significantly from the previous year. Despite high debt levels and insider selling, Tapestry's shares are trading at US$123.21, below the estimated fair value of US$137.73, supported by strong profit growth forecasts of 24.6% annually over the next three years and ongoing share buybacks totaling US$2 billion since November 2024.

- The growth report we've compiled suggests that Tapestry's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Tapestry's balance sheet health report.

Summing It All Up

- Unlock our comprehensive list of 211 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal