Rheinmetall (XTRA:RHM): Assessing Valuation After New Dutch Air Defense Contract Extends Growth Visibility

The latest catalyst for Rheinmetall (XTRA:RHM) is a new order from the Dutch Ministry of Defence for Skyranger 30 air defense systems, which extends deliveries into 2029 and underscores sustained European demand for its core defense hardware.

See our latest analysis for Rheinmetall.

That backdrop helps explain why, despite a recent 30 day share price return of negative 6.4 percent and a 90 day share price return of negative 17.1 percent, Rheinmetall still boasts a powerful year to date share price return of about 167 percent and a three year total shareholder return above 700 percent. This suggests that long term momentum remains intact even as the market periodically reassesses geopolitical risk.

If this kind of defense spending story has your attention, it is a good moment to see what else is happening across aerospace and defense stocks and compare potential opportunities.

Yet with revenues and profits still growing briskly, the shares changing hands at a sizable discount to analyst targets and intrinsic value, and sentiment cooling, is Rheinmetall now a mispriced compounder, or is the market already baking in its wartime windfall?

Most Popular Narrative: 79.9% Undervalued

According to EUinvestor, Rheinmetall's last close of €1,616 sits far below a narrative fair value above €8,000, implying enormous upside if the thesis holds.

450% in 5 years

On April 17, 2025, Armin Papperger, Rheinmetall's CEO, said he expects orders to grow 450% by 2030.

Source: https://finance.yahoo.com/news/rheinmetall-ceo-expects-order-book-113644072.html

Price 8,052 EUR

The share price at the time of this information on 17/04/2025 was 1,464 EUR

Price estimate for 2030: 1,464 + 450% = 8,052 EUR

NATO spending in Europe

17/04/2025 The results of the NATO Summit held 24-26 June 2025 in The Hague, where it was agreed to increase defence spending to 3.5% of GDP and transport and IT infrastructure spending at 1.5% each year until 2035, were not yet known.

Source: https://www.nato.int/cps/en/natohq/official_texts_236705.htm

But there is one discrepancy, while the official NATO report talks about this budget increase to 3.5% +1.5% annually, the European media talks about 3.5% +1.5% as a target to be gradually reached by 2030-2035.

Want to see how this narrative gets from booming orders to that sky high price tag, using bold growth, margin and valuation assumptions hidden in the fine print?

Result: Fair Value of $8052 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could quickly unravel if a Ukraine ceasefire deflates defense demand, or a Trump-driven tariff shock crimps European budgets.

Find out about the key risks to this Rheinmetall narrative.

Another View: Lofty Earnings Multiple

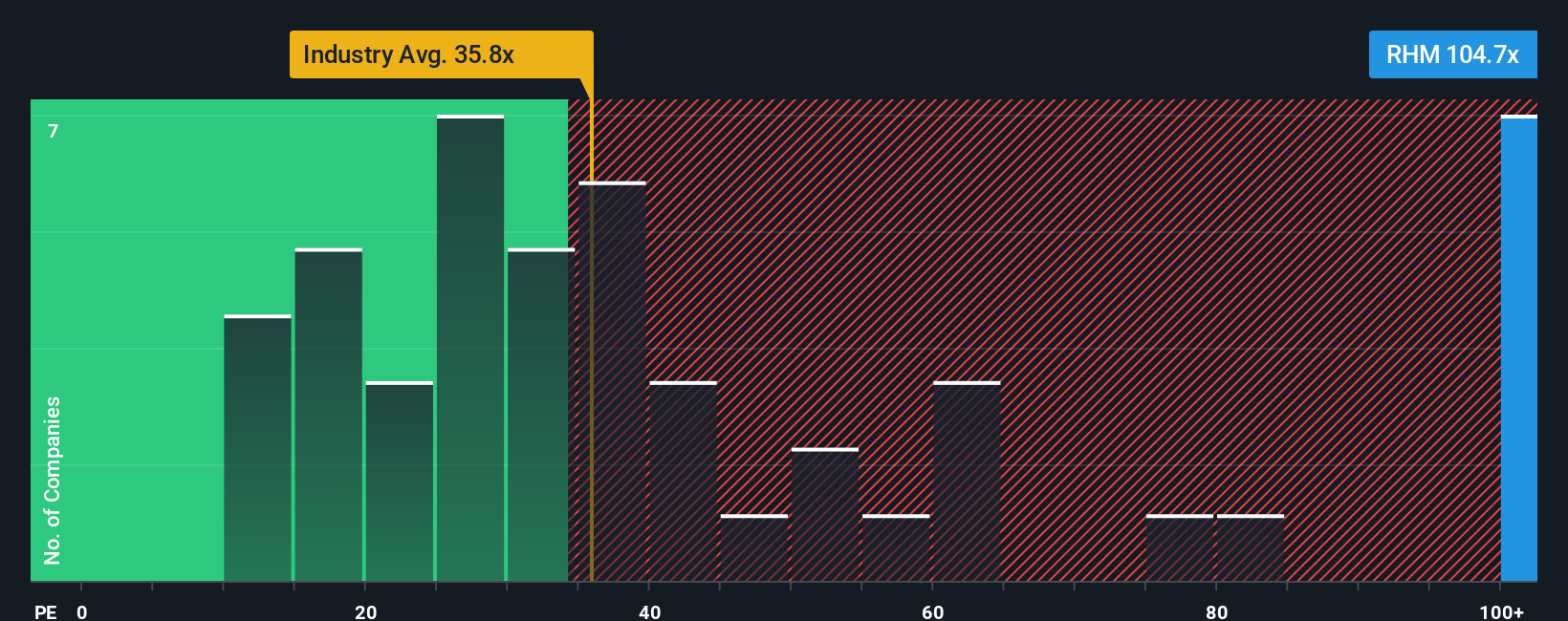

Set against that narrative fair value, Rheinmetall's current valuation on earnings looks far more demanding. At about 86 times profits versus a European aerospace and defense average of 30.3 times and a fair ratio of 51.8 times, the stock screens expensive, leaving less room for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rheinmetall Narrative

If this perspective does not fully align with your own, or you prefer to dig into the numbers yourself, you can build a customized view in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rheinmetall.

Ready for more high conviction ideas?

Before you move on, make your research count by lining up fresh opportunities that match your strategy, so the next big winner is already on your radar.

- Position your portfolio for asymmetric upside by targeting discounted cash flow potential using these 908 undervalued stocks based on cash flows tailored to strong fundamentals and compelling valuations.

- Capture the next wave of innovation in automation and intelligent software by zeroing in on these 26 AI penny stocks that may benefit from structural AI adoption.

- Build resilient income streams while rates shift by focusing on these 13 dividend stocks with yields > 3% that combine reliable payouts with sustainable balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal