Kinder Morgan (KMI) Valuation After Upgraded 2025–2026 Guidance and Higher 2026 Dividend Target

Kinder Morgan (KMI) just paired fresh 2025 to 2026 earnings guidance with a higher 2026 dividend target, signaling confidence in cash flow and a continued commitment to steadily rewarding income focused shareholders.

See our latest analysis for Kinder Morgan.

The new dividend and earnings outlook lands after a relatively soft patch for the shares, with a year-to-date share price return of minus 4.91 percent, even as the 1-year total shareholder return sits at about 5 percent. A much stronger multi-year total shareholder return suggests this guidance could help rebuild some of the momentum that has cooled recently.

If Kinder Morgan’s steady income profile appeals to you, it could be worth seeing what else is out there by exploring fast growing stocks with high insider ownership.

With shares lagging this year despite rising earnings and dividend guidance, Kinder Morgan now trades at a noticeable discount to analyst targets. The key question is whether this signals a genuine buying opportunity or simply reflects markets already pricing in future growth.

Most Popular Narrative: 14% Undervalued

Compared to Kinder Morgan’s last close of $26.73, the most followed narrative points to a materially higher fair value anchored in long term cash flows.

The surging U.S. LNG export market, with U.S. gas feed to export terminals projected to double by 2030 and Kinder Morgan already transporting about 40% of this feed gas, is likely to significantly increase future earnings, especially as additional U.S. capacity comes online and new contracts are signed.

Curious how steady pipeline tolls, rising margins, and a richer future earnings multiple combine into that upside case? The narrative spells out the full math.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and accelerating energy transition policies could still constrain Kinder Morgan’s growth, pressuring utilization rates and challenging the bullish valuation narrative.

Find out about the key risks to this Kinder Morgan narrative.

Another View: Rich On Earnings Multiple

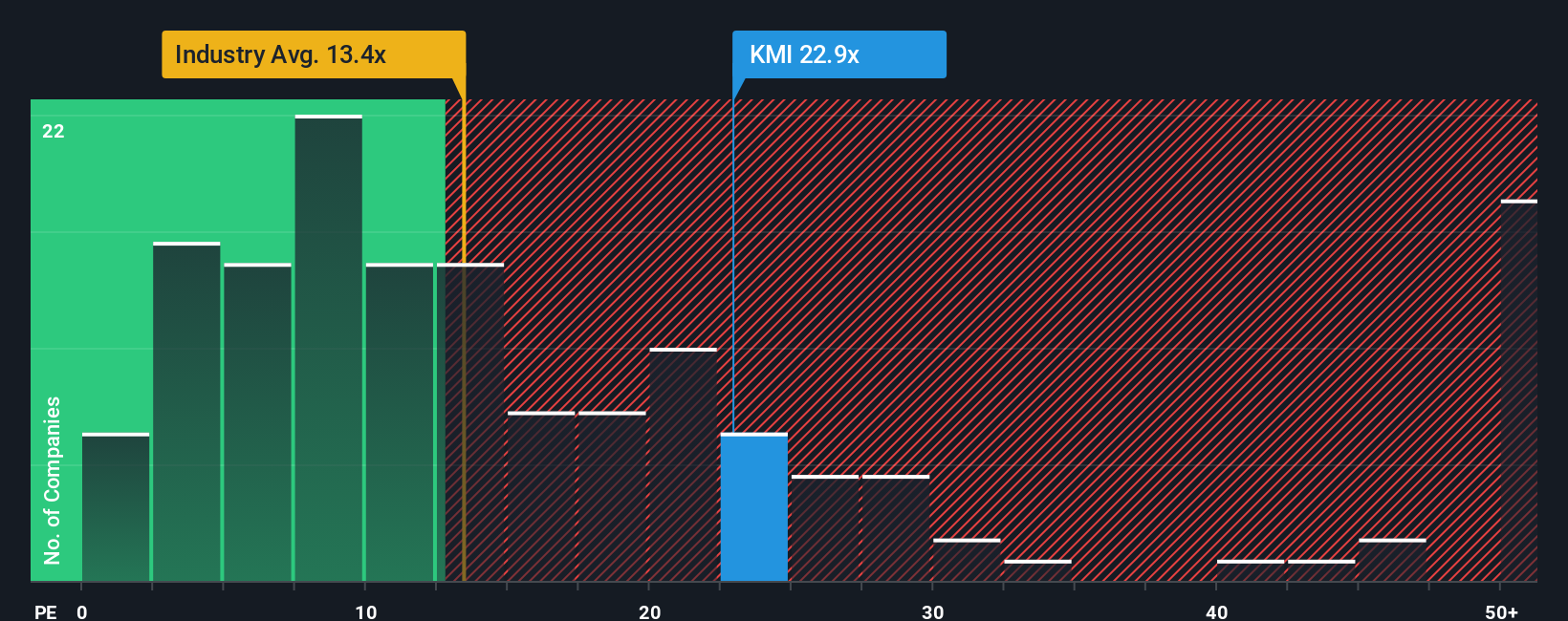

While the narrative and analyst target frame Kinder Morgan as about 14 percent undervalued, our lens on its price to earnings ratio tells a cooler story. KMI trades on 21.9 times earnings, above peers at 16.9 times and the US Oil and Gas industry at 13.3 times, and even above its own fair ratio of 21.1 times, suggesting less margin of safety if growth or LNG tailwinds disappoint. Is this a premium worth paying for stability, or a signal to be patient?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh leads from the Simply Wall St Screener so you are not relying on a single Kinder Morgan thesis.

- Capture potential turnaround names by scanning these 3613 penny stocks with strong financials that already show stronger balance sheets and improving fundamentals.

- Position ahead of the next wave of innovation by targeting these 26 AI penny stocks that pair scalable technology with real revenue traction.

- Lock in value opportunities by filtering for these 904 undervalued stocks based on cash flows where cash flow strength does not yet match the market price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal