Mettler-Toledo (MTD) Valuation Check After Earnings Beat and Strengthening Analyst Support

Mettler-Toledo International (MTD) just cleared a key hurdle, posting quarterly results that beat expectations on both revenue and adjusted earnings per share. This combination tends to reset how investors think about the stock.

See our latest analysis for Mettler-Toledo International.

Even with the upbeat quarter and fresh coverage from major banks, the share price has been treading water in the very near term, but a 10.6% 90 day share price return and solid 5 year total shareholder return suggest momentum is gradually rebuilding rather than fading.

If this kind of steady compounder appeals to you, it is worth also exploring healthcare stocks to see which other healthcare names are quietly building long term return potential.

With revenue and earnings surprising to the upside and the stock still trading at a modest discount to analyst targets, the key question now is whether this is a fresh buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 6.6% Undervalued

The most widely followed narrative pegs Mettler-Toledo International’s fair value modestly above the last close of $1,393.64, presenting a case for measured upside rather than a speculative surge.

Accelerating trends in automation and digitalization of manufacturing and laboratory environments are creating strong, recurring demand for Mettler-Toledo's data-driven solutions and process analytics, enabling greater share of wallet, increased adoption of its automation products, and supporting revenue growth as well as higher-margin recurring software and services.

Curious how steady mid single digit growth, rising margins and a richer earnings multiple can still point to upside from here? The narrative connects disciplined share shrink, stable expansion in high value verticals and a premium future valuation multiple into a single fair value number that challenges what the current price implies. Want to see exactly which revenue and profit assumptions carry most of the weight in that call?

Result: Fair Value of $1492.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and prolonged weakness in China and Europe could easily derail the expected margin recovery and steady mid single digit growth.

Find out about the key risks to this Mettler-Toledo International narrative.

Another Take on Valuation

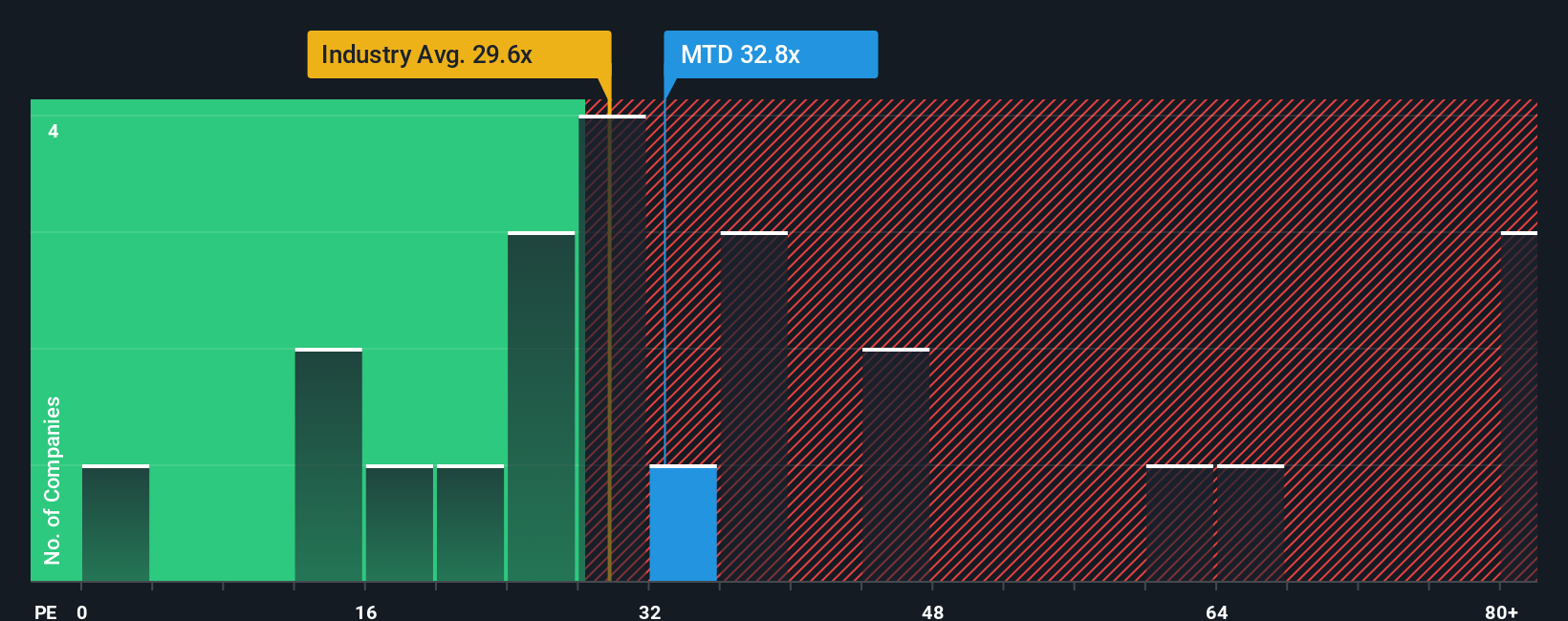

While the narrative suggests Mettler-Toledo International is modestly undervalued, a simple price to earnings cross check is less generous. The current 34.1x multiple is slightly below the Life Sciences average at 34.4x, but well above its 23.4x fair ratio. This points to limited margin of safety if growth underwhelms. Is the market paying up for quality, or just getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mettler-Toledo International Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Mettler-Toledo International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single compelling company when you can scan the market efficiently and spot fresh opportunities that other investors are still overlooking.

- Identify potential multi baggers early by reviewing these 3612 penny stocks with strong financials, which focus on companies with small market capitalizations and specific balance sheet and earnings profiles.

- Explore companies at the forefront of the next technology wave by checking these 26 AI penny stocks that use machine learning, automation, and data intelligence to change how industries operate.

- Evaluate risk and return more thoroughly by focusing on these 908 undervalued stocks based on cash flows, where current prices may differ from what long term cash flow analysis could support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal