Freshpet (FRPT): Assessing Whether the Stock’s Recent Rebound Signals Undervaluation

Why Freshpet Stock Has Caught Investor Attention

Freshpet (FRPT) has quietly staged a comeback, with shares up roughly 14% over the past month even though the stock is still down sharply year to date.

See our latest analysis for Freshpet.

That recent momentum, reflected in a 30 day share price return of 14.04% and a three year total shareholder return of 14.85%, is encouraging but still sits against a steep year to date share price decline and weaker one year total shareholder returns.

If Freshpet’s rebound has you reassessing growth stories in your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership for more ideas with strong backing.

With shares still far below their highs despite steady sales and modest profit growth, investors face a key question: Is Freshpet now trading at a discount to its long term potential, or has the market already priced in its recovery?

Most Popular Narrative: 10.3% Undervalued

With Freshpet last closing at $63.42 against a narrative fair value near $70.67, the story hinges on steady growth and improving profitability.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput, leading to a significant reduction in CapEx ($100 million less over 2025 to 26) and enhanced gross and EBITDA margins, setting the business up for improving net earnings and cash generation.

Want to see how lower capital needs, rising margins, and a premium earnings multiple all connect into one valuation story? The full narrative reveals the playbook. See our AI narrative and valuation for Freshpet.

Result: Fair Value of $70.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing pet adoption trends and intensifying competition in premium fresh pet food may challenge Freshpet’s growth assumptions and put pressure on its valuation story.

Find out about the key risks to this Freshpet narrative.

Another Lens on Valuation

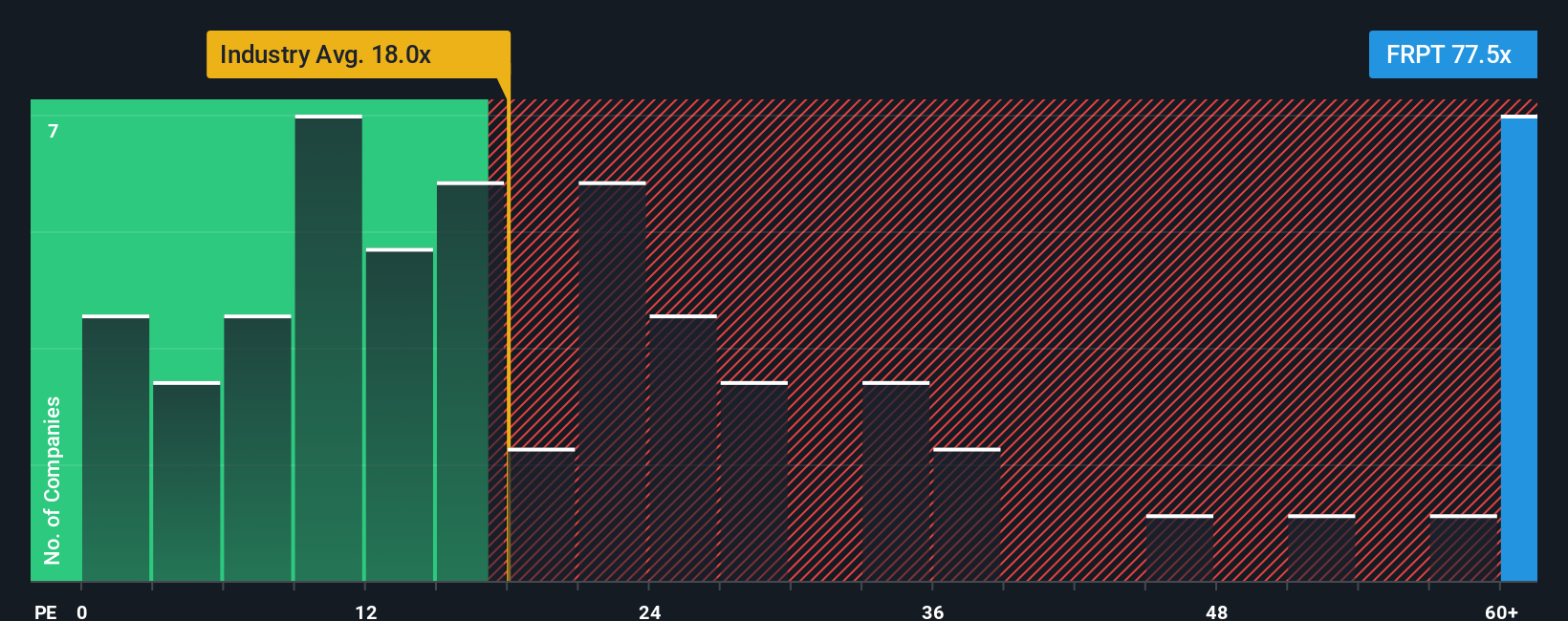

Step back from the narrative fair value, and Freshpet looks expensive on a simple price to earnings lens. Its 25.1x ratio sits well above the 20.4x industry average, the 17.4x peer average, and a 15.4x fair ratio, which hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

If you would rather dig into the numbers yourself and shape a view that fits your own research, you can build a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your Freshpet research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More High Conviction Ideas?

Do not stop with one opportunity. Use the Simply Wall St screener to pinpoint stocks that match your strategy before the next wave of returns leaves you behind.

- Lock in potential income streams by targeting these 13 dividend stocks with yields > 3% that can support long term compounding through consistent cash returns.

- Capitalize on mispriced opportunities by zeroing in on these 902 undervalued stocks based on cash flows where market expectations may lag improving fundamentals.

- Ride powerful technological shifts by focusing on these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal