K. Wah International Holdings And 2 Other Asian Penny Stocks To Consider

As global markets navigate a landscape shaped by shifting interest rates and economic uncertainties, investors continue to explore diverse opportunities across various sectors. Penny stocks, despite their somewhat outdated moniker, remain a compelling area for those seeking growth potential in smaller or newer companies. With solid financial foundations, these stocks can offer surprising value and stability, making them an intriguing option for investors looking beyond the mainstream indices.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.59 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.099 | SGD51.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.49 | SGD13.74B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.96 | HK$21.94B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.90 | NZ$243.88M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 972 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K. Wah International Holdings Limited is an investment holding company involved in property development and investment in Hong Kong and Mainland China, with a market capitalization of approximately HK$6.94 billion.

Operations: The company's revenue is primarily derived from property development in Mainland China (HK$5.91 billion), followed by property investment (HK$623.61 million) and property development in Hong Kong (HK$410.53 million).

Market Cap: HK$6.94B

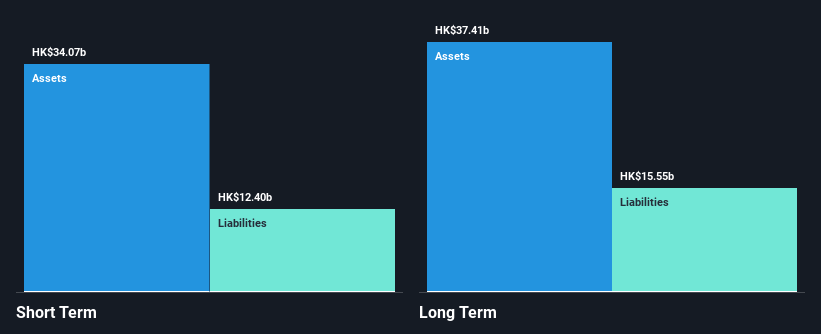

K. Wah International Holdings, recently added to the S&P Global BMI Index, presents a mixed picture for investors interested in penny stocks. While its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity (HK$28.8 billion vs HK$10.6 billion and HK$12.5 billion respectively), the company faces challenges with declining earnings and profit margins over recent years. Despite trading below estimated fair value and having satisfactory debt levels with well-covered interest payments, its low return on equity (0.7%) and unstable dividend history may concern potential investors seeking consistent growth or income stability in the real estate sector.

- Click to explore a detailed breakdown of our findings in K. Wah International Holdings' financial health report.

- Explore K. Wah International Holdings' analyst forecasts in our growth report.

Mount Everest Gold Group (SEHK:1815)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mount Everest Gold Group Company Limited is an investment holding company that designs and sells gold, silver, colored gemstones, gem-set, and other jewelry products in the People's Republic of China with a market capitalization of approximately HK$3.07 billion.

Operations: The company generates revenue of CN¥295.39 million from its new jewelry retail segment in the People's Republic of China.

Market Cap: HK$3.07B

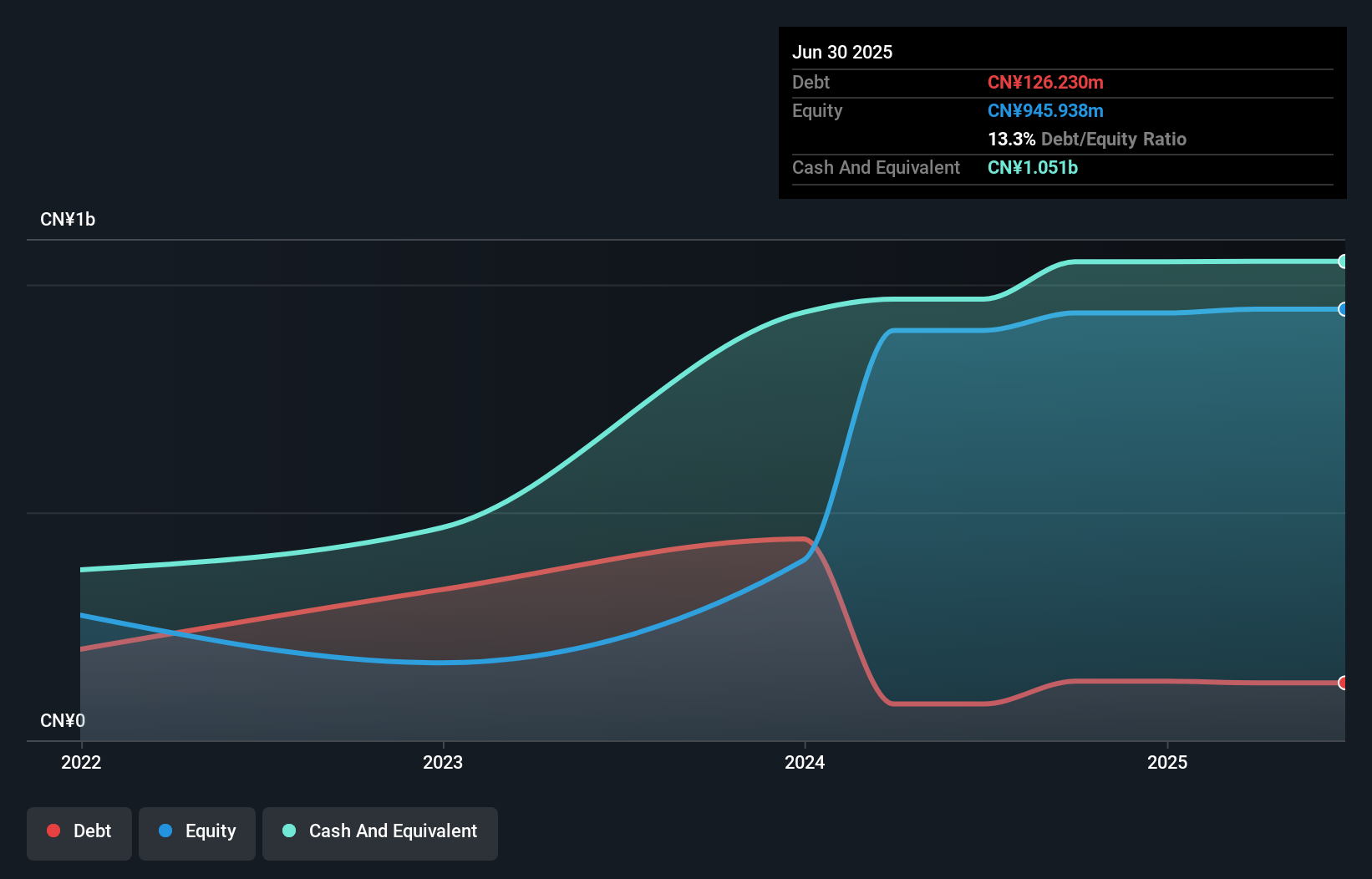

Mount Everest Gold Group, recently included in the S&P Global BMI Index, offers a compelling case for those exploring penny stocks. The company has demonstrated robust earnings growth of 304.2% over the past year, significantly outpacing its industry peers. Its financial health is underscored by short-term assets of CN¥1.7 billion exceeding both short and long-term liabilities, ensuring strong liquidity. While its return on equity remains low at 2.5%, Mount Everest Gold's interest payments are well-covered by EBIT (12x), and it holds more cash than total debt, highlighting prudent financial management despite a volatile share price history.

- Jump into the full analysis health report here for a deeper understanding of Mount Everest Gold Group.

- Examine Mount Everest Gold Group's past performance report to understand how it has performed in prior years.

Autostreets Development (SEHK:2443)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Autostreets Development Limited, with a market cap of HK$2.52 billion, is an investment holding company that offers used vehicle transaction services in China.

Operations: The company generates revenue primarily through the provision of transportation and related services, amounting to CN¥359.13 million.

Market Cap: HK$2.52B

Autostreets Development Limited, recently added to the S&P Global BMI Index, presents a mixed picture for penny stock investors. The company has achieved profitability this year, with short-term assets of CN¥1.2 billion comfortably covering both short and long-term liabilities, indicating sound liquidity. Despite a low return on equity at 4.7%, its interest payments are well-covered by EBIT (50.3x), and it maintains more cash than total debt—reflecting solid financial management. However, a significant one-off loss of CN¥142 million has impacted recent earnings quality, suggesting potential volatility in financial performance moving forward.

- Dive into the specifics of Autostreets Development here with our thorough balance sheet health report.

- Gain insights into Autostreets Development's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Explore the 972 names from our Asian Penny Stocks screener here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal