Here's Why We Think Dalrymple Bay Infrastructure (ASX:DBI) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Dalrymple Bay Infrastructure (ASX:DBI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Dalrymple Bay Infrastructure with the means to add long-term value to shareholders.

How Fast Is Dalrymple Bay Infrastructure Growing Its Earnings Per Share?

Over the last three years, Dalrymple Bay Infrastructure has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that Dalrymple Bay Infrastructure's EPS has grown from AU$0.15 to AU$0.18 over twelve months. There's little doubt shareholders would be happy with that 16% gain.

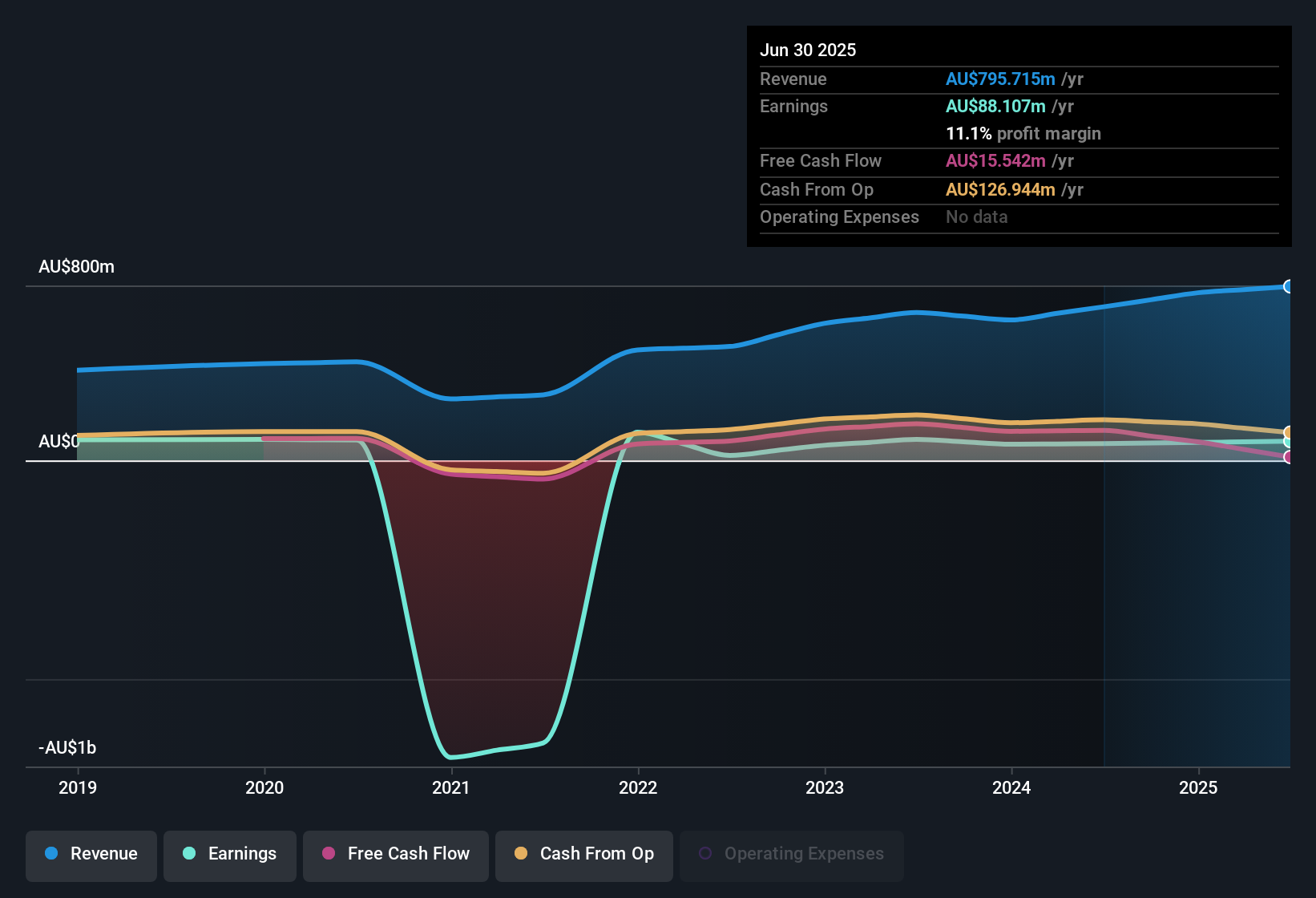

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Dalrymple Bay Infrastructure achieved similar EBIT margins to last year, revenue grew by a solid 13% to AU$796m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Dalrymple Bay Infrastructure

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Dalrymple Bay Infrastructure's future profits.

Are Dalrymple Bay Infrastructure Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Dalrymple Bay Infrastructure, with market caps between AU$1.5b and AU$4.8b, is around AU$2.5m.

Dalrymple Bay Infrastructure offered total compensation worth AU$1.4m to its CEO in the year to December 2024. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Dalrymple Bay Infrastructure Worth Keeping An Eye On?

One positive for Dalrymple Bay Infrastructure is that it is growing EPS. That's nice to see. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So all in all Dalrymple Bay Infrastructure is worthy at least considering for your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Dalrymple Bay Infrastructure , and understanding these should be part of your investment process.

Although Dalrymple Bay Infrastructure certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Australian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal