West Pharmaceutical Services (WST) Valuation Check After 19% Year-to-Date Share Price Decline

West Pharmaceutical Services (WST) has been drifting lower this year, and with the stock down about 19% year to date, investors are starting to revisit the story with a fresh valuation lens.

See our latest analysis for West Pharmaceutical Services.

The recent pullback has come despite steady underlying growth, with the 90 day share price return of 3.89% only partially offsetting the 18.52% year to date share price decline and softer 1 year total shareholder return of 18.67%. This suggests momentum has cooled for now, even after a modest 30 day share price uptick.

If West Pharmaceutical Services has you reassessing your healthcare exposure, it might be worth exploring healthcare stocks for other medical names showing stronger momentum and fundamentals right now.

With earnings still growing, a double digit pullback this year, and the stock trading nearly 30% below consensus targets, is West Pharmaceutical now a mispriced quality compounder, or is the market already discounting its future growth?

Most Popular Narrative: 22.7% Undervalued

With West Pharmaceutical Services last closing at $267.56 against a narrative fair value near $346, the focus shifts to how future growth might close that gap.

The continued growth in GLP-1s, which made up about 7% of total revenues in the first quarter, and the company's ability to capitalize on significant opportunities in this market could drive revenue and earnings growth. The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale, enhancing net margins.

Curious how modest top line gains, rising margins, and a richer earnings multiple can still support a higher fair value than today? The narrative leans on accelerating profits, mix shift toward premium components, and a valuation usually reserved for faster growing sectors. Want to see the exact growth and margin path behind that confidence, and how it all discounts back at a relatively low required return? Read on to unpack the full blueprint behind this target.

Result: Fair Value of $346.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still depends on smooth execution, with tariff pressures and contract manufacturing transitions both capable of squeezing margins and delaying earnings progress.

Find out about the key risks to this West Pharmaceutical Services narrative.

Another View: Valuation Looks Stretched on Earnings

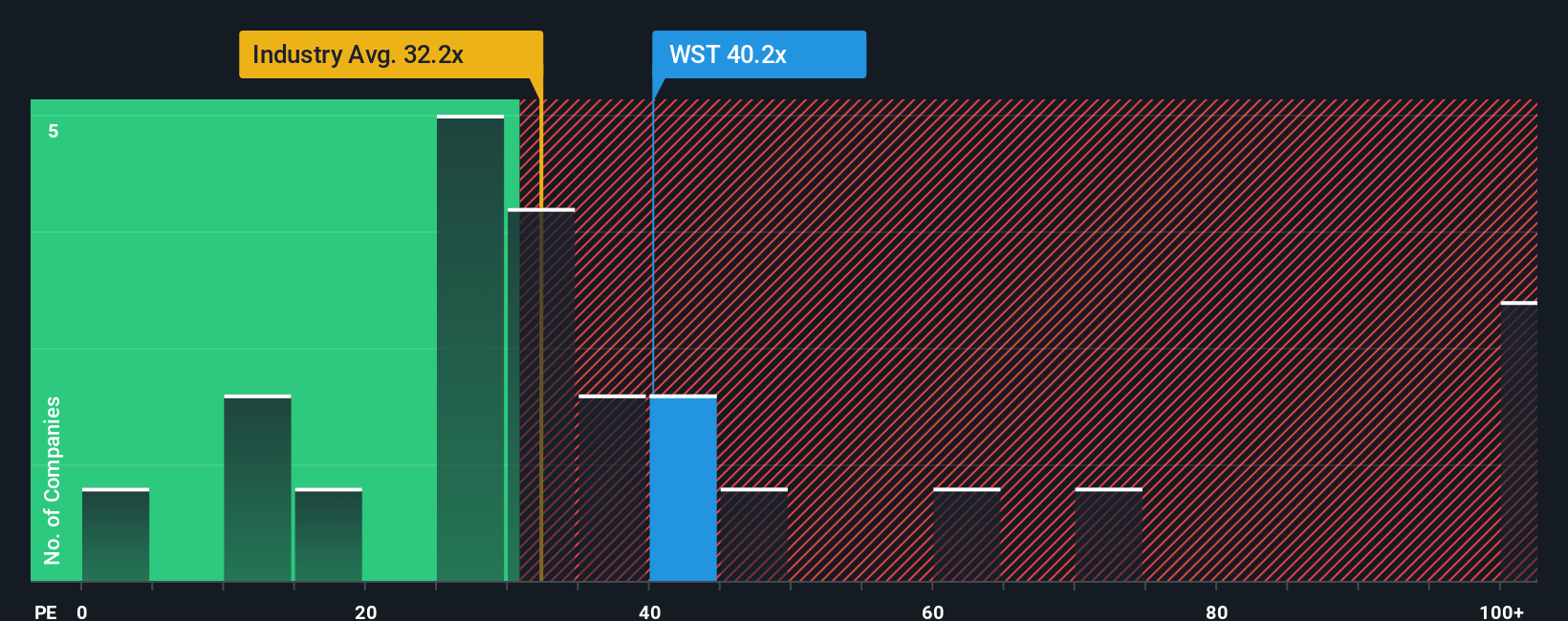

Step away from the narrative fair value and the picture changes. On earnings, West Pharmaceutical trades on a 39.1x P E ratio versus 35.8x for the North American Life Sciences industry, 30.6x for peers, and a fair ratio of 25.1x. That premium leaves less margin for error if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If you see the numbers differently or want to test your own assumptions, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding West Pharmaceutical Services.

Ready for more high conviction opportunities?

Before you move on, consider some targeted screens that highlight quality, momentum, and income potential.

- Look for potential market mispricings by scanning these 903 undervalued stocks based on cash flows that show strong cash flow support for their current valuations.

- Explore secular growth trends by focusing on these 26 AI penny stocks positioned at the center of the AI transformation.

- Seek to strengthen your income stream by examining these 13 dividend stocks with yields > 3% that may offer payouts above 3% while maintaining a focus on quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal