Assessing MarketAxess (MKTX) Valuation After Recent Share Price Rebound

Recent Performance Puts MarketAxess in Focus

MarketAxess Holdings (MKTX) has quietly climbed over the past week, even as its longer term returns remain weak. That mix of short term strength and multi year drawdown is drawing value oriented investors back for another look.

See our latest analysis for MarketAxess Holdings.

The recent 7 day share price return of 7.0 percent to around $178.99 stands in sharp contrast to a year to date share price decline of just over 20 percent, signaling a tentative shift in sentiment after a long stretch of weak total shareholder returns.

If you are weighing MarketAxess against other opportunities in financial technology, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares still down sharply over three and five years, despite mid single digit revenue growth and double digit profit growth, is MarketAxess now trading below its true potential, or are markets already pricing in a rebound in volumes and fees?

Most Popular Narrative Narrative: 10.9% Undervalued

With MarketAxess closing at $178.99 versus a narrative fair value near $201, the current price implies a clear gap in long term expectations.

The company's accelerated investments in automation, portfolio trading, and proprietary trading protocols (such as Open Trading and Mid X) are resulting in demonstrable gains across multiple strategic channels (client initiated, portfolio trading, dealer initiated). These developments are creating new, higher margin revenue streams that may enhance net margins over time.

Curious how steady revenue growth, rising margins and a richer earnings profile can still point to upside from here? Unpack the full playbook behind this fair value call.

Result: Fair Value of $201 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower shift of large block trades to electronic venues and intensifying price competition could easily derail this upside case.

Find out about the key risks to this MarketAxess Holdings narrative.

Another Way to Look at Value

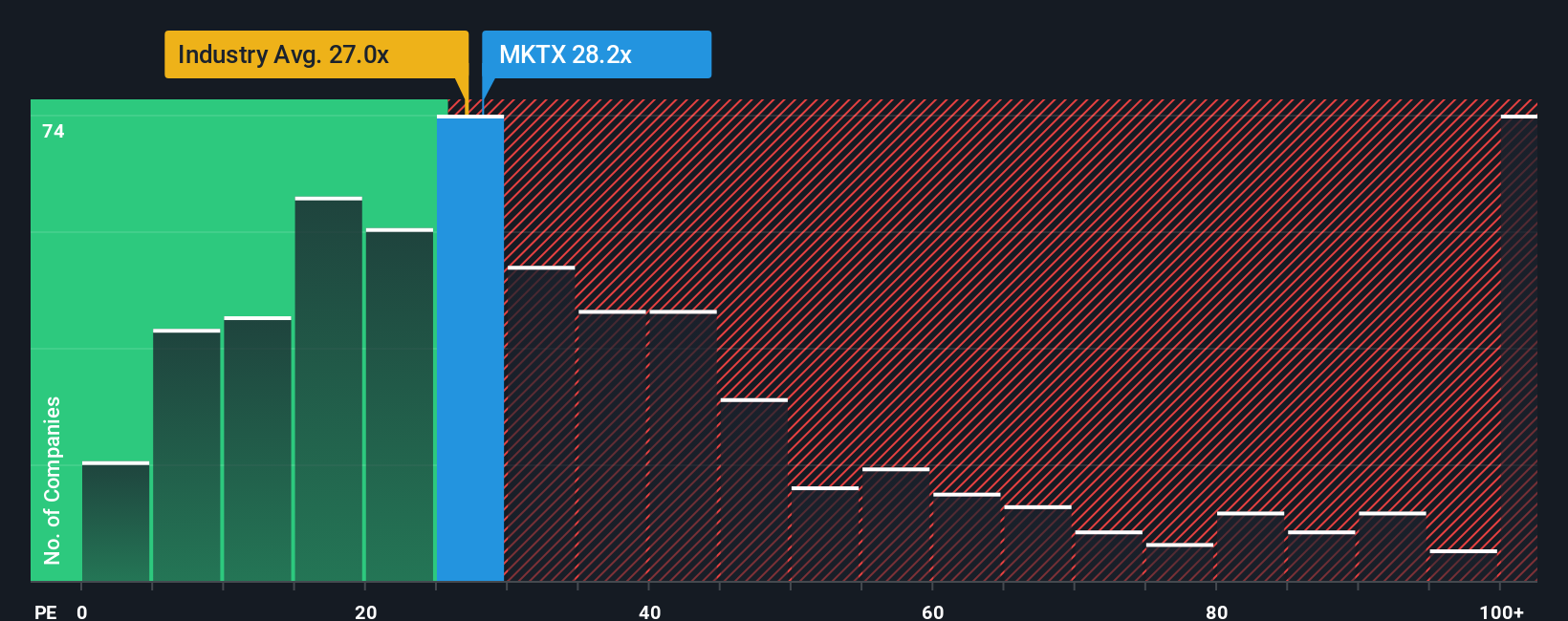

While the narrative model points to roughly 11 percent upside, our earnings based lens says something different. At about 30 times earnings versus a fair ratio near 15 and an industry level closer to 25, the stock screens as expensive. Is this a quality premium or valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MarketAxess Holdings.

Looking for more investment ideas?

Before you move on, explore your next opportunity now using the Simply Wall Street Screener to avoid missing timely, high conviction setups.

- Capture early momentum by scanning these 80 cryptocurrency and blockchain stocks positioned at the forefront of digital finance and blockchain infrastructure.

- Strengthen your portfolio’s recurring income by targeting these 13 dividend stocks with yields > 3% that can support reliable cash flows through changing markets.

- Position yourself ahead of market reratings by filtering for these 908 undervalued stocks based on cash flows that still trade below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal