Reassessing IDEXX Laboratories (IDXX) Valuation After Fresh Bullish Analyst Coverage and Global Growth Momentum

Barclays just kicked off coverage on IDEXX Laboratories (IDXX) with a favorable view, adding to a run of upbeat analyst calls as the company leans into global expansion and rising demand for its diagnostics platform.

See our latest analysis for IDEXX Laboratories.

That upbeat backdrop comes after a sharp re-rating, with the share price now at $704.2. Despite a slightly negative 30 day share price return, a strong year to date share price gain and robust multi year total shareholder returns suggest momentum is still very much intact.

If IDEXX’s run has you thinking about what else is working in healthcare, it could be worth exploring other innovative names using our healthcare stocks today.

With shares hovering near record highs and analysts still nudging targets upward, the real question now is whether IDEXX remains undervalued on its long term growth trajectory or if the market has already priced in the next leg of expansion.

Most Popular Narrative: 6.7% Undervalued

With IDEXX closing at $704.2 against a narrative fair value near $755, the spread points to modest upside if growth plays out as projected.

Recurring revenues, especially from Companion Animal Group diagnostics, are expected to accelerate over the next few years, aided by resilient visit volumes and the strengthening “IDEXX premium.”

Curious what justifies paying a premium multiple for mid teens growth, expanding margins, and hefty buybacks, all at once. Want to see the assumptions powering that fair value call, and how long they expect IDEXX to compound before the market blinks.

Result: Fair Value of $754.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer US clinic visit trends and potential saturation in new instrument placements could slow recurring diagnostic growth and challenge today’s premium multiple.

Find out about the key risks to this IDEXX Laboratories narrative.

Another View: Valuation Looks Stretched On Earnings

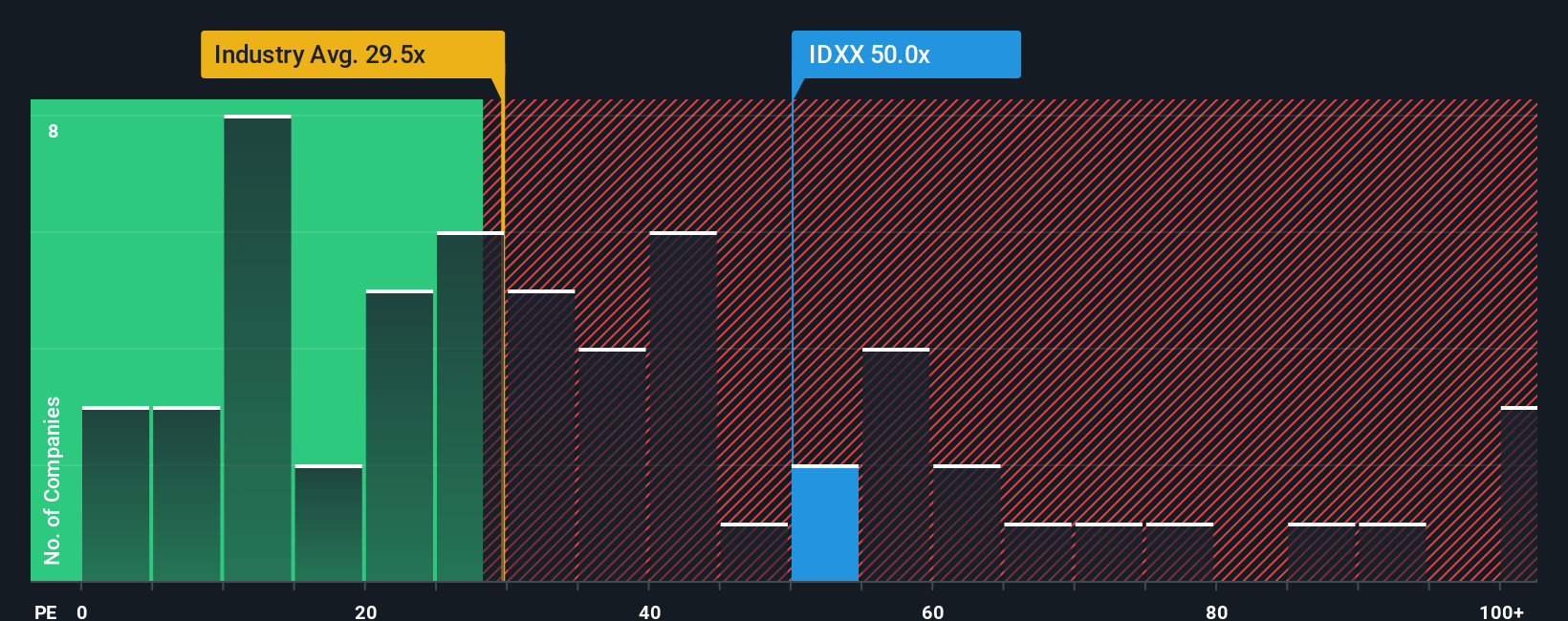

While the narrative fair value suggests upside, IDEXX trades at about 54.7 times earnings versus a fair ratio of 31.6 times and a peer average near 28 times. That rich gap implies little room for disappointment and raises the question of how long investors will tolerate this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDEXX Laboratories Narrative

If you see IDEXX differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Round out your watchlist with opportunities beyond IDEXX, and let smart screeners surface focused, data driven ideas before the market fully wakes up to them.

- Identify potentially mispriced quality by targeting these 903 undervalued stocks based on cash flows that may offer upside relative to their intrinsic cash flow characteristics.

- Follow the next wave of intelligent automation by zeroing in on these 26 AI penny stocks involved in software, data analytics, and machine learning.

- Seek a mix of income and growth by scanning these 13 dividend stocks with yields > 3% that combine dividend payments with established business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal