Rhythm Pharmaceuticals (RYTM): Reassessing Valuation After Encouraging Phase 2 Progress in Prader-Willi Syndrome

Rhythm Pharmaceuticals (RYTM) jumped into focus after early Phase 2 data in Prader Willi syndrome showed reductions in body mass index and hunger, prompting management to prepare a Phase 3 registrational trial.

See our latest analysis for Rhythm Pharmaceuticals.

Those PWS data have landed against a strong backdrop, with the stock still up roughly 89% on a year to date share price basis and a powerful 105% one year total shareholder return. This suggests momentum is building as investors reprice Rhythm’s pipeline potential and risk profile.

If this kind of clinical inflection point interests you, it could be a good moment to explore other specialist names across healthcare stocks and see what else may be setting up for the next leg higher.

With shares already near all time highs, a 66 percent implied intrinsic discount, and analyst targets still pointing higher, investors now face a tougher question: Is Rhythm still mispriced, or is the market already discounting years of future growth?

Most Popular Narrative Narrative: 10.6% Undervalued

With Rhythm closing at $113.56 against a widely followed fair value estimate of $127, the narrative frames further upside as driven by long term earnings power.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader Willi syndrome, alongside expansion into younger age groups, are set to materially grow Rhythm's commercial opportunity and topline over the next several years.

Want to see the math behind that confidence? The narrative leans on rapid revenue acceleration, sharp margin expansion, and a future earnings multiple more often reserved for market darlings. Curious which assumptions really power that $127 fair value and how far profitability is expected to swing? Read on to unpack the full growth blueprint behind this call.

Result: Fair Value of $127 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case hinges on flawless execution, as any safety setback for setmelanotide or slower than expected hypothalamic obesity uptake could quickly challenge it.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

Another Angle on Valuation

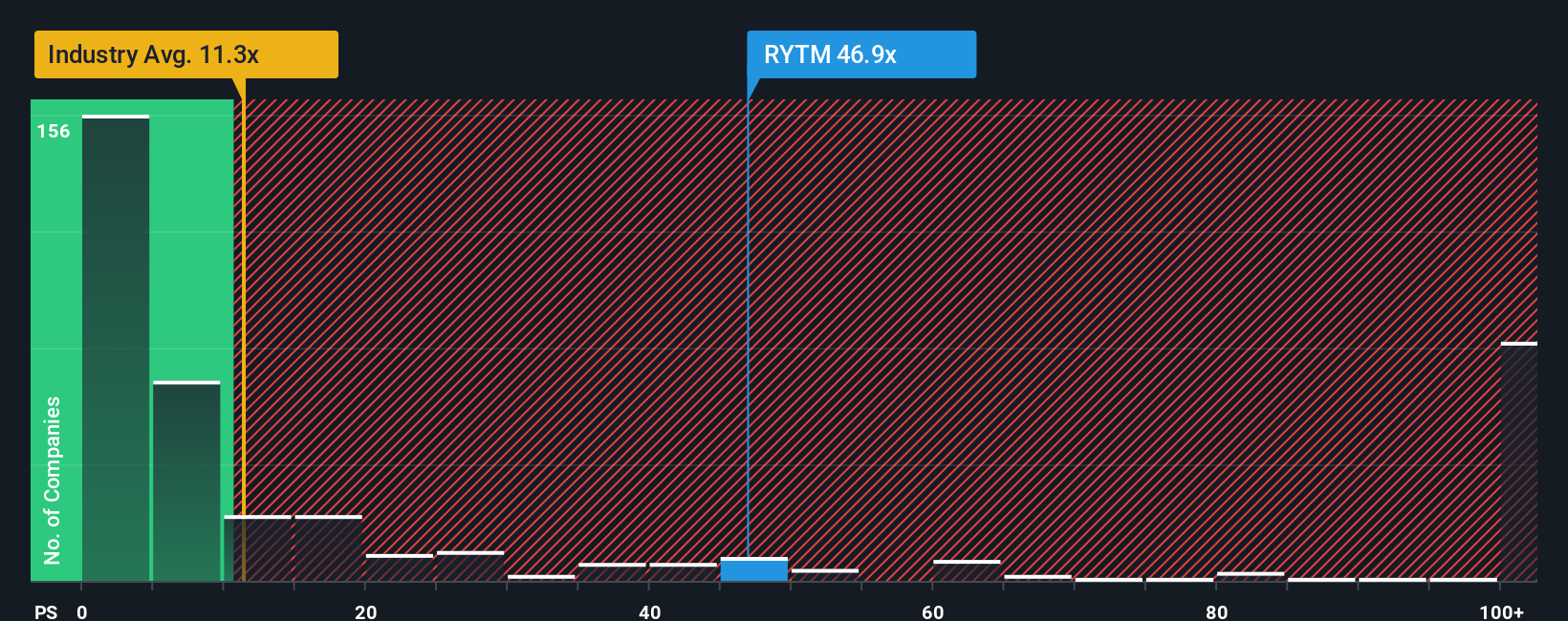

While the narrative points to upside, the price tag looks demanding when you zoom in on sales. Rhythm trades on a rich 43.5 times sales compared with 12.1 times for the US Biotechs industry and a fair ratio of 23.2 times, raising the risk that sentiment, not fundamentals, is doing more of the heavy lifting. Which lens do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you would rather stress test the assumptions yourself and dig into the numbers directly, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Ready for more high conviction ideas?

Do not stop at a single opportunity when the market is full of mispriced potential. Use the Simply Wall St Screener to uncover what others are overlooking.

- Accelerate your hunt for small, agile opportunities by scanning these 3612 penny stocks with strong financials that already show strong financial underpinnings instead of fragile speculation.

- Capitalize on structural shifts in technology by targeting these 26 AI penny stocks that pair cutting edge innovation with fundamentals that can support long term growth.

- Identify potential bargains before the crowd catches on by focusing on these 908 undervalued stocks based on cash flows where cash flow strength may not yet be priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal