Wallenius Wilhelmsen (OB:WAWI): Valuation Check After Securing Long-Term, Sustainability-Linked Shipping Contracts

Wallenius Wilhelmsen (OB:WAWI) just locked in extensions on two major shipping contracts worth an estimated USD 500 million, stretching key customer relationships to 2028 and 2030 and sharpening its long term revenue visibility.

See our latest analysis for Wallenius Wilhelmsen.

The market seems to be catching on to that stability, with a 1 month share price return of 21.54 percent and a 1 year total shareholder return of 31.09 percent, building on an impressive 666.01 percent total shareholder return over five years.

If this contract win has you rethinking transport and industrial exposure, it could be worth scanning auto manufacturers to see which other players might benefit along the value chain.

Yet with revenue and earnings growth softening, and the share price already above consensus targets, the key question now is whether Wallenius Wilhelmsen still trades at a discount or if markets are fully pricing in future growth.

Most Popular Narrative: 16.9% Overvalued

With Wallenius Wilhelmsen closing at NOK104.10 against a narrative fair value near NOK89.04, the prevailing view leans toward a stretched valuation built on demanding assumptions.

The analysts have a consensus price target of NOK99.255 for Wallenius Wilhelmsen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK116.11, and the most bearish reporting a price target of just NOK75.38.

Curious why a shrinking top line, lower future margins and a higher earnings multiple still add up to a premium valuation narrative, not a discount? Dive in.

Result: Fair Value of $89.04 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, resilient Asian export demand and long term contracts that lock in capacity could cushion softer volumes and margins, which challenges the case for a sustained premium valuation.

Find out about the key risks to this Wallenius Wilhelmsen narrative.

Another View: Market Multiples Tell a Different Story

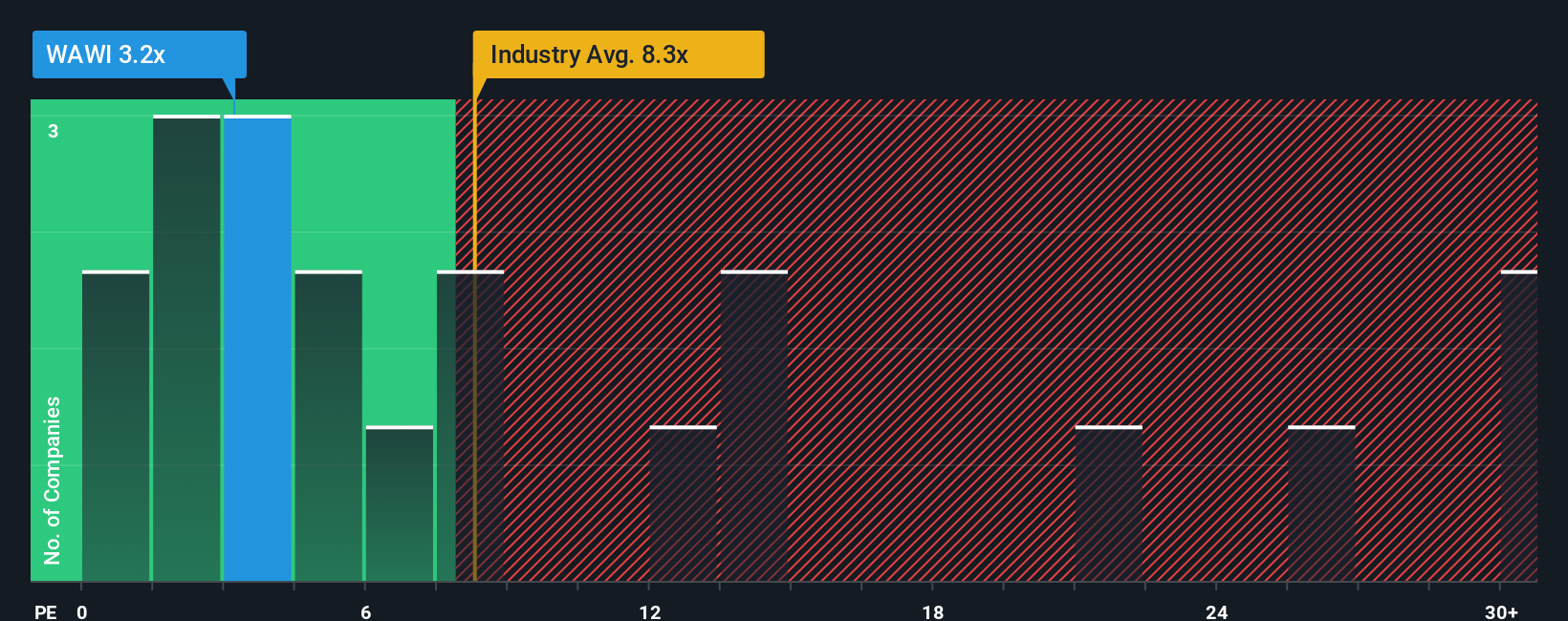

Our valuation checks using earnings multiples paint a very different picture, with Wallenius Wilhelmsen looking cheap at 3.9 times earnings versus a fair ratio of 4.8 times, peers at 4.4 times and the wider European shipping group near 9 times. Is sentiment lagging the fundamentals here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wallenius Wilhelmsen Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a complete thesis in just minutes: Do it your way.

A great starting point for your Wallenius Wilhelmsen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart investing move?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover focused ideas that match your style before the crowd piles in.

- Target reliable income streams by scanning these 13 dividend stocks with yields > 3% that combine robust payouts with the potential for long term compounding.

- Back bold innovation by reviewing these 26 AI penny stocks shaping the future of automation, productivity and intelligent software.

- Capitalize on market mispricing by filtering for these 903 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal