Wallenstam (OM:WALL B): Valuation Check After New Green Financing Framework and S&P ‘Medium Green’ Rating

Green financing shift puts Wallenstam (OM:WALL B) back on investors radar

Wallenstam (OM:WALL B) just refreshed its green financing framework with Handelsbanken and secured a Medium Green rating from S&P Global Ratings, a move that quietly reshapes how it might fund future projects.

See our latest analysis for Wallenstam.

The latest green financing push lands at a time when momentum has been soft, with the share price at SEK 41.84 and a year to date share price return of minus 13.98 percent. The five year total shareholder return of minus 30.49 percent shows how long term holders have been under pressure.

If this sustainability shift has you rethinking where growth could come from next, it may be worth exploring fast growing stocks with high insider ownership as a source of new ideas beyond real estate.

Yet with shares still lagging and only a modest discount to analyst targets, the real question is whether Wallenstam is a mispriced turnaround in waiting or if the market already reflects its green driven growth potential.

Most Popular Narrative: 9% Undervalued

Compared with the last close at SEK 41.84, the most followed narrative anchors around a fair value of SEK 46, implying modest upside if its assumptions land.

Major investments in self-produced renewable energy and property energy efficiency projects (e.g., wind turbine self-sufficiency and apartment retrofits) are reducing energy costs and improving portfolio energy ratings, supporting margin expansion and enhancing future earnings resiliency.

Want to see what kind of revenue climb, margin leap, and earnings power this narrative is quietly baking in, and how that shapes the 2028 valuation math? Have a read of the narrative in full and understand what's behind the forecasts.

Result: Fair Value of $46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher interest costs on Wallenstam’s sizeable debt and weaker demand for commercial space could quickly chip away at those margin assumptions.

Find out about the key risks to this Wallenstam narrative.

Another View: Multiples Point to a Richer Price

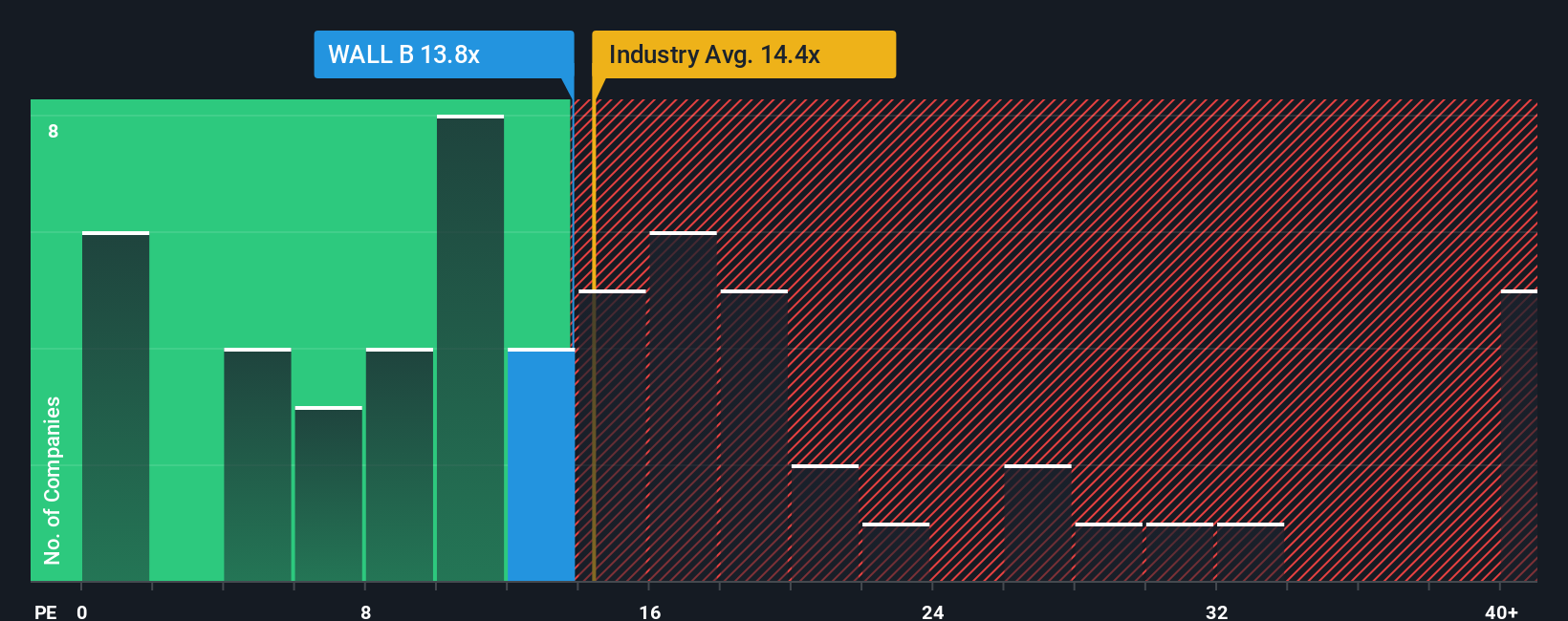

While the 9% upside narrative paints Wallenstam as mildly undervalued, a different lens pokes holes in that story. On our numbers, the stock trades at 14.3 times earnings, slightly above its fair ratio of 13.7 times. This hints at limited margin of safety if growth underwhelms.

Compared with the Swedish market at 22.2 times and real estate peers at 14.9 times, Wallenstam still looks cheaper. However, the small gap to its own fair ratio suggests investors are no longer being paid much for taking on its earnings and debt risks. If sentiment turns, how quickly could that valuation discount close, or widen further?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wallenstam Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom narrative in minutes: Do it your way

A great starting point for your Wallenstam research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few fresh ideas that could upgrade your watchlist and help you stay prepared for the next wave of market opportunities.

- Look for potential mispricings by scanning these 908 undervalued stocks based on cash flows, where future cash flows may indicate stronger value than current share prices suggest.

- Follow major innovation trends by focusing on these 26 AI penny stocks that are reshaping industries with real world AI products and platforms.

- Reinforce your income strategy by targeting these 13 dividend stocks with yields > 3% that can help support more reliable portfolio level cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal