Is Intuitive Surgical (ISRG) Still Undervalued After Its Recent Pullback?

Recent performance sets the stage

Intuitive Surgical (ISRG) has pulled back about 6% over the past week and roughly 5% over the past month, even though shares are still up more than 20% in the past 3 months.

See our latest analysis for Intuitive Surgical.

Zooming out, the recent pullback sits against a still impressive backdrop, with the 3 year total shareholder return more than doubling even as short term share price momentum has cooled around the current 542.32 dollars level. This hints at some profit taking rather than a broken growth story.

If Intuitive Surgical has you thinking about the broader medical innovation space, this could be a good moment to explore other healthcare stocks that might fit your portfolio.

With growth still robust and shares trading below average analyst targets, investors now face a key question: Is Intuitive Surgical undervalued after this pullback, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 9.1% Undervalued

With Intuitive Surgical last closing at 542.32 dollars, the most followed narrative sees fair value closer to the mid 590s, implying upside from here.

Ongoing product innovation (including full launch of da Vinci 5, integrated force feedback, and digital/AI case insights), coupled with R&D to expand into adjacent specialties, enhances clinical outcomes and surgeon efficiency supporting future procedure growth, higher system ASPs, and increased recurring instrument and accessory revenues.

Want to know why a mature medtech name is priced like a high growth compounder? The narrative leans on accelerating procedures, sticky recurring revenue, and a punchy future earnings multiple. Curious how those moving parts stack up over the next few years and what that implies for future returns?

Result: Fair Value of $596.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff and trade uncertainties, alongside mounting budget pressures in key international markets, could constrain margins and slow Intuitive Surgical’s system expansion.

Find out about the key risks to this Intuitive Surgical narrative.

Another Way to Look at Value

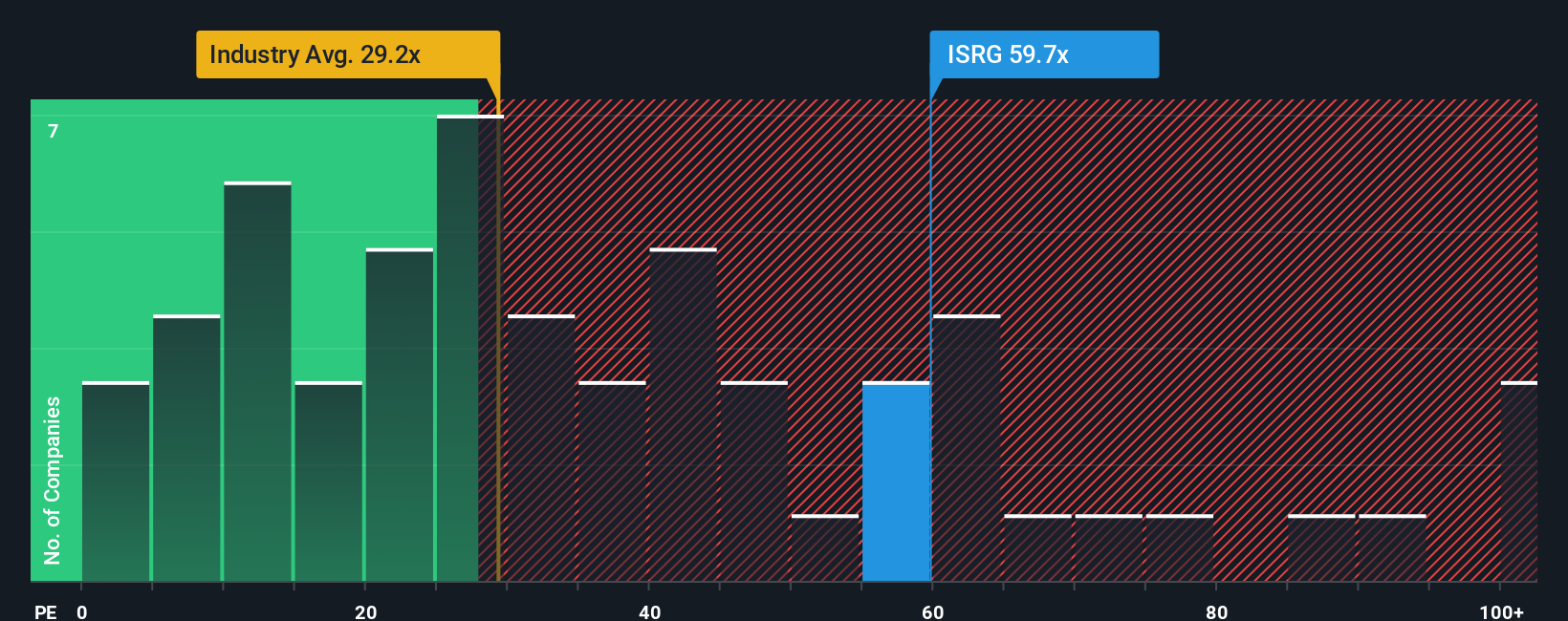

Step away from narratives and Intuitive Surgical looks far less forgiving. At about 70 times earnings, the shares trade at more than double the US Medical Equipment sector on 30.4 times, and well above a fair ratio of 38.6 times, leaving little room for execution hiccups or sector jitters. Is that a runway for further gains or a tightrope for new buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Surgical Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a tailored narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intuitive Surgical.

Ready for more investment ideas?

Before the market sets the next big winners in motion, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy and risk appetite.

- Capture high-upside potential from under-the-radar names by targeting these 3610 penny stocks with strong financials that already back their story with solid financials.

- Ride structural shifts in technology by focusing on these 26 AI penny stocks positioned at the heart of AI adoption across industries.

- Lock in attractive entry points with these 902 undervalued stocks based on cash flows that markets may be overlooking based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal