XPO (XPO): Evaluating Whether Recent Share Price Momentum Still Leaves Valuation Upside

XPO (XPO) has quietly kept grinding higher, with the stock up about 11% over the past month and 10% in the past 3 months, even after a slight dip yesterday.

See our latest analysis for XPO.

Zooming out, that recent strength caps a solid year to date, with a 12.5% year to date share price return even though the 1 year total shareholder return is still slightly negative. This suggests sentiment and growth expectations are now rebuilding around XPO.

If XPO’s momentum has your attention and you want more ideas in transportation and adjacent logistics, now is a good time to explore fast growing stocks with high insider ownership.

With the shares now hovering just below analyst targets and trading at only a modest intrinsic discount after strong multi year gains, is XPO still offering mispriced upside, or is the market already pricing in the next phase of growth?

Most Popular Narrative Narrative: 1.4% Undervalued

Compared with XPO’s last close at $149.06, the most widely followed narrative pegs fair value only slightly higher, implying modest upside built on operating leverage.

The company's rapid expansion in high value, premium services such as grocery consolidation and other accessorial offerings positions XPO to capture incremental, higher margin revenue streams from evolving customer needs, supporting both top line growth and improved operating margins.

Curious how steady but not spectacular revenue growth can still justify a rich future earnings multiple and rising margins over time? The full narrative lays out a detailed roadmap for earnings, cash generation, and valuation that may surprise anyone expecting a typical cyclical trucking story.

Result: Fair Value of $151.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight market weakness or structurally higher labor costs could cap margin expansion and challenge assumptions behind both the premium multiple and earnings ramp.

Find out about the key risks to this XPO narrative.

Another Angle On Value

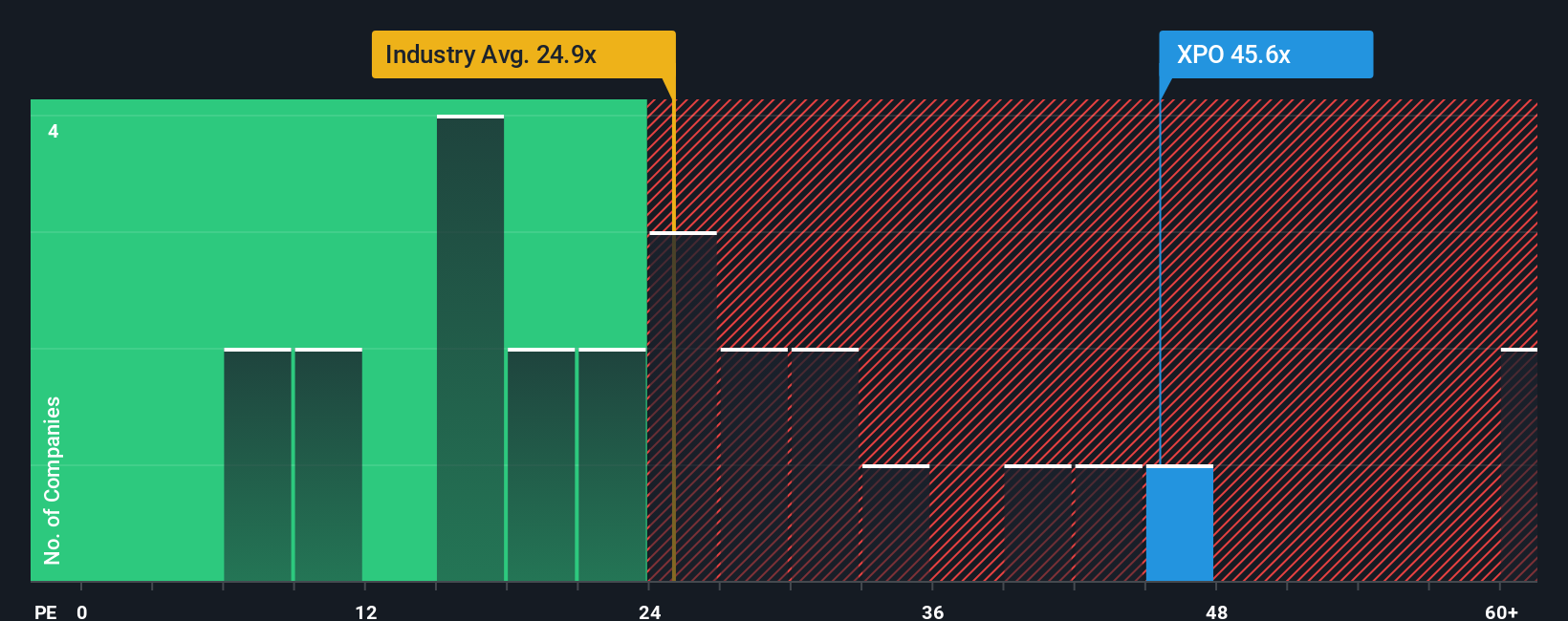

Our fair ratio work paints a sharper contrast. XPO trades on a 52.7x price to earnings ratio, versus about 32.3x for the wider US transportation group and 33x for peers, while the fair ratio sits nearer 20.2x. That premium may be justified, but how much execution risk are you really pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPO Narrative

If you see the story differently or want to stress test the numbers yourself, you can spin up your own narrative in minutes, Do it your way.

A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your next smart idea with targeted stock lists that spotlight real opportunities most investors overlook, straight from the Simply Wall Street Screener.

- Capture potential market mispricing by reviewing these 904 undervalued stocks based on cash flows, where strong cash flow analysis suggests some companies could be trading below their intrinsic worth.

- Tap into cutting edge innovation by scanning these 26 AI penny stocks, which are positioned to benefit from surging demand for artificial intelligence solutions.

- Strengthen your income game by focusing on these 13 dividend stocks with yields > 3%, which can help support reliable portfolio cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal