CStone Pharmaceuticals (SEHK:2616): Valuation Check After GAVRETO Wins China National Reimbursement Drug List Approval

CStone Pharmaceuticals (SEHK:2616) just secured a key regulatory win, with its RET-targeting cancer drug GAVRETO set to join China’s National Reimbursement Drug List from January 2026. This change could reshape both patient access and long term revenue visibility.

See our latest analysis for CStone Pharmaceuticals.

The market seems to be warming up to that story already, with a 1 month share price return of 11.48 percent and a powerful year to date share price gain of 149.8 percent, even though the 1 year total shareholder return of 132.7 percent still comes after a choppy multi year ride.

If this NRDL catalyst has you rethinking healthcare exposure, it could be worth scanning healthcare stocks to find other names where sentiment and fundamentals may be starting to line up.

Yet even after that rally, CStone still trades at a steep discount to analyst targets. That raises a key question: Is this an overlooked growth story, or is the market already pricing in the next leg of expansion?

Price to Sales of 40.3x: Is It Justified?

CStone shares last closed at HK$6.12, and on a price to sales basis the stock screens as expensive versus both peers and our internal benchmarks.

The price to sales ratio compares the company’s market value to its annual revenue, which can be a useful yardstick for high growth, loss making biotechs where earnings are still negative.

At roughly 40.3 times sales, investors are paying a much richer premium than the Hong Kong Biotechs industry average of 13.2 times, and far above our estimated fair price to sales ratio of 4.2 times that our regression work suggests the market could ultimately gravitate toward if expectations cool.

That gap to the fair ratio underlines how aggressively the market is capitalizing CStone’s current revenue base, relative to what its fundamentals would imply on our models. It also sets a high bar for future execution if the share price is to keep pace with the growth narrative already embedded.

Explore the SWS fair ratio for CStone Pharmaceuticals

Result: Price to Sales of 40.3x (OVERVALUED)

However, investors still face execution and regulatory risks, particularly if NRDL-driven volumes, pipeline approvals or pricing power fall short of optimistic expectations.

Find out about the key risks to this CStone Pharmaceuticals narrative.

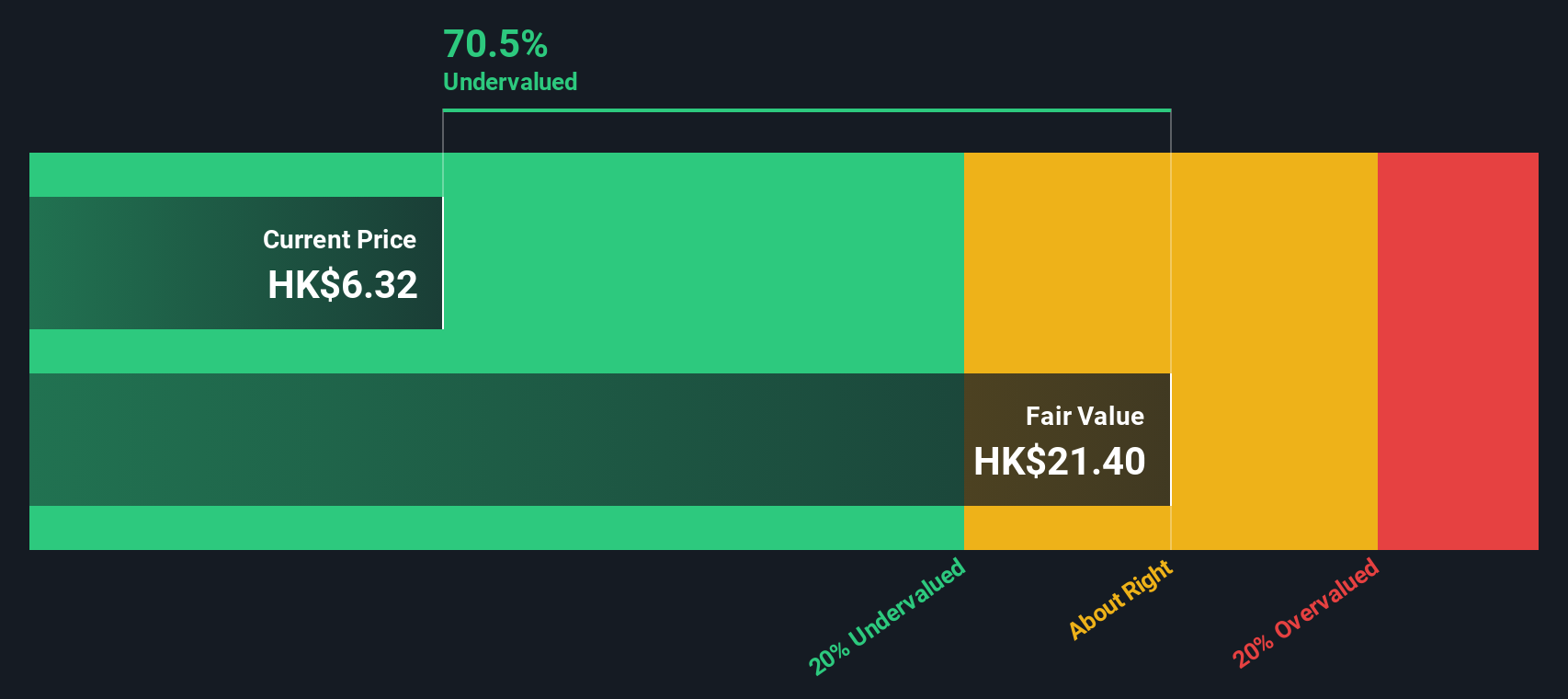

Another View: DCF Points the Other Way

While the current price to sales of 40.3 times looks stretched, our DCF model paints a very different picture, suggesting fair value closer to HK$21.26. That implies the shares are trading about 71 percent below this estimate, so is sentiment still playing catch up with fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CStone Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CStone Pharmaceuticals Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment move?

Consider reviewing a range of opportunities so you can quickly scan targeted stock ideas on Simply Wall St and explore ways to position your portfolio.

- Identify potential multi baggers early by reviewing these 3612 penny stocks with strong financials that already show stronger financial foundations than typical speculative names.

- Explore structural themes in automation and data by assessing these 26 AI penny stocks that may be exposed to growing AI spending in different markets.

- Review income-focused ideas by screening these 13 dividend stocks with yields > 3% that combine dividend payouts with established underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal