Is Bank of America (BAC) Using Community Soccer Partnerships to Quietly Reinforce Its Brand Moat?

- Earlier this month, the Portland Timbers named Bank of America as their new front-of-jersey partner in a multi-year deal focused on inclusive youth soccer initiatives, while Tillamook moved to the sleeve patch and maintained its community involvement.

- The partnership brings Bank of America’s Soccer with Us program to Oregon and Southwest Washington, combining brand visibility with grassroots investment through free camps, equipment donations, and plans to build or resurface 10 community futsal courts in underserved areas.

- With Bank of America expanding its Soccer with Us community program through the Timbers partnership, we’ll examine how this affects its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bank of America Investment Narrative Recap

To own Bank of America, you need to believe it can keep converting its scale, digital investments and disciplined credit into steady earnings while managing rate and credit cycles. The Timbers jersey deal is primarily a brand and community initiative, so it does not materially change near term earnings catalysts such as digital efficiency gains and capital returns, nor the key risk that market and economic swings could pressure credit quality, funding costs and margins.

More relevant to the investment story is Bank of America’s enhanced Workplace Benefits platform for business owners, which ties directly into its push for deeper digital engagement and higher value relationships. If this offering helps attract and retain small and mid sized business clients over time, it could reinforce existing catalysts around fee income and loan growth, even as competition for deposits and borrowing remains intense.

Yet while the headlines look positive, investors should be aware that rising competition for deposits could still...

Read the full narrative on Bank of America (it's free!)

Bank of America's narrative projects $122.0 billion in revenue and $32.9 billion in earnings by 2028.

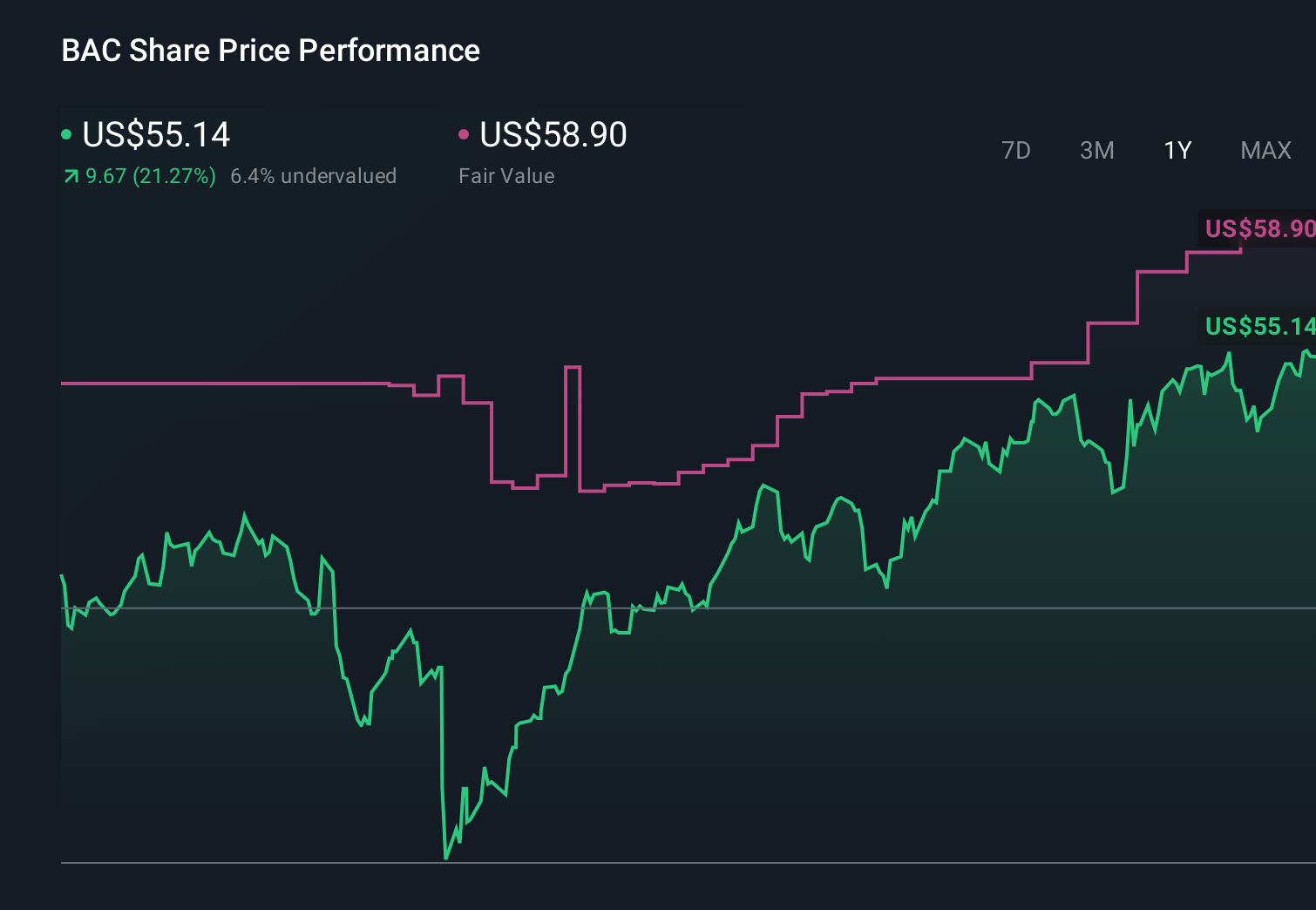

Uncover how Bank of America's forecasts yield a $58.98 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community value Bank of America between US$43.34 and US$58.98, highlighting very different opinions on upside from today’s price. As you weigh those views against catalysts like ongoing digital and AI investment, consider how shifts in credit quality and funding costs could change the earnings picture and explore several competing narratives before deciding what it means for you.

Explore 16 other fair value estimates on Bank of America - why the stock might be worth 21% less than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal