BlueNord (OB:BNOR): Valuation Check After Strong Tyra Ramp-Up and Better-Than-Expected Production

BlueNord (OB:BNOR) just posted preliminary November production numbers that highlight a smooth ramp up at the Tyra hub and stronger than expected output from its legacy Danish fields, giving investors fresh data to reassess value.

See our latest analysis for BlueNord.

Even with this operational outperformance, the 1 month share price return of minus 14.29 percent and year to date share price return of minus 37.61 percent show sentiment has been weak. However, a 5 year total shareholder return of 283.23 percent hints that longer term investors who sat through past volatility have still been rewarded.

If BlueNord’s story has you rethinking where the next leg of energy driven returns might come from, it could be worth scouting fast growing stocks with high insider ownership for other under the radar opportunities.

With shares trading at a steep discount to analyst targets despite rising production and accelerating earnings, the key question now is whether BlueNord is quietly undervalued or if the market is already pricing in its next phase of growth.

Most Popular Narrative Narrative: 25.3% Undervalued

Against a last close of NOK 423, the most followed narrative points to a materially higher fair value, built on a powerful cash flow and earnings transition.

The Tyra Hub is expected to more than double BlueNord's production, driving significant revenue growth as it reaches maximum capacity and maintains stable production in 2025. Exploration success with the HEMJ well has exceeded forecasts, adding substantial reserves and accelerating production, which is projected to prolong Tyra's plateau, enhancing long term revenue potential.

Curious how a still unprofitable producer can justify a richer future earnings multiple than most traditional oil and gas peers while keeping growth assumptions surprisingly grounded? The narrative leans heavily on an earnings inflection, expanding margins, and a re rating that might catch the market off guard. Want to see exactly how those moving parts combine into that higher fair value target?

Result: Fair Value of $566.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Tyra’s ramp up stumbles or gas prices soften meaningfully, the earnings inflection and re rating implied by this narrative could quickly unravel.

Find out about the key risks to this BlueNord narrative.

Another Angle on Value

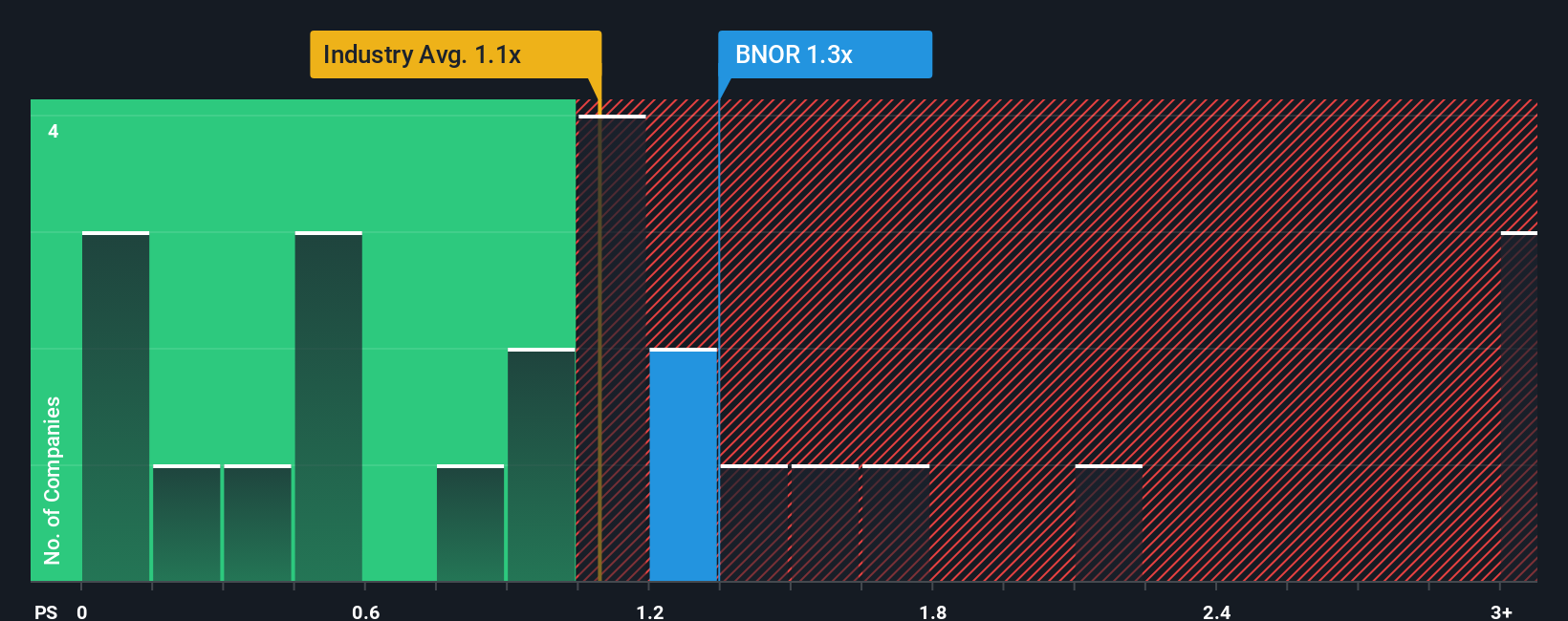

While the narrative leans on future earnings and cash flow, current pricing tells a more cautious story. BlueNord trades on a price to sales ratio of 1.2 times, only slightly below the European oil and gas average of 1.3 times and near its own fair ratio of 1.3 times. This suggests less obvious upside if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlueNord Narrative

If you see things differently or would rather examine the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your BlueNord research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single stock when the Simply Wall Street Screener can reveal focused shortlists that sharpen your watchlist and upgrade your next move.

- Capture potential mispricings by targeting companies that screens flag as markedly below intrinsic value, starting with these 903 undervalued stocks based on cash flows.

- Position yourself early in transformative technologies by filtering for innovators shaping automation, data intelligence, and software, using these 26 AI penny stocks.

- Strengthen portfolio income by focusing on companies with reliable cash flows and attractive yields through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal