Has Knight-Swift’s 24% Monthly Rally Pushed Its Valuation Too Far in 2025?

- Wondering if Knight-Swift Transportation Holdings at around $53 is a bargain or a value trap? This article will walk through what the numbers are really saying about the stock.

- After slipping over the past year with a -2.5% return, the stock has recently bounced, up 3.7% over the last week and 23.9% over the last month, hinting that sentiment might be turning.

- Investors have been reacting to a mix of industry headlines, including shifting freight demand expectations and ongoing consolidation across the trucking and logistics space, which can change how the market prices large carriers like Knight-Swift. At the same time, regulatory and fuel cost developments have kept risk perceptions in flux, adding another layer to recent price moves.

- Despite that backdrop, Knight-Swift currently scores 0/6 on our valuation checks. This means it does not screen as undervalued on any of our standard measures. Next we will unpack those approaches one by one, before finishing with a more powerful way to think about valuation in the real world.

Knight-Swift Transportation Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Knight-Swift Transportation Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects the cash a business is expected to generate in the future and then discounts those cash flows back to today to estimate what the entire company is worth in $.

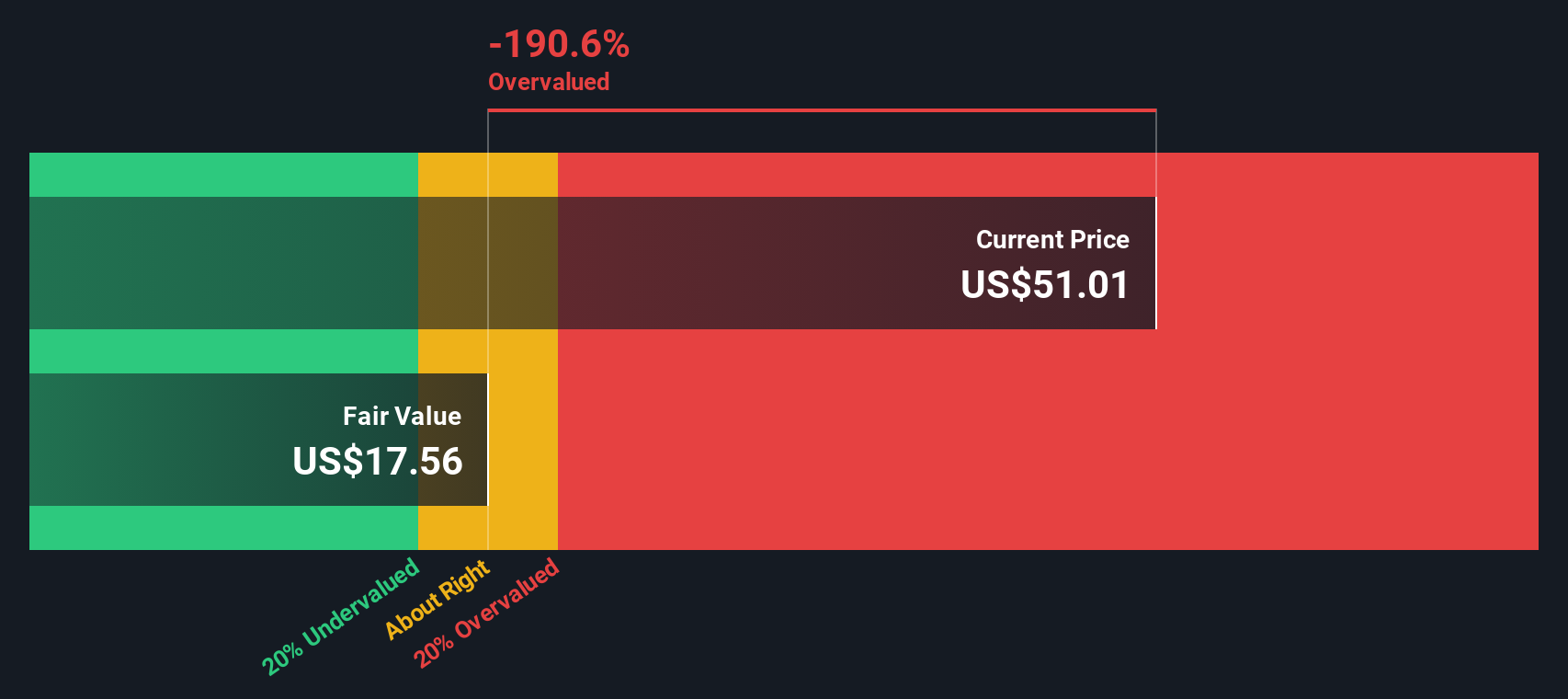

For Knight-Swift Transportation Holdings, the latest twelve month Free Cash Flow is negative at roughly $154.7 Million, reflecting a tougher recent cash picture. Analysts and extrapolations then project FCF turning positive and stabilizing, reaching around $158.2 Million by 2035, with the path from 2026 to 2035 based on a mix of analyst forecasts and Simply Wall St extrapolations under a 2 Stage Free Cash Flow to Equity model.

Combining all of those projected cash flows and discounting them back to today yields an estimated intrinsic value of about $17.65 per share. Versus a current share price near $53, this implies the stock is roughly 201.5% overvalued on this metric. This suggests that, on cash flows alone, the market is paying a rich premium for Knight-Swift.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Knight-Swift Transportation Holdings may be overvalued by 201.5%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Knight-Swift Transportation Holdings Price vs Earnings

For profitable companies, the price to earnings ratio is often the most intuitive valuation yardstick, because it directly links the price you pay to the profits the business is generating today. A higher PE can be justified when investors expect stronger growth or see the earnings stream as relatively low risk, while slower growth or higher uncertainty typically warrant a lower, more conservative multiple.

Knight-Swift currently trades on a PE of about 60.7x, which is well above both the Transportation industry average of roughly 32.3x and the broader peer group average of around 33.5x. To go a step further, Simply Wall St estimates a Fair Ratio for Knight-Swift of about 25.1x. This proprietary metric represents the PE we would normally expect for the company after factoring in its earnings growth outlook, profit margins, industry dynamics, market cap and specific risk profile.

Because the Fair Ratio is tailored to Knight-Swift rather than based on broad group averages, it gives a more nuanced view than simple peer or industry comparisons. Measured against this 25.1x Fair Ratio, the current 60.7x PE suggests Knight-Swift is trading at a substantial premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Knight-Swift Transportation Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page where you connect your story about a company to a set of assumptions about its future revenue, earnings and margins. These assumptions then flow into a forecast and a Fair Value you can compare to today’s price to help you decide whether to buy or sell. Everything is dynamically updated as new news and earnings arrive. For Knight-Swift, one investor might plug in the more bullish view implied by a Fair Value near about $68 per share, based on stronger freight recovery and margin expansion. Another might lean toward a cautious stance closer to roughly $43 per share, reflecting slower demand and integration risks. Narratives makes both perspectives visible, quantified and easy to track as conditions change.

Do you think there's more to the story for Knight-Swift Transportation Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal