Will Renault’s Ford EV Platform Deal Reshape Renault's (ENXTPA:RNO) Scale and Margin Narrative?

- Earlier this week, Renault Group and Ford announced a landmark partnership to co-develop two Ford-branded electric cars on Renault’s Ampere platform, produced in Northern France and targeting early 2028 showroom arrivals, alongside a Letter of Intent to collaborate on light commercial vehicles in Europe.

- This tie-up combines Renault’s EV manufacturing ecosystem and Ford’s brand and software ambitions, potentially reshaping Europe’s mass-market EV and van landscape through shared scale, cost efficiencies, and broader model choice for retail and business customers.

- Next, we’ll examine how Ford’s use of Renault’s Ampere EV platform might influence Renault’s investment narrative around scale, margins, and partnerships.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Renault Investment Narrative Recap

To own Renault today, you need to believe its reset around Ampere, partnerships and cost discipline can turn a lowly valued, loss-making automaker into a more focused, capital-light EV and LCV player. The Ford tie-up reinforces that story by validating Ampere’s technology and industrial base, but it does not change the immediate pressure point, which is restoring profitability after the recent large net loss, nor the key risk around execution on multiple partnerships and regulatory-driven EV margin strain.

The recent Geely investment in Renault do Brasil, which brought Geely to a 26.4% stake and access to the Ayrton Senna plant, underlines how central partnerships have become to Renault’s plan. Together with the new Ford collaboration on Ampere-based EVs and potential LCVs, it shows Renault leaning hard on shared platforms and jointly used factories as a possible way to improve scale economics while trying to meet tight CO2 and CAFE rules without eroding margins too far.

However, while partnerships can help absorb EV costs and regulatory burdens, investors should be aware that …

Read the full narrative on Renault (it's free!)

Renault's narrative projects €59.9 billion revenue and €2.5 billion earnings by 2028. This requires 1.7% yearly revenue growth and a €14.2 billion earnings increase from €-11.7 billion today.

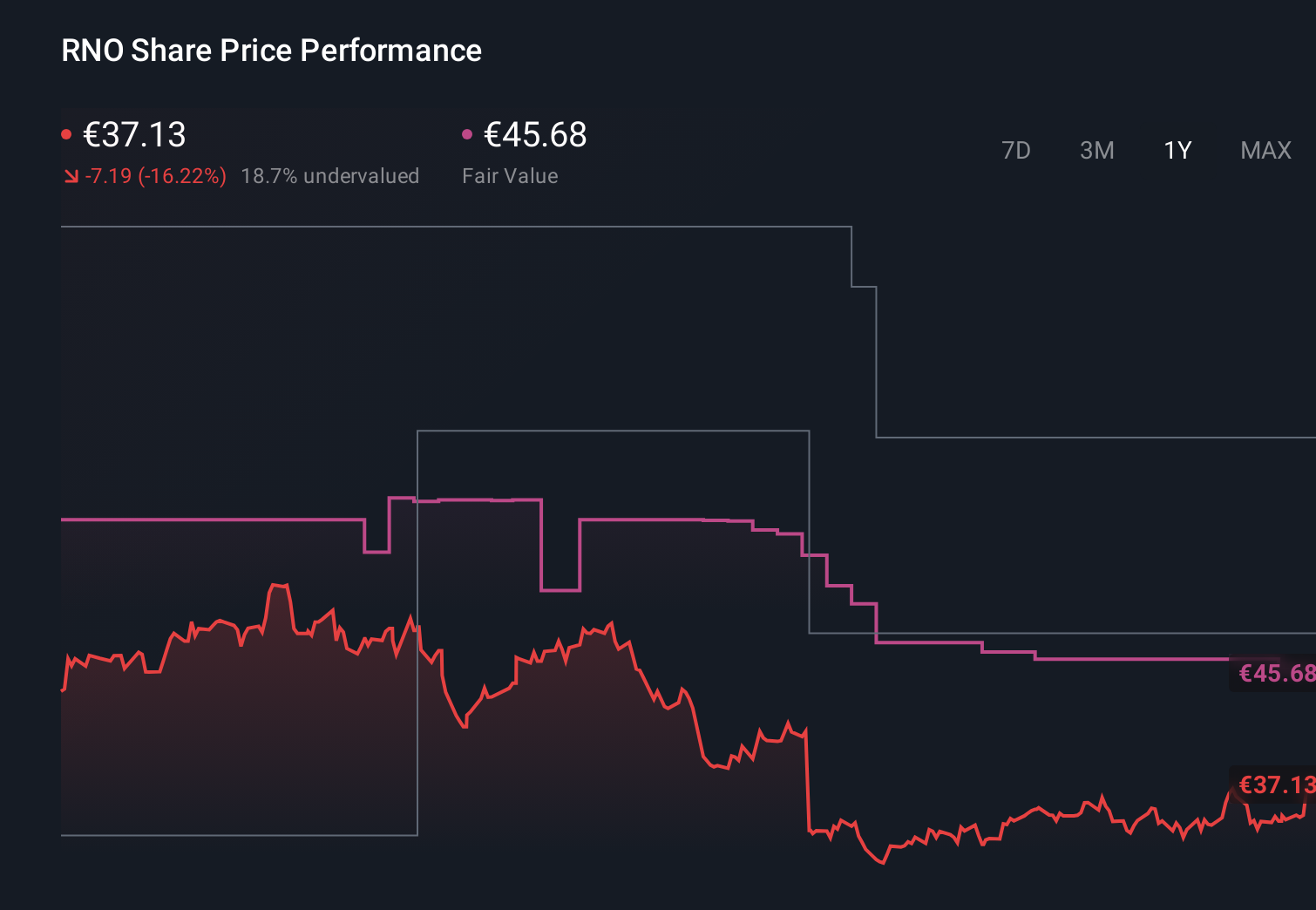

Uncover how Renault's forecasts yield a €45.68 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see Renault’s fair value between €38.00 and about €80.31, highlighting very different expectations around the upside. Set that against Renault’s reliance on complex partnerships, now including Ford’s use of the Ampere platform, and you can see why it may pay to compare several independent views on how these alliances could affect future margins and resilience.

Explore 9 other fair value estimates on Renault - why the stock might be worth just €38.00!

Build Your Own Renault Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Renault research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Renault research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Renault's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal