Has Marriott’s Share Price Rally Left Limited Upside After Recent Valuation Signals?

- Wondering if Marriott International at around $298 a share is still a smart buy, or if most of the easy money has already been made?

- The stock has climbed about 2.1% over the last week, 4.5% over the past month, and is up 8.8% year to date, compounding a powerful 100.2% gain over three years and 140.4% over five.

- Much of this strength has been underpinned by steady travel demand and Marriott’s push into higher fee, asset light franchise and management contracts, which boost margins and make growth less capital intensive. At the same time, investors have been watching how the company expands its loyalty ecosystem and luxury footprint to attract and retain higher spending guests, including in periods when the global economy may be slower.

- Despite that backdrop of solid long term returns, our framework suggests Marriott currently scores just 0/6 on our valuation checks. In this article, we will unpack what different valuation approaches say about the stock today and then finish with a more intuitive way to tie those numbers back to the long term narrative.

Marriott International scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marriott International Discounted Cash Flow (DCF) Analysis

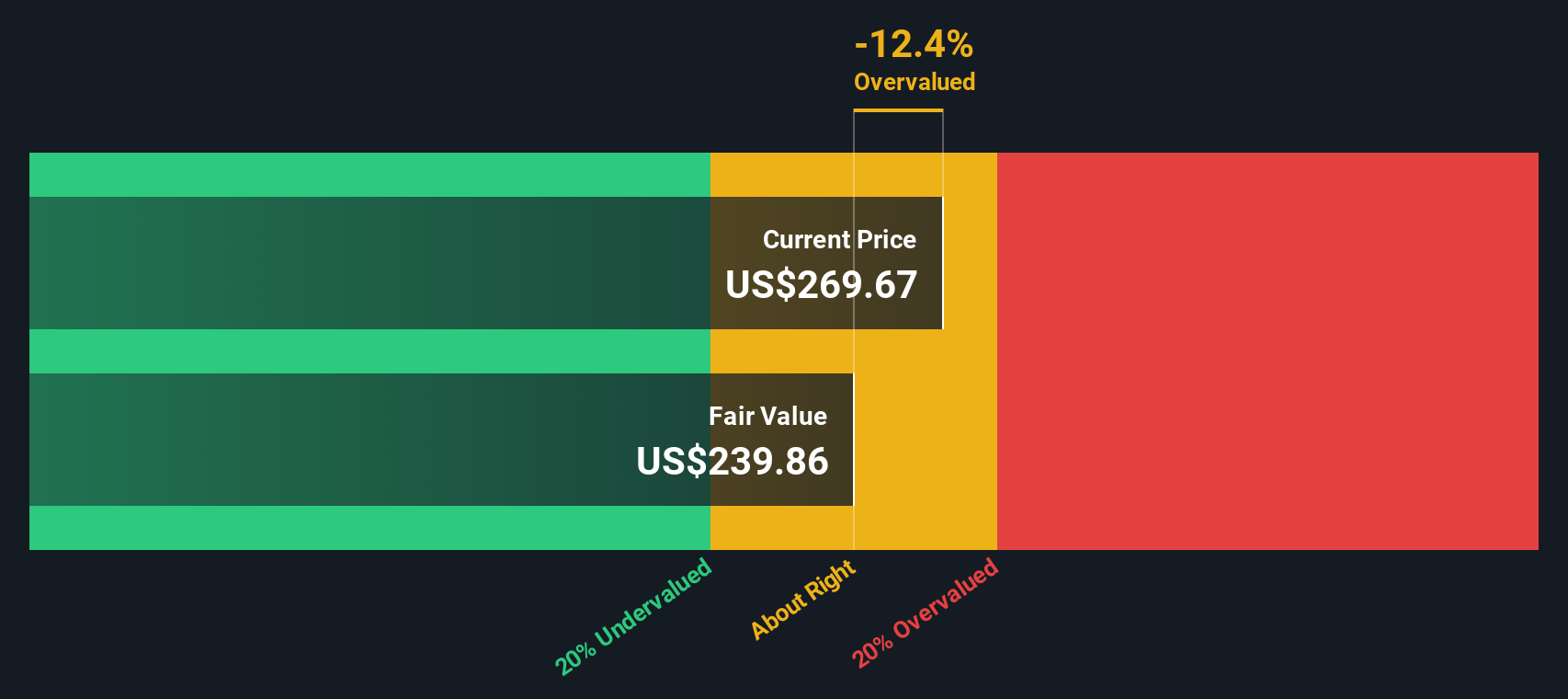

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Marriott International, the model uses a 2 stage Free Cash Flow to Equity approach, based on $1.91 billion of last twelve month free cash flow and analyst projections that see free cash flow rising to about $4.20 billion by 2029. Beyond the explicit analyst window, Simply Wall St extrapolates additional yearly growth in dollar free cash flows for the following decade.

When all of these projected cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $264.89 per share. With the stock trading around $298, this implies Marriott is about 12.8% overvalued on a DCF basis. This suggests that investors are currently paying a premium to the cash flows that can reasonably be justified by this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marriott International may be overvalued by 12.8%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

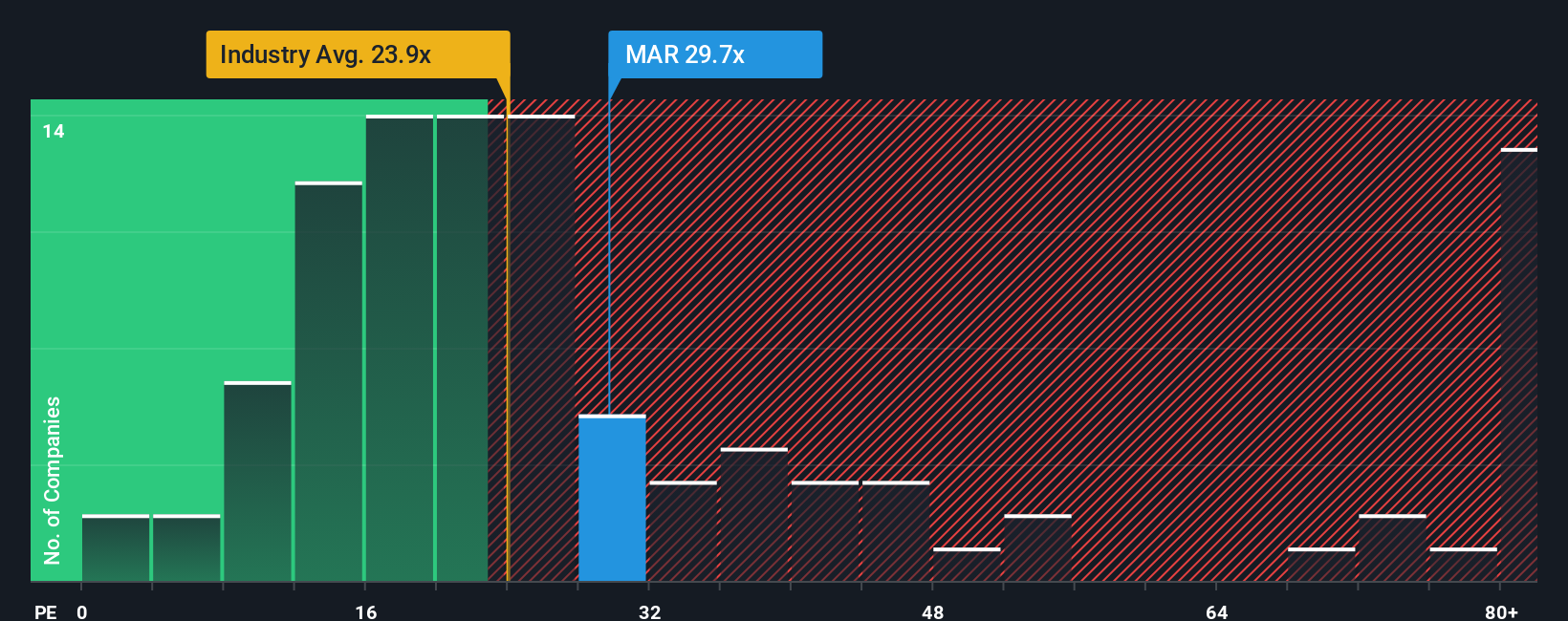

Approach 2: Marriott International Price vs Earnings

For profitable companies like Marriott, the price-to-earnings ratio is a useful way to gauge valuation because it links what investors pay per share to the actual earnings the business generates. In general, faster and more reliable earnings growth, along with lower perceived risk, justify a higher PE multiple, while slower growth or elevated risk tend to cap what investors are willing to pay.

Marriott currently trades on a PE of about 30.7x, which is meaningfully above both the Hospitality industry average of roughly 24.6x and the peer average of around 27.9x. To go a step further, Simply Wall St calculates a proprietary Fair Ratio of 27.9x, which estimates the PE Marriott should trade on given its specific earnings growth profile, profitability, size, industry context and risk factors. This tailored Fair Ratio is more informative than a simple comparison to peers because it adjusts for Marriott’s own fundamentals rather than assuming all hotel operators deserve the same multiple.

With the actual PE of 30.7x sitting above the Fair Ratio of 27.9x, Marriott screens as somewhat expensive on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marriott International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of a company’s story with a concrete forecast and a fair value estimate. A Narrative captures your perspective on how Marriott’s business will evolve, including assumptions about future revenue, earnings, and margins, then translates that story into a forward-looking model and a fair value you can easily compare with today’s share price to inform your decision to buy, hold, or sell. Because Narratives on the platform are updated dynamically as new information comes in, such as earnings or major news about Marriott’s Series by Marriott expansion, your fair value and conviction can adjust in real time. For example, one Marriott Narrative might assume that global expansion, loyalty growth, and tech investments justify a fair value closer to the top end of recent targets near $332. A more cautious Narrative could emphasize macro risks and margin pressure, resulting in a fair value nearer $205. That spread reflects how different investors can reasonably disagree while still grounding their decisions in structured assumptions.

Do you think there's more to the story for Marriott International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal