How Casio’s AI-Engineered Full-Metal G-SHOCK Launch At Casio ComputerLtd (TSE:6952) Has Changed Its Investment Story

- Earlier this month, Casio America launched the GMWBZ5000 collection, a new full-metal evolution of the iconic G-SHOCK 5000 series that combines AI-driven shock-resistance engineering, advanced digital displays, and premium two-tone finishes in silver, black, and gold.

- The use of artificial intelligence to redesign G-SHOCK’s core shock-resistant structure, while preserving its 1983 silhouette and elevating metal craftsmanship, signals how Casio is blending heritage with cutting-edge engineering in its higher-end watch lineup.

- We’ll now examine how this AI-engineered full-metal GMWBZ5000 launch could influence Casio’s investment narrative around premium timepieces and innovation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Casio ComputerLtd Investment Narrative Recap

To own Casio, you need to believe the company can turn its heritage in durable watches and calculators into steadier growth and better margins, despite recent declines in key financial metrics and uneven regional performance. The AI‑engineered, full‑metal GMWBZ5000 strengthens Casio’s push into higher‑priced timepieces, but on its own it is unlikely to materially change the short term picture of margin pressure, tariff exposure, or dependence on mature product categories.

The recent launch of 25 new design calculators for the 60th anniversary of Casio’s desktop calculator business sits alongside the GMWBZ5000 as another example of the company refreshing long‑standing product lines rather than moving away from them. For investors focused on catalysts, both releases highlight Casio’s current path of premiumization and design upgrades within core segments, which may help brand relevance but does not directly resolve concerns around tariffs, regional demand softness, or intense price competition.

Yet beneath these premium watch launches, investors should be aware of how ongoing tariff risks and Casio’s reliance on mature categories could...

Read the full narrative on Casio ComputerLtd (it's free!)

Casio ComputerLtd's narrative projects ¥275.8 billion revenue and ¥20.2 billion earnings by 2028.

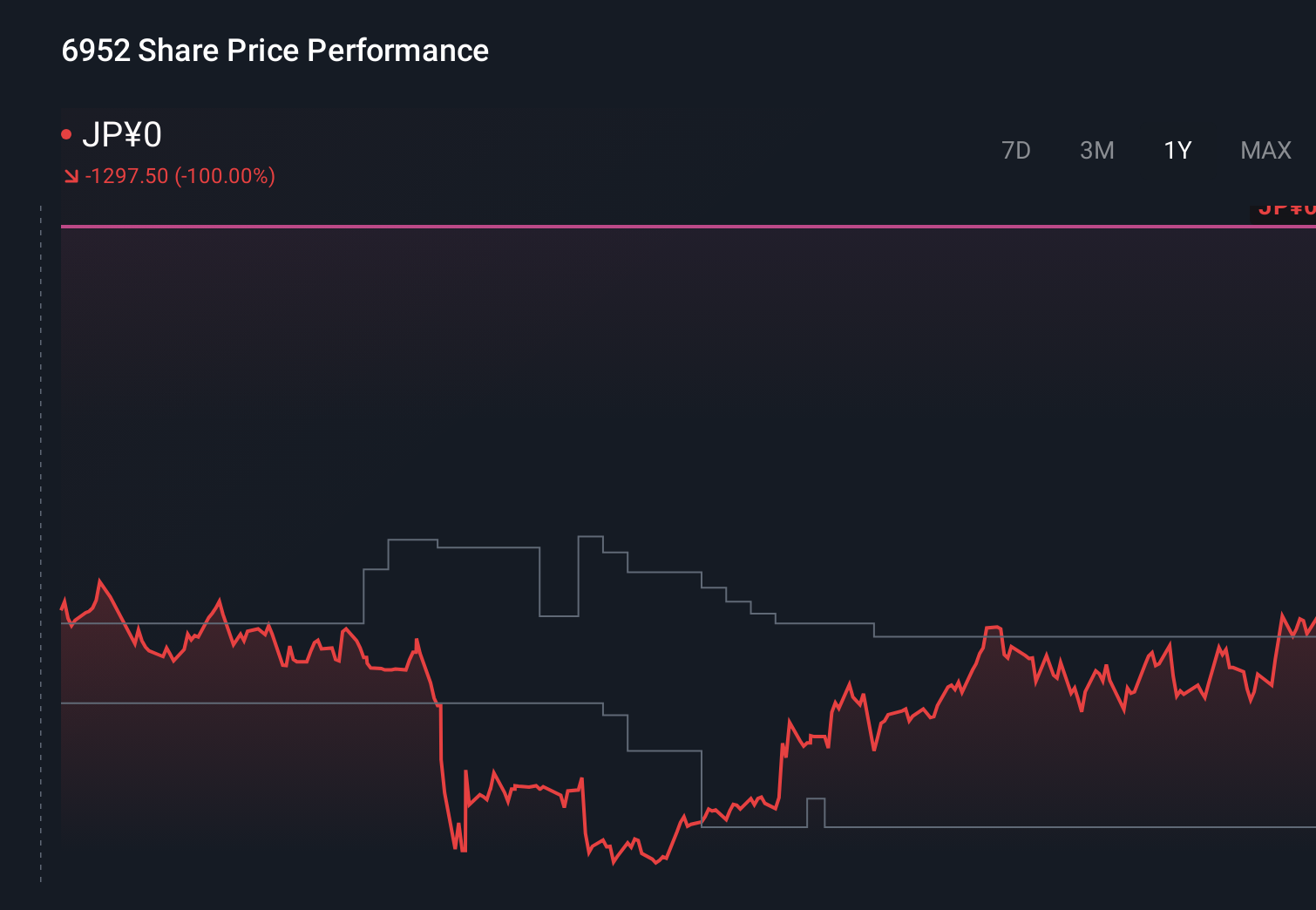

Uncover how Casio ComputerLtd's forecasts yield a ¥1291 fair value, in line with its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value views for Casio span from ¥1,291 to ¥1,477, underscoring how far individual expectations can diverge. As you weigh those perspectives, remember that recent net sales and profit declines highlight how sensitive Casio remains to demand softness and tariff pressures, which could shape how those valuation opinions ultimately play out in practice.

Explore 2 other fair value estimates on Casio ComputerLtd - why the stock might be worth just ¥1291!

Build Your Own Casio ComputerLtd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casio ComputerLtd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Casio ComputerLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casio ComputerLtd's overall financial health at a glance.

No Opportunity In Casio ComputerLtd?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal