Air Products (APD) Valuation Check After New Yara Low-Carbon Ammonia Project Talks and Hydrogen Expansion

Air Products and Chemicals (APD) just moved deeper into the low carbon ammonia game, entering advanced negotiations with Yara on massive US and Saudi projects that could reshape its long term clean energy revenue mix.

See our latest analysis for Air Products and Chemicals.

Despite these ambitious ammonia and hydrogen projects, Air Products and Chemicals has been under pressure, with a roughly 16 percent 90 day share price return and 20 percent one year total shareholder return both firmly in negative territory. This signals that momentum has been fading even as the long term clean energy story builds.

If projects like Louisiana and NEOM have you thinking about where the next long term winners might emerge, this could be a good time to explore fast growing stocks with high insider ownership.

With the share price sliding despite solid long term project visibility and a double digit discount to analyst targets, the key question now is simple: is Air Products and Chemicals a contrarian buy, or is the market rightly skeptical about future growth?

Most Popular Narrative: 21.3% Undervalued

With Air Products and Chemicals last closing at $243, the most followed narrative places fair value meaningfully higher, suggesting the market is discounting its long term transition story.

Heavy investments in large-scale hydrogen, blue or green ammonia, and carbon capture projects supported by multi decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast) are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Curious how much future revenue, earnings power, and margin expansion this narrative is baking in, and which profit multiple it needs to work? The full story lays out the entire math behind that upside.

Result: Fair Value of $308.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on mega hydrogen or ammonia projects, along with prolonged industrial demand weakness, could cap margin expansion and undermine the current undervaluation thesis.

Find out about the key risks to this Air Products and Chemicals narrative.

Another Angle on Valuation

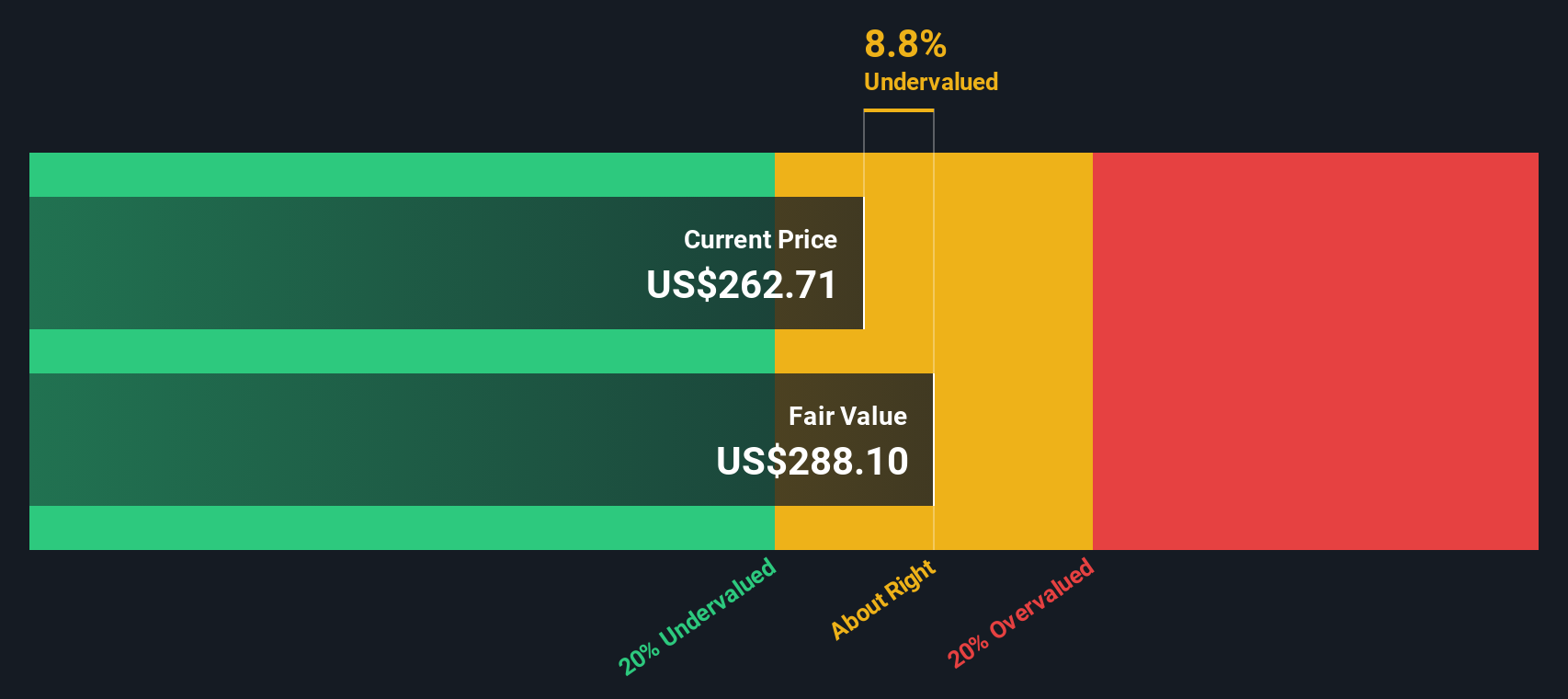

On cash flows, our DCF model paints a softer picture than the narrative fair value. It suggests APD is only about 7.6 percent below its intrinsic value, which implies the margin of safety may be thinner than the 21.3 percent upside story suggests. Which future do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Air Products and Chemicals Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build a personalized narrative in just minutes: Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single thesis when the market is packed with potential, use the Simply Wall St Screener to uncover your next smart move today.

- Capture potential cash flow opportunities by targeting companies that screens highlight as mispriced through these 908 undervalued stocks based on cash flows before the crowd catches on.

- Explore innovation by focusing on cutting edge businesses involved in automation, data, and productivity with these 26 AI penny stocks.

- Strengthen your income stream by focusing on payers that stand out for attractive yields and resilience via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal