Evaluating Williams Companies’ Valuation After Recent Share Price Pullback and Multi‑Year Gains

Recent Performance and Why Williams Companies Still Matters

Williams Companies (WMB) has drifted lower over the past week, but zooming out tells a different story. The stock is still up solidly over the past year and has more than doubled over three years.

See our latest analysis for Williams Companies.

The latest pullback in Williams Companies’ share price, now around $59.74 after a weak week of trading, looks more like a pause than a reversal, given its solid year to date share price gains and strong multi year total shareholder returns. This suggests momentum is cooling, but the longer term trend still reflects growing confidence in its cash flows and midstream footprint.

If Williams’ steady gains have you rethinking your energy exposure, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other potential outperformers backed by committed insiders.

With Williams still trading below analyst targets and showing solid earnings growth, the key question now is whether the current valuation underestimates its resilient cash flows or if the market has already priced in future expansion.

Most Popular Narrative Narrative: 11.8% Undervalued

With Williams Companies last closing at $59.74 against a narrative fair value near $67.70, followers see meaningful upside driven by future cash flow strength.

The company's robust, fully contracted project backlog (extending beyond 2030), disciplined layering of short and long-cycle projects, and committed capital plan are driving upward revisions to EBITDA and AFFO guidance, indicating future earnings and dividend visibility that may not be fully reflected in current valuation.

Curious how long dated contracts, rising margins, and steady top line growth can support this richer future profit multiple? The narrative’s projections may surprise you.

Result: Fair Value of $67.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster decarbonization policies and renewed permitting setbacks on key Northeast projects could slow volumes and undermine today’s optimistic long term growth assumptions.

Find out about the key risks to this Williams Companies narrative.

Another Lens on Valuation

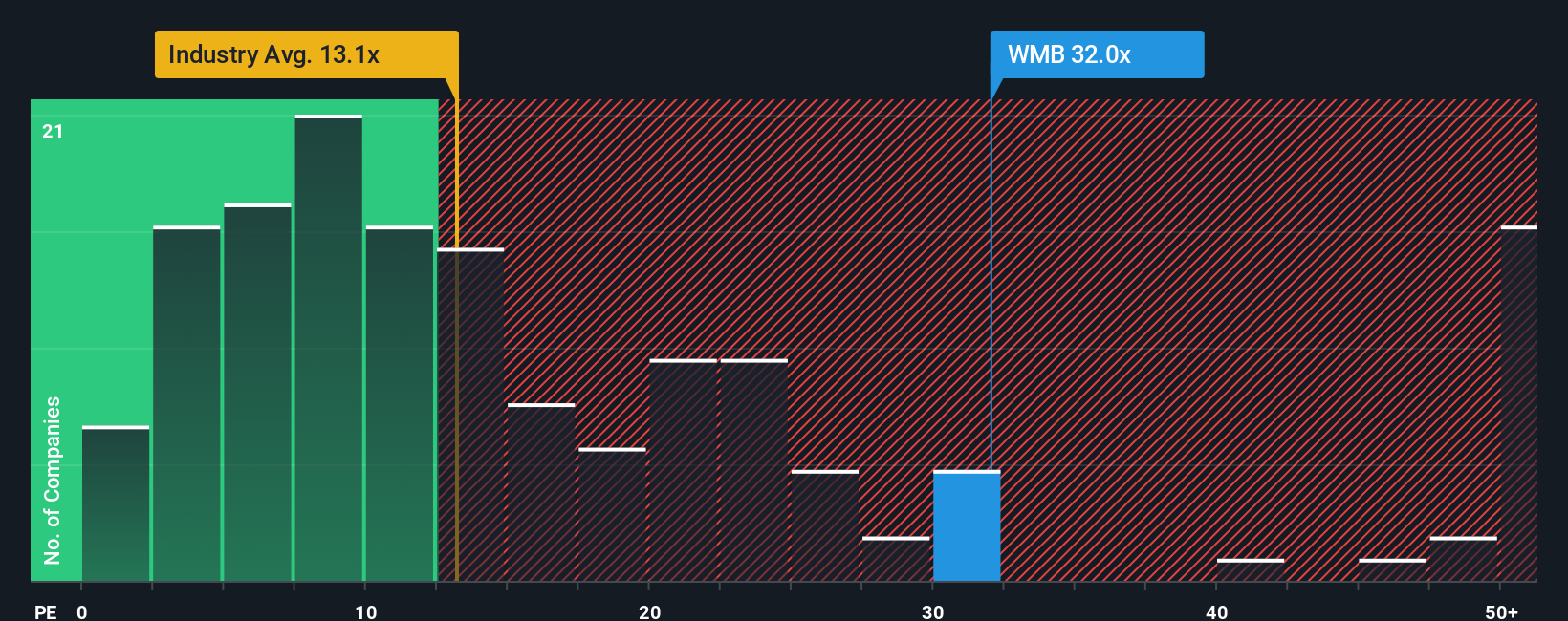

While the narrative fair value points to upside, the earnings multiple tells a more cautious story. Williams trades on roughly 30.8 times earnings, far richer than both the US Oil and Gas sector at 13.3 times and its own fair ratio of 23.1 times. This may hint at limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If this perspective does not quite align with your own, explore the numbers yourself and create a personalized view in just minutes, Do it your way.

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, tap into the Simply Wall St Screener to uncover fresh, data driven opportunities that could quietly reshape your portfolio’s long term returns.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 903 undervalued stocks based on cash flows, and position yourself ahead of a possible re rating.

- Ride structural growth trends by focusing on innovators shaping the future of automation and machine learning with these 26 AI penny stocks before the crowd catches on.

- Strengthen your income stream by zeroing in on reliable payers using these 13 dividend stocks with yields > 3%, so your capital works harder for you in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal